Retail Media Buyers Say They Want Transparency, Then Ask for ROAS

The retail media transparency paradox isn't just about what retailers hide—it's about what buyers fail to demand.

When I told my 8-year-old I was doing a "LinkedIn live," he looked at me blankly. So I tried again: "It's like a Twitch stream, but for work." That he understood. His advice? "Watch out for the comments." Smart kid.

Turns out, he was right—but not in the way he expected. During my "Retail Media Tech Jam" livestream with Scott Messer and Tom Limongello from The Middlemen podcast, we were absolutely run off our feet with audience questions and comments. What started as a casual tech discussion turned into an hour-long deep dive with viewers throwing everything from DSP integration challenges to measurement standardization questions at us.

Yesterday, I shared one snippet from our conversation—my diagnosis of "The Retail Media Doom Loop" and why retailers get trapped between early growth and true scale. But here's another important part of the conversation: the transparency paradox isn't just about what retailers hide—it's about what buyers fail to demand.

The Gap Between What Buyers Say and Do

Scott hit this nail squarely during our conversation: "What people say in a poll is very different from what they actually do during the day. As a media seller, you hear 'we want transparency, we want fraud-free,' and then they go 'yeah, but can you just spend my money and tell me what I got as ROAS?'"

This connects directly to the poll data I shared during our stream. When I asked 67 verified brand-side buyers whether knowing a retailer's tech stack would influence their spending decisions, 89% said yes—these are people managing billions in retail media spend collectively. Yet many of these same buyers aren't pushing for the granular data that would actually help them optimize performance.

I've been documenting the industry's challenges with transparency this year. Jordan Witmer from the agency Salt gave me a shocking example, where one major retail media network responded to brands identifying poor-performing placements by removing their ability to select specific placements entirely—forcing them into bundled packages that obscured the underperformers.

A Media Buyer's Checklist

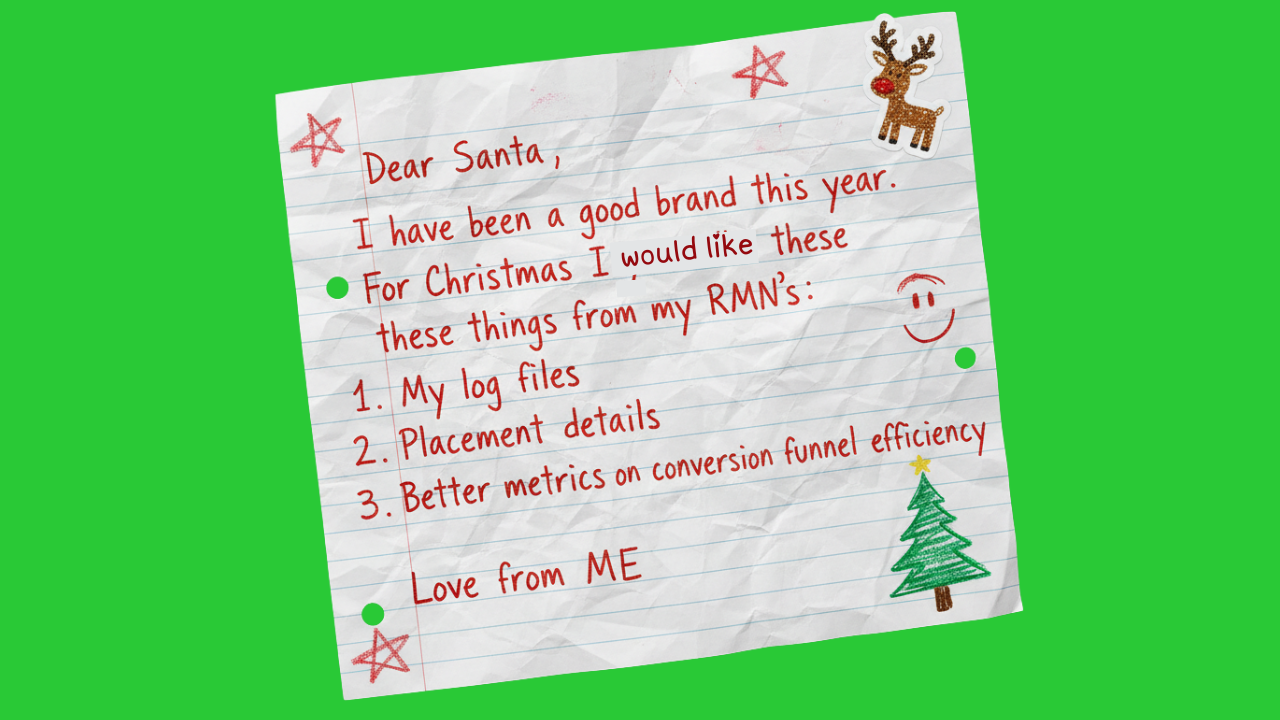

Scott offered up a "buyer's checklist" that brands and agencies should push for when discussing potential expansion to additional RMNs:

Demand your log files. This is where Scott draws a sharp line between using a retail media network's buying platform, versus using your own DSP. "The DSP will definitely give you the log file back, the retail media network may not." Log files show you exactly where your ads ran, when, and how they performed. Without them, you're flying blind.

Ask for site lists and placement details. Scott's point: "There might still be brand damage that gets caused. There might be things that you don't like or that you wanna be sensitive to." You need to know where your media is actually running.

Evaluate conversion funnel efficiency. When you're running on multiple retail media networks, compare not just ROAS but how efficiently each platform moves users through the purchase funnel. Some networks might deliver lower ROAS but much higher efficiency—meaning less wasted spend.

Acosta Group’s retailer intimacy is legendary—merchants answer their calls.

You're not going to find that access at the same scale with any other partner out there. That expertise with both retailers and shoppers fuels its Connected Commerce team, which offers digital shelf, retail media, and data analytics all under one roof. Tap into 100 years of retailer relationships and award-winning digital commerce capabilities.

The Marketplace Evolution Changes Everything

The Middlemen co-host Tom Limongello added another crucial layer: as retailers become more marketplace-like, brands essentially become publishers themselves. Your product detail pages, brand stores, and content quality now directly impact ad performance in ways that traditional retail media buyers aren't used to thinking about.

This shift requires new evaluation criteria. Tom's insight here draws from the early days of sponsored search: initially, platforms simply awarded ad placements to the highest bidder, but quickly discovered that without relevance factors, users wouldn't engage. The same evolution is happening now in retail media.

Quality scores for PDPs could become as important as quality scores were for Google Ads. If you're only buying one retail media network, PDP quality might not seem to matter—you get what you get. But when you're comparing multiple networks, funnel efficiency becomes a real differentiator.

Breaking the Comfort Zone

The most sophisticated brands I've spoken with recently aren't demanding perfection immediately. Instead, they're creating detailed scorecards that clearly outline what it takes to onboard with them or unlock additional budget. They're being transparent about their own requirements if they expect transparency in return.

The key insight: be firm on your ultimate goals, but flexible on the timeline to get there. A fledgling regional grocer's RMN can't match Amazon's reporting capabilities overnight—but they can commit to a roadmap and show progress against clear benchmarks.

As I learned from my 8-year-old's Twitch wisdom, sometimes you have to prepare for uncomfortable feedback. The same applies here. But rather than creating adversarial relationships, the smartest brands are turning these conversations into partnerships.

Share your scorecard. Explain why log file access matters for your optimization process. Help retailers understand that transparency isn't about catching them doing something wrong—it's about building sustainable partnerships that deliver real results for both sides.

The Middlemen podcast, hosted by Tom Limongello, Todd Sawicki, and Scott Messer, features career ad tech experts sharing insights from retail media leaders. You can find the full replay of our "Retail Media Tech Jam" conversation on LinkedIn.