Rufus Remembers Me

Rufus is building persistent memories of who I am as a shopper, transforming from a search tool into something closer to a relationship. A relationship more like the ones we're starting to build with AI tools in our personal lives.

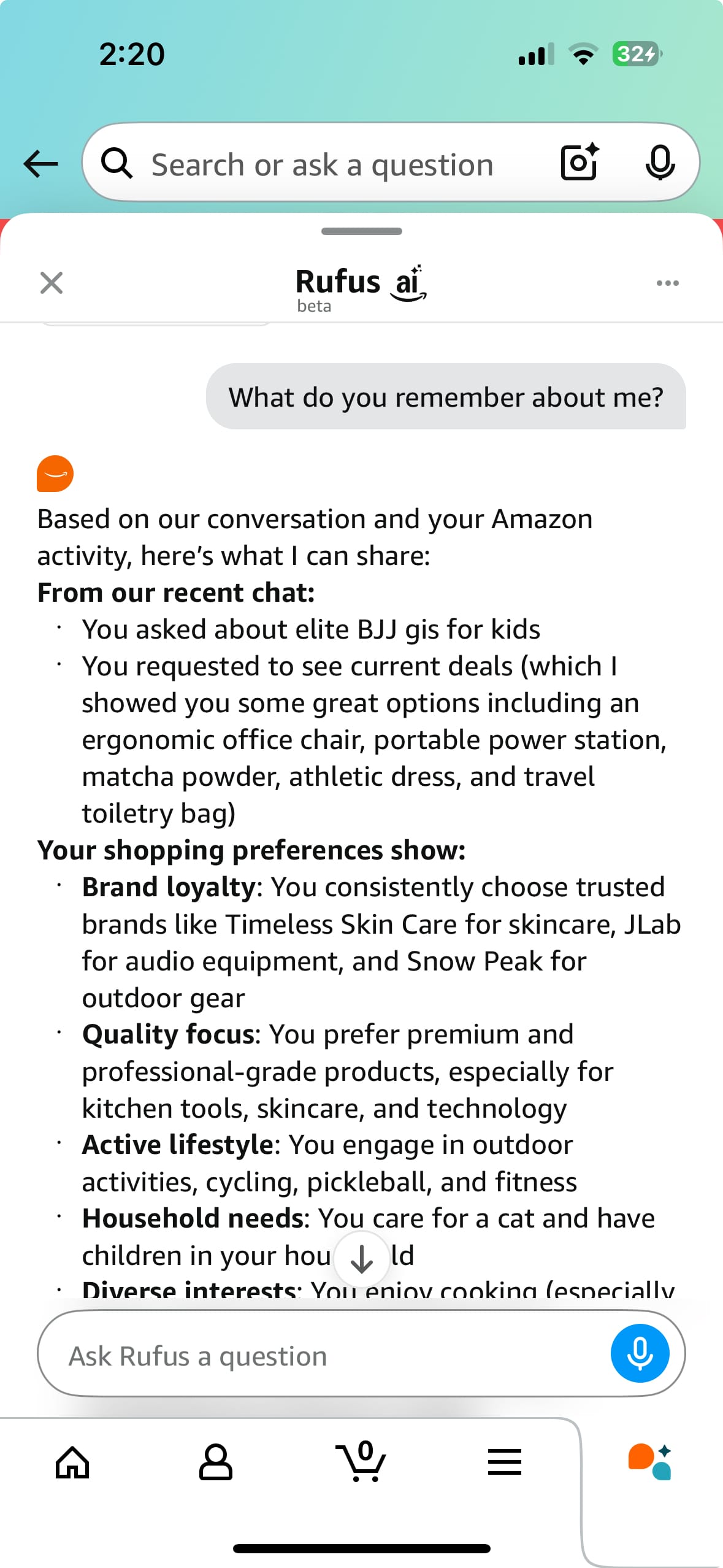

Last Friday, I asked Amazon's Rufus a simple question: 'What kind of person am I in real life?'

Its response stopped me cold. Not because it was wrong, but because it was so specifically right. Rufus knew I play pickleball, have kids, own a cat, crave expensive Japanese camping gear, and maintain what it called a 'comprehensive skincare routine.'

This 'memory' capability appears to have rolled out just last week. Don't be fooled - this is not just a basic feature update. Rufus is building persistent memories of who I am as a shopper, transforming from a search tool into something closer to a relationship. A relationship more like the ones we're starting to build with AI tools in our personal lives.

Rufus' Memory Goes Beyond Personalization

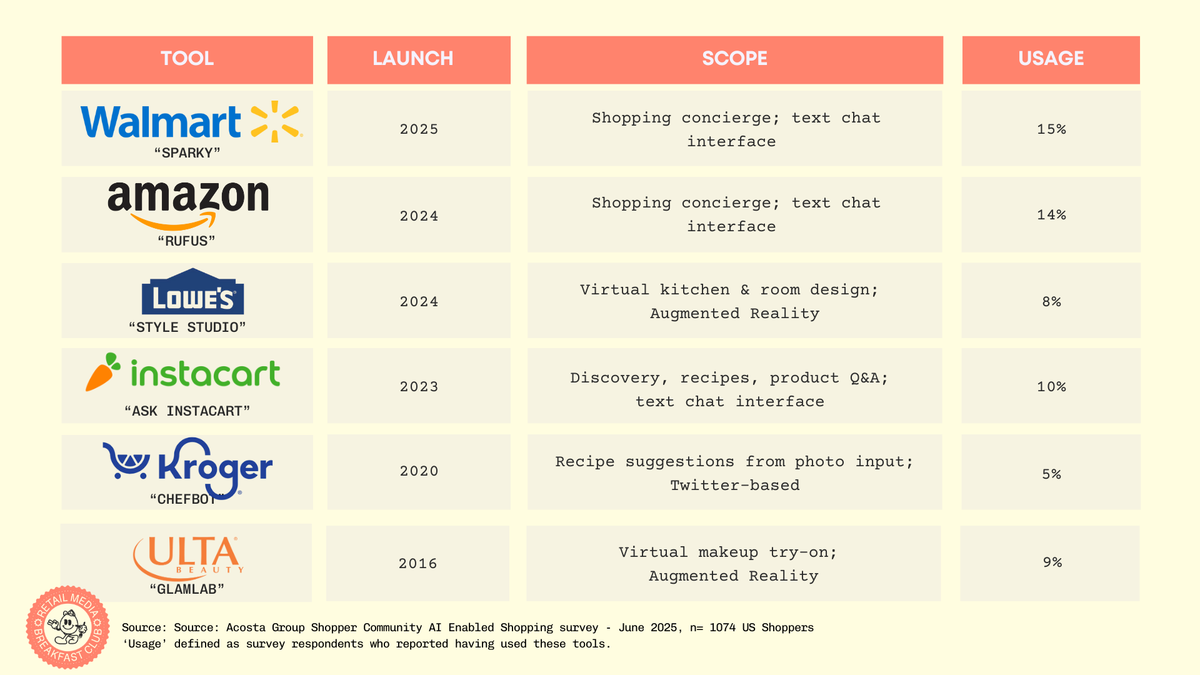

Its true that Amazon has offered personalization for a long time. Here's what's different between traditional Amazon personalization and Rufus with memory:

| Dimension | Traditional Personalization | Rufus with Memory |

|---|---|---|

| Recommendation Trigger | Session-based (“You just searched for running shoes”) | Longitudinal understanding (“You’ve been training for a marathon based on six months of purchases”) |

| Follow-up Logic | Purchase-triggered (“You bought diapers, want more?”) | Persistent preferences (“Last time you asked for plastic-free packaging”) |

| Recommendation Method | Collaborative filtering (“Customers also bought…”) | Cross-category intelligence (“Since you buy organic baby food, here are toddler snacks”) |

| Context Duration | Short-term, resets frequently | Conversational continuity across weeks and months |

The Agent Integration Divide

This memory update forces me to reconsider something. I've been arguing that retailers launching standalone chatbots are wasting their time—that winners will be those who integrate with the personal AI agents consumers already use daily, like ChatGPT or Claude.

But Rufus with memory may change that calculation. If Amazon can make Rufus persistently useful enough—knowing my kids' ages, my cooking habits, my brand loyalties—maybe they can pull off what I thought impossible: getting consumers to use a retailer-specific agent as their primary shopping companion.

Still, most retailers launching "me-too" chatbots without Amazon's data advantage are kidding themselves. A retailer chatbot that forgets me between sessions while ChatGPT remembers everything? Dead on arrival. The smart play remains building bridges to wherever consumers already live digitally—whether that's ChatGPT, Gemini... maybe even Rufus.

When your time, budget and team are already maxed out, keeping up with retailer platforms and media requirements can feel like a never-ending labyrinth. That’s why even the best brands bring in an execution partner.

Acosta Group makes retail media execution simpler. They stay ahead of every platform update, tech shift, and media spec. So your campaigns actually show up and perform—without draining your team. Check them out at Acosta.Group

What Changes for Brands

For consumer brands selling on Amazon:

1. Switching costs just went up When Rufus "knows" a shopper always buys Tide, getting them to try Persil requires more than winning a keyword bid. You're now fighting an encoded preference that strengthens with each purchase.

2. Quality becomes defensible Brands with high satisfaction scores and low return rates get algorithmically entrenched. Your post-purchase experience – packaging, product quality, customer service – now directly impacts future discoverability. Consider the "Customers usually keep this item" messaging that you see on some PDPs – we could see similar personalized messages based on shared interests, like "Customers who love the camping brand Snow Peak also tend to shop this brand."

This potentially helps established CPG brands defend against private label and scrappy unbranded sellers. When AI consistently steers shoppers toward "what worked for you before," displacing trusted brands becomes harder, not easier.

Why Retailers Should Pay Attention

Other retailers face a genuine challenge here. Amazon's advantage isn't just having an AI assistant – it's having two decades of behavioral data to train it on; AND the breadth of category insight that's fairly unique to Amazon. While Walmart and other retailers are building capable AI tools, they're likely working with a fraction of the historical purchase data.

But this isn't insurmountable. Smart retailers have options:

- Pool data through partnerships – Retail media alliances and loyalty programs can aggregate insights

- Focus on specialized categories – Deep expertise in specific verticals can outweigh broad data

- Leverage physical store advantages – In-store behavior data remains a unique asset. This is an area where some retailers will have an advantage over Amazon.

The Bigger Picture

This development challenges my long-held view that retailer-specific agents are doomed—that only those who integrate with consumers' preferred AI assistants will survive. As I've argued before, most retailers launching standalone chatbots are building digital ghost towns. But if Amazon can make Rufus persistently valuable enough, they might prove me wrong.

Read my related posts: