Why GEO Isn't Enough: What CPG Brands Actually Control in Agentic Commerce

When AI agents start actually transacting—completing purchases on behalf of consumers—they'll need something beyond GEO (Generative Engine Optimization)

A lot of consumer brands are investing in GEO (Generative Engine Optimization)—making sure their products surface when someone asks an LLM for recommendations. Box checked. Moving on.

But while these GEO and AEO approaches may get you “found” in conversations, it doesn't necessarily mean your product is ready for the next era of commerce: agents who shop and transact for buyers.

When AI agents start actually transacting—completing purchases on behalf of consumers—they'll need something different: canonical product data, structured attributes, rich context. That's what Scot Wingo calls Agentic Commerce Optimization (ACO), and it's a much longer checklist. (note: I am an advisor to Scot's company ReFiBuy)

The bigger problem? For CPG brands selling through retailers, most of that checklist isn't yours to control.

A note on audience: This piece is written for brands—specifically CPG brands selling through retailers like Walmart, Kroger, or Amazon. If you're a retailer reading this, go straight to Scot Wingo's original Agentic Commerce Optimization (ACO) framework at Retailgentic. You're the enabler (or blocker) for your brand suppliers on everything I'm about to describe.

The Difference Between GEO and ACO

GEO gets you discovered. When someone asks Perplexity or ChatGPT for dog food recommendations, your brand might show up. That's visibility.

ACO (Agentic Commerce Optimization) gets you chosen—and purchased. It's what ensures when an AI agent is ready to transact, it has everything it needs: canonical product data, complete attributes, rich context, reviews, and proper schema markup. It's the difference between "Purina appears in search results" and "The agent recommends this specific Purina SKU, knows it's in stock at the nearest retailer, understands it's grain-free, and completes the purchase."

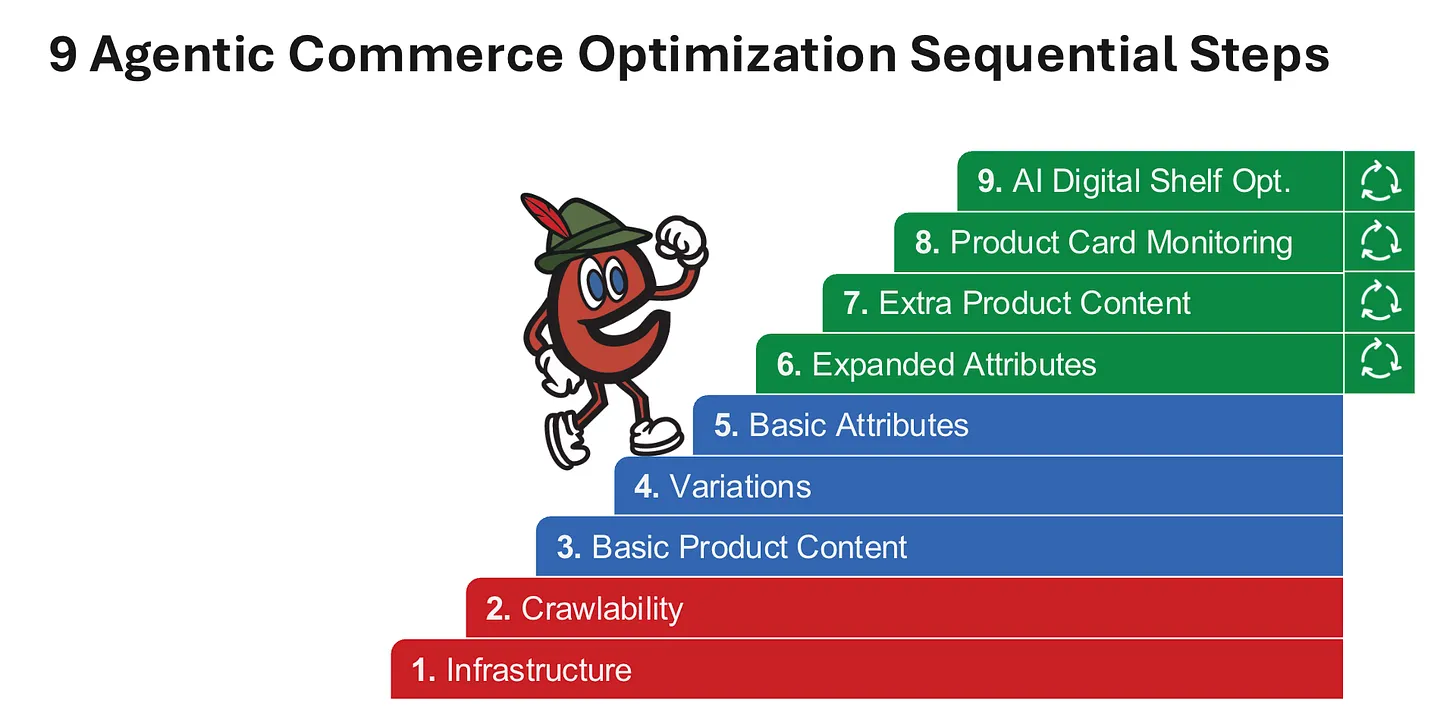

Scot Wingo developed the below ACO framework for retailers and DTC brands who control their own digital shelf. But what if you're a CPG brand that sells primarily through retail partners rather than their own website? You don't control the infrastructure of the site and its crawlability. You don't control how your product data gets served to AI agents.

But that doesn't mean you're powerless.

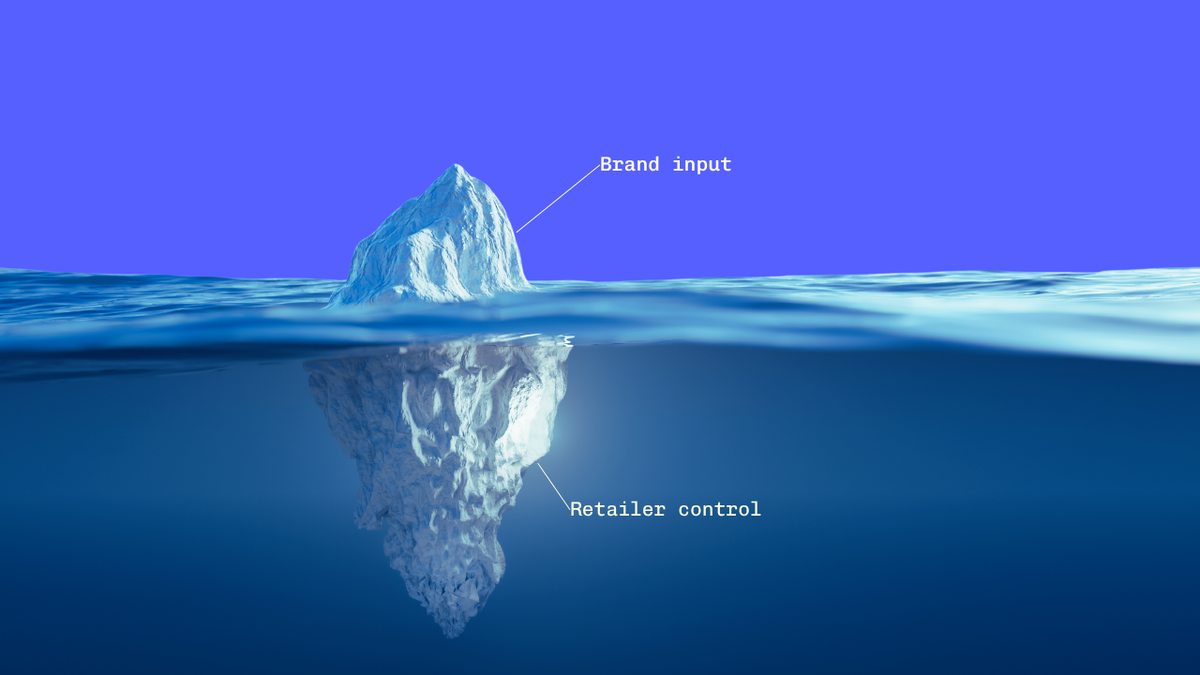

What Brands Control vs. What Retailers Control

The infrastructure for agentic commerce is being built right now. Walmart has partnered with ChatGPT for instant checkout integration. OpenAI's Atlas Browser and Perplexity's Comet browser can already shop on Instacart for you.

Retailers are also building their own AI-powered shopping layers—what's being called Commerce GPTs—that act as personalized discovery engines across their catalogs. These systems don't just retrieve products based on keywords; they understand intent and context to make recommendations. But they can only recommend what they can parse.

Whether it's a retailer's Commerce GPT answering "what's good for weeknight dinners?" or a shopping agent comparing products across multiple stores, the requirement is the same: clean, canonical product data. The brands that own that data—structured, consistent, rich product information flowing to every retailer—will control the product cards these systems use to make decisions. Everyone else will be at the mercy of whatever inconsistent, incomplete data their retail partners scraped together.

The problem is that most of the ACO framework sits on the retailer's side of the fence. CPG brands need to understand what's actually within their control versus what requires retailer action—so they can have informed conversations about readiness.

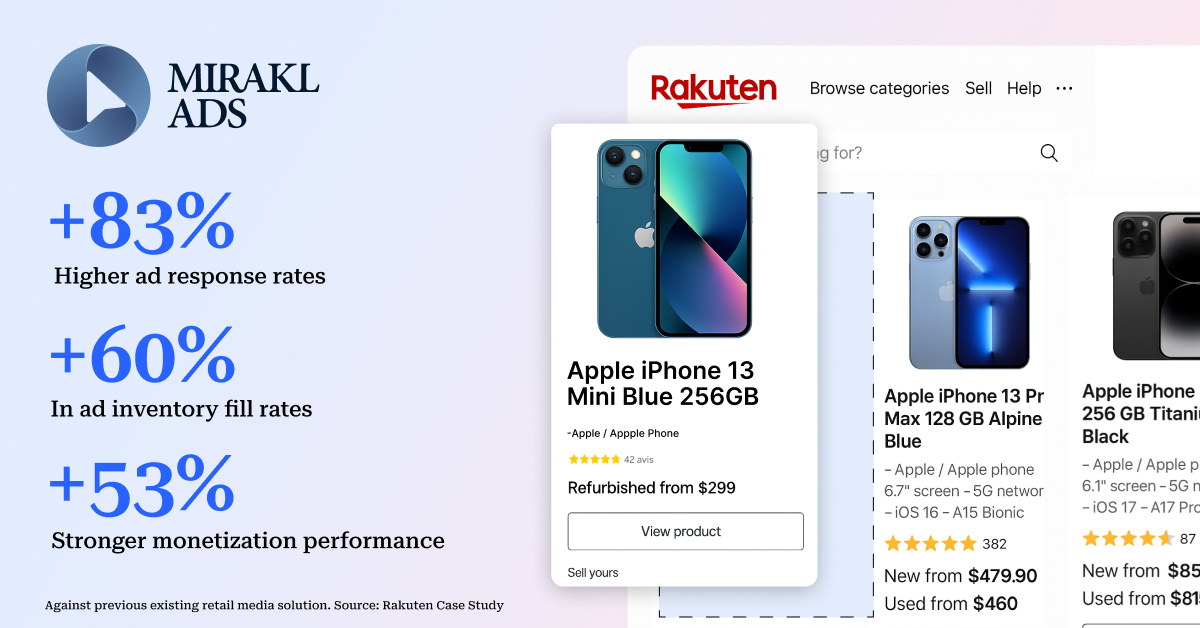

Mirakl Ads is the ad-tech solution trusted by Rakuten and 50+ global enterprise retailers.That’s because Mirakl Ads was built with both 3P marketplace sellers and 1P suppliers in mind. Both advertiser audiences demand a seamless advertising journey from onboarding to reporting. You can offer everything from Sponsored Products to video all in one solution

The 9-Step ACO Framework – For Brands

Here's the Retailgentic nine-step ACO framework, adapted to show the reality for CPG brands selling through retail partners.

Across many of these factors, Brands can provide inputs. But retailers control outputs.

You can create perfect, agent-ready product data. But if your retail partner doesn't implement it correctly—or at all—it doesn't matter.

What This Means for Brands

Steps 3-7 are where CPG brands have real leverage. You control:

The canonical product data you create and syndicate. Every title, attribute, spec, image, and piece of context you provide to retailers. Is it structured? Consistent across all retail partners? Agent-ready?

The enhanced content you supply. Usage scenarios, product context, review syndication, Q&A content. Are you providing this proactively or waiting for retailers to ask?

The product data feeds you maintain. Whether through PIM systems, syndication platforms, or direct feeds to retailer portals. Are you pushing agent-ready schema?

Where you don't have control is Steps 1-2 (infrastructure and crawlability) and Steps 8-9 (monitoring and optimization). These are retailer decisions. But you can influence them—if you know what to look for.

Retailers And Brands Must Continue To Partner

The reality is that agentic commerce is still nascent right now. But if you believe that consumer behavior is heading in this direction, you'll see how the retailers who prepare for ACO will capture those early sales and have stronger positioning when agentic commerce scales.

To be clear, this is going to be a big lift for retailers. The infrastructure required for agentic commerce represents a whole new layer of complexity.

Brands should use this framework as a discussion tool. Walk through the nine steps with your retail partners. Ask where they are in their preparation for agentic commerce. Understand what you control versus what they control. Because when agentic commerce hits scale, the brands with structured, canonical, context-rich product data will own the product cards agents use to make purchase decisions.

For the complete ACO framework and detailed implementation guidance, see Scot Wingo's full playbook at Retailgentic. Retailers: that's your roadmap. Brands: use it to understand what your retail partners should be building—and how the partnership needs to evolve.