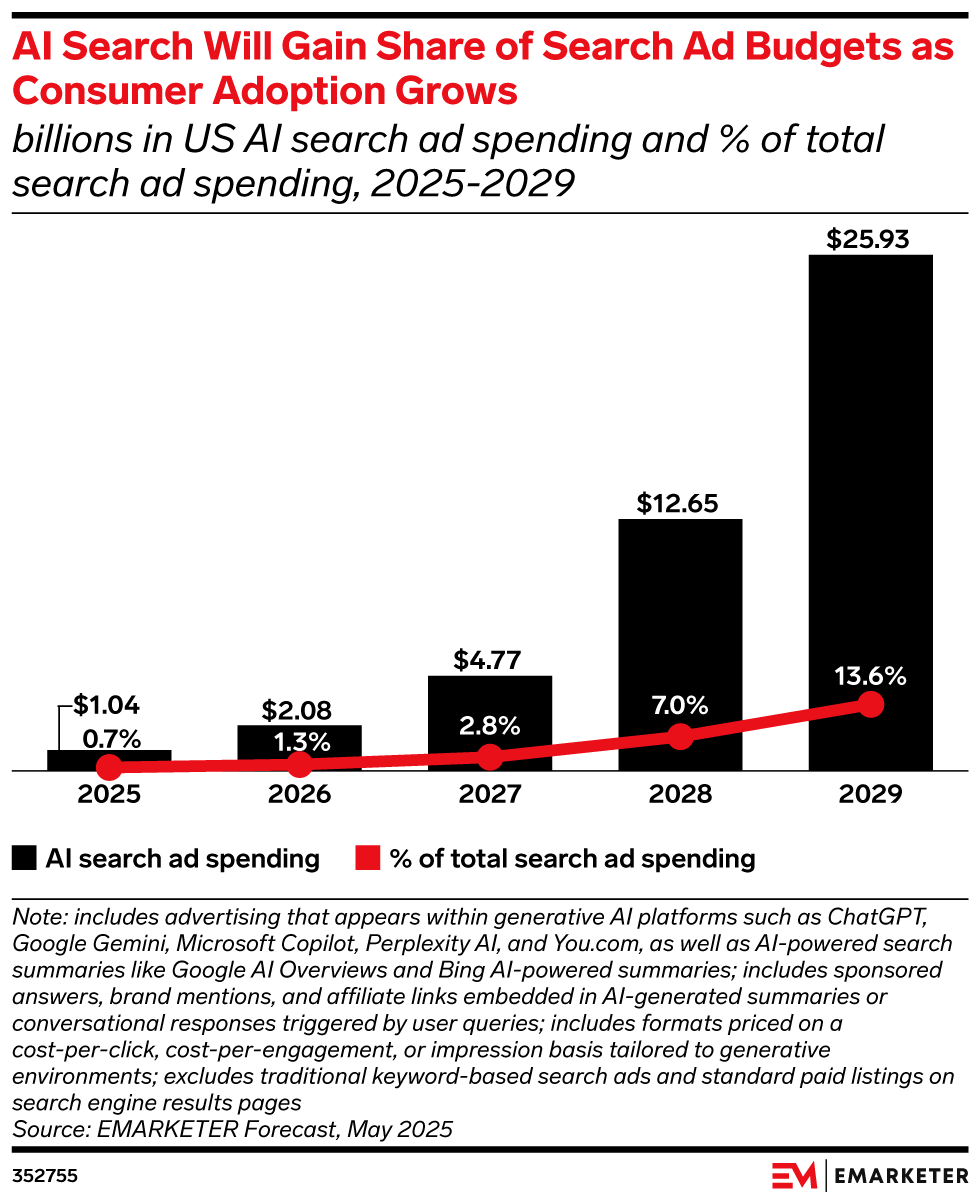

Why AI Search Advertising Could Reach $25 Billion By 2029

EMARKETER now projects U.S. advertisers will pour over $25 billion—about 14% of all search budgets—into AI-powered search results by 2029.

This post was originally published to my column on Forbes.com on May 31st, 2025. It has been reproduced here with permission.

EMARKETER now projects U.S. advertisers will pour over $25 billion—about 14% of all search budgets—into AI-powered search results by 2029. That leap from just $1.04 billion this year isn’t wishful thinking: behind the scenes, platforms are wiring live, structured product feeds straight into large-language-model (LLM) interfaces.

Shopify’s new Catalog API, announced last week, now lets agents like Perplexity read titles, prices, and inventory for every Shopify SKU in real time, no scraping required. Meanwhile, early AI shopping experiences from ChatGPT to Amazon's "Buy for Me" show agents that can research, refine, and even check out in one conversational flow. Together, these infrastructure developments are transforming conversational answers into shoppable ad inventory—unlocking the explosive spend curve that EMARKETER is forecasting.

The New Hockey-Stick of Media Growth

The trajectory EMARKETER projects—from $1 billion to $25 billion in five years—follows a familiar pattern in digital advertising evolution. Retail media took approximately five years to reach similar scale (from $1BN to $30BN in ad revenue), while search and social advertising each required longer timeframes. AI search advertising appears positioned to match retail media’s rapid adoption curve.

An Adobe survey of 5,000 U.S. consumers reveals that 39% have already used generative AI for online shopping, with 53% planning to do so this year. The shopping tasks consumers are using AI for include:

- Conducting research (55% of respondents)

- Receiving product recommendations (47%)

- Seeking deals (43%)

- Getting present ideas (35%)

- Finding unique products (35%)

- Creating shopping lists (33%).

Retail media exploded once merchants simply flipped on sponsored listings in their own walled gardens—immediate inventory, immediate return on ad spend. The sector started that sprint nine years ago and is already a $60-plus-billion line item today, whereas AI search is just entering year one.

And what exactly will AI search advertising look like? Unlike traditional search ads that appear alongside blue links, AI search ads will be rendered inside conversational answers themselves. EMARKETER defines AI search ads as "sponsored answers, brand mentions, and affiliate links embedded in AI-generated summaries or conversational responses."

From Feed Hygiene to Discovery Advantage

AI search needs more complex infrastructure before advertisers push big budgets. Clean, real-time product data feeds must connect with checkout capabilities—whether through direct payment processing or seamless retailer integration.

The infrastructure for this shift is rapidly falling into place. Shopify’s Catalog API, quietly launched during the company’s Summer '25 Edition rollout on May 21st, provides "a single machine readable feed of every product published on Shopify," according to Gavin McKew, Director at Shero Commerce, who attended Shopify's developer conference. "Discovery apps like ChatGPT, Perplexity, or Copilot can pull titles, prices, stock levels, taxonomy, and enriched attributes in real time. No scraping, no daily lag."

This creates an entirely new optimization challenge for brands. Success requires treating Shopify metafields, product descriptions, and structured data not as IT chores but as performance-media inputs. McKew's advice to merchants reflects this shift: "Treat every product field like ad copy. Fill standard metafields and tighten descriptions."

“A credible agentic-commerce flow must let customers see a product and buy it inside the chat,” says retail marketplaces expert Scot Wingo in an article mapping the AI agent ecosystem. This requires real-time product feeds as the foundation, plus either secure payment processing within the AI platform or seamless integration that redirects to retailer checkout—without accurate product data, neither path works.

Retailers Choose Different AI Paths

The emergence of AI shopping agents is forcing retailers to make strategic choices about how they want to participate in conversational commerce. Two distinct approaches are emerging, with implications for brands planning their AI search advertising strategies.

I recently wrote how Walmart is pursuing a dual path: building their own shopping agents while exploring technology that enables consumers to shop Walmart's assortment using their preferred personal shopping agents. This contrasts with Amazon's walled garden approach—developing proprietary AI tools including Rufus, Alexa+, and "Buy for Me" while blocking external agents from accessing its platform.

Meanwhile, multi-merchant platforms like Shopify's partnership with Perplexity represent a third model: unified, cross-retailer shopping experiences. Users can discover products through AI search, compare options across multiple Shopify stores, and complete purchases using Shop Pay, all within a single conversational experience.

The technical infrastructure is rapidly maturing beyond Shopify's approach. Standards like Anthropic's Model Context Protocol (MCP) are creating what amounts to "USB-C for AI agents"—standardized connections that expose products, inventory, loyalty programs, and checkout capabilities to any compliant AI model. This gives retailers the opportunity to participate in multiple AI marketplaces without surrendering customer data or pricing control.

For brands, these diverging retailer strategies create complex decisions about platform prioritization and budget allocation across different AI shopping environments.

Media Attribution Gets Even More Blurry

AI-powered shopping experiences are creating new measurement challenges that will compound existing retail media attribution problems. When transactions begin in conversational interfaces and complete through various checkout systems, traditional budget categorization breaks down.

If a shopper uses Perplexity to research "wireless headphones under $200," receives AI-powered recommendations, and then purchases through Perplexity using Shop Pay, does that sale belong to "search," "retail media," or "affiliate" budgets? Traditional attribution models weren’t designed for transactions that begin in chat and complete in merchant wallets.

This challenge extends beyond simple budget classification. Marketing teams will need new frameworks to track and optimize spending across conversational interfaces, especially as these platforms develop their own advertising inventory. The complexity increases when considering that a single AI agent might source product information from multiple retailers, compare prices across platforms, and complete transactions through entirely different systems.

Getting Ready for AI Search Advertising

Even at its projected $25 billion scale by 2029, AI search advertising will remain smaller than retail media in absolute dollars. But the incremental advertising growth from 2027 onward will increasingly tilt toward AI-powered search as conversational interfaces become primary discovery channels.

The convergence of product-data feeds and AI search advertising creates first-mover advantages for brands willing to treat these systems as integrated rather than separate challenges. Success requires alignment between traditionally siloed teams managing product information, media buying, and technology infrastructure.

Jason Goldberg, Chief Commerce Strategy Officer at Publicis Commerce, emphasizes the organizational challenge in a new white paper: "The companies that thrive in the new AI search landscape will not be the loudest—they’ll be the most adaptable." His recent analysis of AI commerce disruption suggests brands should "optimize products and content for LLMs" while simultaneously piloting "AI commerce partnerships" with emerging platforms.

Brands that treat product data and media strategy as connected priorities will be better positioned as AI search advertising scales. Those who continue managing AI initiatives separately from their core commerce operations may find themselves at a disadvantage as conversational search becomes more prevalent.