Real Time Bidding: Retail Media's Savior Or Saboteur?

Andreas Reiffen of Pentaleap talks about how RTB can help solve retail media's fragmentation problem.

Sometimes things don't go according to plan.

I had a great conversation queued up with Andreas Reiffen CEO & Co-Founder of Pentaleap, yesterday. We were going livestream on LinkedIn on a topic that Andreas is super passionate about: Real Time Bidding (RTB).

Unfortunately, the tech gods were unkind to us, and the video buffered pretty badly during the livestream. People wanted to ask questions but it was a miserable viewing and listening experience. I'm trying to get to the bottom of it with Streamyard. But – transcripts and AI came to the rescue – I have been able to summarize our conversation here.

(Note: Pentaleap is a client of mine)

Q: To start off, can you explain what real-time bidding (RTB) means in the context of retail media?

Andreas:

RTB has a bad reputation from its early days in programmatic display. Back then, it was associated with poor-quality inventory, brand-unsafe placements, and money leaking through a long supply chain. But retail media is a very different world with a very specific problem: limited reach.

Retail media networks have great endemic inventory but struggle to access large media budgets. RTB offers a mechanism to connect big ad platforms directly to onsite inventory across different RMNs. This means brands can spend through the same UI they already use—making the whole retail media market just a click away.

From an end-user perspective, nothing changes visually: you still see sponsored product listings on retailer sites. But behind the scenes, some of those ads come via RTB—making it easier for brands to buy at scale without managing one-by-one retailer relationships.

Q: Some critics worry that RTB could create a “race to the bottom” on ad pricing. Should retailers be concerned?

Andreas:

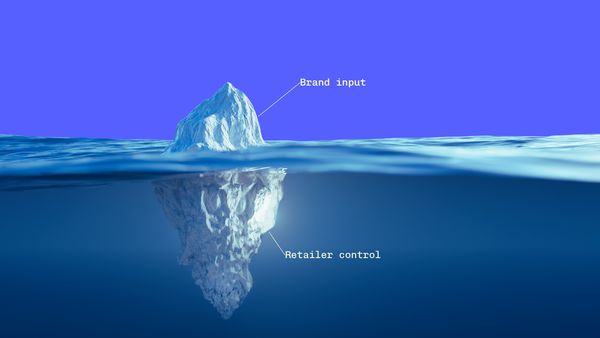

Not really. Platforms like ours (Pentaleap) give retailers full control. They can define which inventory can be targeted, set rules, or even blacklist brands to steer them toward direct-sales channels.

This flexibility lets retailers pursue different monetization strategies simultaneously—just as we’ve seen with Macy’s. They have private-marketplace deals, direct sales, and now RTB connections that allow them to access the same budgets brands spend on Amazon.

Ultimately, this gives brands more choice and retailers more revenue options without losing control.

Q: What are the benefits of RTB for retailers specifically?

Andreas:

Fragmentation is the big issue. On the brand side, you often have a seller negotiating with a merchant, allocating shopper marketing or trade dollars under pressure. On the retailer side, it’s hard to access big agency budgets—they want scale and simplicity.

RTB helps overcome that barrier. It allows retailers—especially smaller or second-tier ones—to tap into large, programmatic-style media budgets. That’s critical for scaling retail media beyond just ecommerce sales.

Q: How is RTB different from traditional API integrations between brands and retail media networks?

Andreas:

APIs have existed for years. Platforms like Pacvue and Skai connect directly to retailer ad servers, pushing campaigns through those APIs. But maintaining those integrations is expensive and time-consuming. Only a handful of partners could afford to build them, limiting access.

RTB flips that model. Campaigns actually live inside major ad platforms like Google, Microsoft, or The Trade Desk. When a retailer sends an ad request, the platform responds with product ads in real time.

Latency used to make that impossible—but we’ve now reduced it to about 15 milliseconds, which makes it completely feasible.

Q: How does RTB differ from solutions like AdCP or other audience connectors?

Andreas:

There’s a misconception that RTB means simply “asking for an ad and showing whatever comes back.” That’s not how it works.

When a retailer sends an ad request, the platform responds with a broad set of potentially relevant products. We then run a quality-scoring process to decide which ones actually get displayed.

We’re also experimenting with another model—sending specific SKUs and asking for bids—but either way, the goal is the same: show highly relevant ads without compromising user experience.

It’s not directly comparable to AdCP; they’re different solutions tackling different parts of the puzzle.

Read more in my recent post for The Drum.

Q: Could RTB eventually power offsite display or video campaigns?

Andreas:

Yes, absolutely. We’re already seeing the first steps toward that.

One example is what I’d call a retailer-led network—where a leading retailer serves as the central hub. Smaller retailers that can’t build full ad networks themselves connect to it via RTB. They send ad requests; the central network responds in real time.

The next step is to use first-party data from those retailers to target customers offsite. That’s tricky in markets like Germany because of privacy laws, but it’s becoming more feasible elsewhere.

Q: What portion of retail media ad spend could eventually run through RTB?

Andreas:

It depends on retailer size and assortment depth. Big retailers will likely handle most of their demand directly and backfill the rest programmatically.

Smaller retailers—especially those joining multi-retailer networks—could see nearly all their demand coming through RTB.

In five years, I expect the market might roughly split 50/50 between direct and programmatic-style buying. But we’ll see—time will tell.

Q: One critique of RTB is that retail media’s strength lies in closed-loop measurement. Does RTB weaken that advantage?

Andreas:

It depends on how you want to buy. If a brand values detailed reporting on a per-retailer basis, they can always go direct.

But if an agency wants to run retail media like any other channel—spending across multiple networks at scale—RTB offers that convenience. They might not drill into each retailer’s reporting but instead view everything as a single aggregated performance bucket.

So it’s really about choice: depth versus scale.

Q: How does RTB interact with traditional trade or shopper marketing budgets?

Andreas:

This is where RTB changes the dynamic. Shopper marketing discussions often happen between a brand’s account manager and a retailer’s merchant, where media spend becomes part of the “relationship tax.”

RTB opens access to entirely different budgets—pure media budgets focused on performance rather than relationship management.

So both models will coexist: relationship-based spending for strategic accounts and performance-based spending via RTB for scalable efficiency.

Q: Pentaleap works with over 20 retailers. Do you expect them all to adopt RTB soon?

Andreas:

Yes, I’m confident. Every retailer we talk to is under pressure to grow media revenue, and everyone wants incremental demand.

After some overly optimistic projections for retail media, there’s now a push to unlock new budget sources. RTB provides exactly that.

Retailers won’t necessarily open everything to RTB—but using it to backfill non-top-tier brands or smaller campaigns makes total sense.

Q: What’s one thing people misunderstand most about RTB?

Andreas :

That it’s only about external demand.

We’ve used RTB internally for about two years, not just for new demand but to improve flexibility in ad-tech stacks. It enables modularity.

You can think of two layers:

- Front-end orchestration — managing the customer experience and page rendering.

- Ad-serving — selecting and delivering the right ads.

RTB lets you swap one layer without replacing the other. That means less vendor lock-in, easier experimentation, and faster innovation.

Large retailers like Home Depot and Macy’s already take this modular approach, but smaller RMNs often don’t realize how much flexibility RTB gives them.

Q: What about B2B companies—can they also build RTB-enabled media networks?

Andreas:

Technically, yes—it’s very similar. The difference lies in customer lifetime value and audience segmentation.

We work with a company that runs both B2C and B2B platforms. Their business buyers reorder frequently, so CLV is much higher. Campaigns should reflect that long-term value.

If you’re targeting professionals—say, Home Depot’s “Pro” customers—you can segment them and apply bid modifiers. For example, you might raise bids by 150% for professional buyers.

As long as you have a diverse set of endemic advertisers, a B2B retail media model can absolutely work.

Q: Any final thoughts to wrap up?

Andreas:

Retail media is still evolving quickly. RTB won’t replace direct sales—it complements them. It’s about choice, efficiency, and interoperability.

Retailers that embrace flexibility—both technically and commercially—will be the ones who capture the next wave of growth.

You can connect with Andreas on LinkedIn, and learn more about Pentaleap here.