What Is Your AI Agent Buying? [New Research]

A new research study from Columbia and Yale researchers gives us the first real look at how AI agents actually shop when left to their own devices. The findings should make every brand and retailer rethink their assumptions about the AI-driven commerce future that's coming faster than most realize.

![What Is Your AI Agent Buying? [New Research]](/content/images/size/w1200/2025/08/agentic-shopping.png)

If I ask my husband, my mother, and my best friend to pick up a new pair of slippers for me the next time they're at the mall, chances are they'll bring me wildly different products. My husband will grab whatever's on sale and looks comfortable. My mother will find something practical and durable that "will last forever." My best friend will choose based on style and whether they match my personality.

Each person would use their own criteria, shaped by their relationship with me and their personal shopping habits. Now imagine those shoppers are AI agents—Claude, ChatGPT, and Gemini—each with their own built-in preferences and decision-making patterns.

A new research study from Columbia and Yale researchers gives us the first real look at how AI agents actually shop when left to their own devices. The findings should make every brand and retailer rethink their assumptions about the AI-driven commerce future that's coming faster than most realize.

First, here's some quick background on the methodology of this study and why it matters:

- The team built a sandbox that replicated the ecommerce shopping journey, allowing them to control variables like layout, prices, reviews, and badges without interfering with a live site.

- The research specifically evaluates frontier AI Models from leading providers, including Claude Sonnet 4, GPT-4.1, and Gemini 2.5 Flash – and tracks how agents from the different models acted.

- The study was authored by a team of five researchers, with affiliations across both a private AI company called MyCustomAI, which builds custom AI models for enterprises, as well as academics from Columbia and Yale. Download the full study here.

Reviews Are the New Currency

AI agents heavily weight both review counts and average ratings, creating a dual optimization challenge for brands.

The study quantifies this impact by estimating how much a seller could increase their product's price if they were to double the number of reviews. Specifically, the "price-equivalent trade-offs" show that:

- Claude Sonnet 4: 19.4% price increase possible

- GPT-4.1: 37.4% price increase possible

- Gemini 2.5 Flash: 17.2% price increase possible

Put simply: if you currently have 100 reviews and increase to 200, you could charge 19-37% more (depending on which AI model is shopping) and still get selected at the same rate.

But volume alone isn't enough—AI agents also assign positive weight to higher average ratings. This creates a compound effect: products with both high ratings and high review volumes get the strongest preference boost from AI agents.

This dual dependency fundamentally changes review strategy. It's not just about having good reviews or lots of reviews—you need both.

The implications for review acquisition strategies are obvious, but the execution challenges are real. This remains a delicate and complex regulatory subject: How do you ethically scale review generation when the stakes are so high?

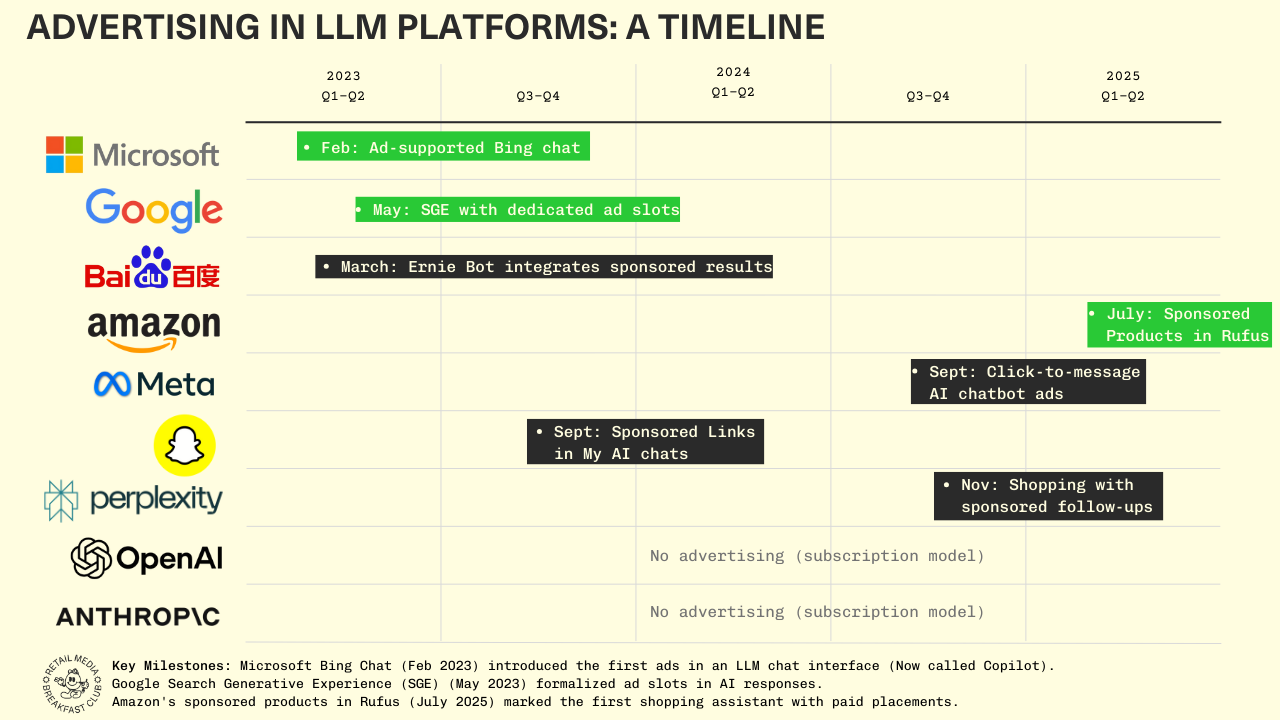

The Sponsored Product Problem (Preview)

Here's the finding that should make every retail media executive pause: AI agents actively avoid sponsored products across all models tested.

This bias against advertising creates a fundamental tension in the retail media ecosystem that's worth billions. I'm diving deep into this tomorrow with specific implications for brands and retailers, but the early signal is clear—the pay-to-play model that drives retail media profitability hits a wall when AI agents do the shopping.

Read my 'part 2' on this topic where I discuss the implications for advertising:

Market Concentration Risk

The most concerning finding isn't about individual products—it's about market dynamics. AI agents consistently concentrate selections among a narrow set of products, with some brands never getting selected despite being viable options.

This creates two scenarios:

- Dominant brands get more dominant - Products that align with AI preferences capture disproportionate market share

- Innovation gets stifled - New or niche products struggle to break through without the traditional discovery mechanisms

If you represent a dominant brand that's been trying to fend off upstart sellers, this might be positive news. But newer brands and products will find it much harder to stand out if AI models continue to prefer the legacy products. The researchers flag this as a potential regulatory concern.

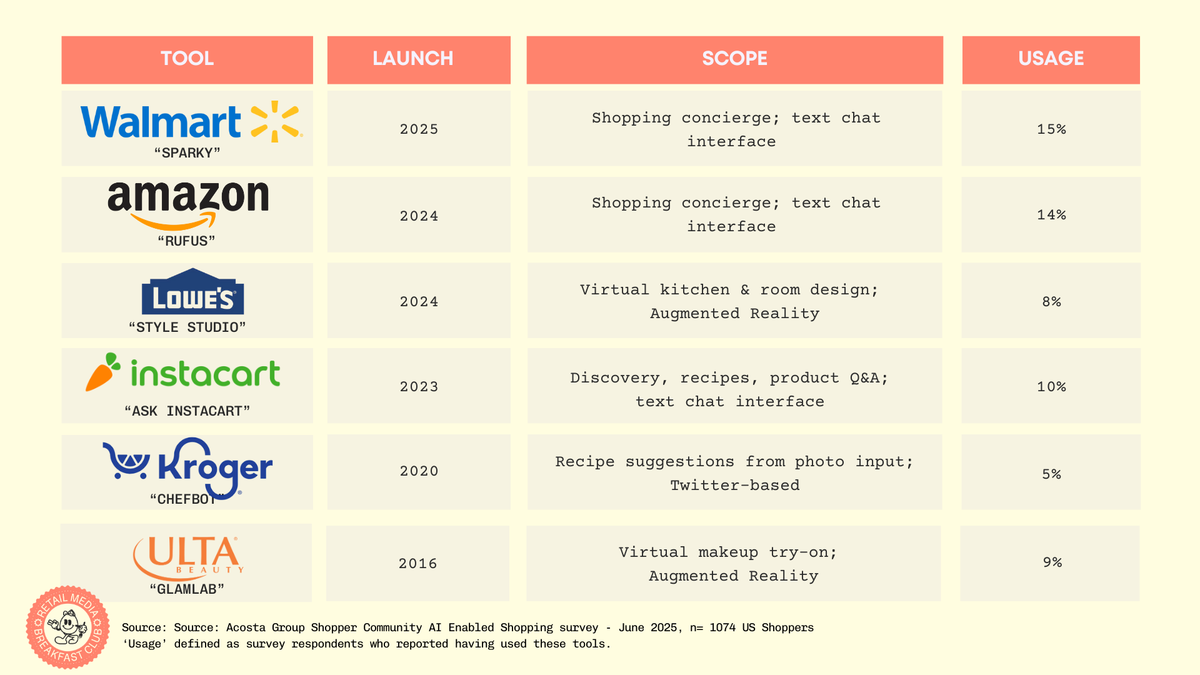

Acosta Group’s retailer intimacy is legendary—merchants answer their calls. You're not going to find that access at the same scale with any other partner out there. That expertise with both retailers and shoppers fuels its Connected Commerce team, which offers digital shelf, retail media, and data analytics all under one roof. Tap into 100 years of retailer relationships and award-winning digital commerce capabilities.

AI-Optimized Content: Mixed Results

One surprise: AI agents don't uniformly prefer AI-generated content. When researchers tested AI-optimized product descriptions, results varied dramatically by category and model.

Big wins in some categories:

- iPhone covers: +9.0% market share (Claude)

- Toilet paper: +15.4% market share (Claude)

- Mousepads: +21.8% market share (GPT-4.1)

But failures in others:

- Washing machines: negative impact across all models

This suggests content optimization for AI agents requires the same category-specific approach that works for human shoppers—there's no universal "AI-friendly" content template.

The Bigger Picture

This research captures AI agents operating in today's grid-based, website-centric shopping environment—but that's also its biggest limitation. The study replicates the ecommerce SERP layout we've used for 20 years, while consumer behavior is rapidly evolving beyond traditional browsing.

Three emerging shopping modalities will likely make these findings less relevant over time:

Vertical video commerce (TikTok Shop, Instagram Shopping) bypasses search grids entirely. When consumers make impulse purchases based on creator recommendations, traditional product positioning and review optimization become irrelevant.

Agent-to-agent shopping through protocols like MCP will make website navigation obsolete. Instead of browsing product grids, AI agents will directly access retailer inventory feeds and product data. Whether retailers are building toward this scenario is unclear, but when it happens, concepts like "grid position" become meaningless.

Voice-enabled shopping is getting another shot with Amazon's Alexa+ and Tesla's integration of Grok. While Alexa and Siri didn't crack voice commerce initially, the technology has improved dramatically. Even if it's just for reordering familiar products, voice shopping operates completely outside visual grid paradigms.

The brands and retailers who win won't be those who game the current system, but those who build authentic product quality and customer satisfaction that translates across all these emerging shopping modalities.

Read more from me on this and related topics: