Criteo Built the Retail Media Playbook. Now Rivals Are Using It Against Them

Everyone seems to want to dunk on Criteo lately, even their tech partners. What does this tell us about the state of retail media?

When Criteo's own partners publicly celebrate a write-up of its struggles, you know something's shifted in retail media's power dynamics.

Last week, Kathryn Lundstrom's ADWEEK piece laid bare Criteo's mounting challenges—lost clients like Target's Roundel and Uber Eats, plus a growing army of nimble competitors nipping at its heels. But what really caught my eye wasn't the article itself. It was the LinkedIn victory lap that followed.

Jon Flugstad from Moloco—a Criteo competitor—posted a cheeky Spotify link to a song about time running out for incumbents. Andreas Reiffen, CEO of rival Pentaleap, chimed in about how "the next phase of competition will be all about technology, and that's where startups are ahead." Even Drew Cashmore from Vantage couldn't resist adding that the industry owes Criteo credit for "educating the market"—corporate speak for "thanks for warming up our customers."

What can we learn about the state of the retail media industry from this frenemy situation? Why are Criteo’s own integration partners prepared to throw them under the bus?

The Disruptor Becomes the Disrupted

Here's the irony that should keep Criteo's executives up at night: they wrote this playbook themselves.

Back in the early 2010’s, Criteo was the scrappy upstart that kneecapped the incumbent ad networks of the era. Criteo’s innovation was retargeting technology that let marketers buy display ads like search—measurable, accountable, and cheaper than the CPM mark-ups incumbents relied on. It was textbook Innovator's Dilemma: attack from below with a "good enough" solution that the big players couldn't match without cannibalizing their margins.

Fast forward to today, and Criteo has become the incumbent of retail media. They're stuck defending a tasty margin which I’m told by insiders can be three or four times as much as what a retailer would spend on an in-house solution. Such a premium made sense when Criteo had a near-monopoly on advertiser demand (i.e. brands wishing to advertise on retailers running on Criteo’s tech). But that moat is evaporating faster than you can say "real-time bidding."

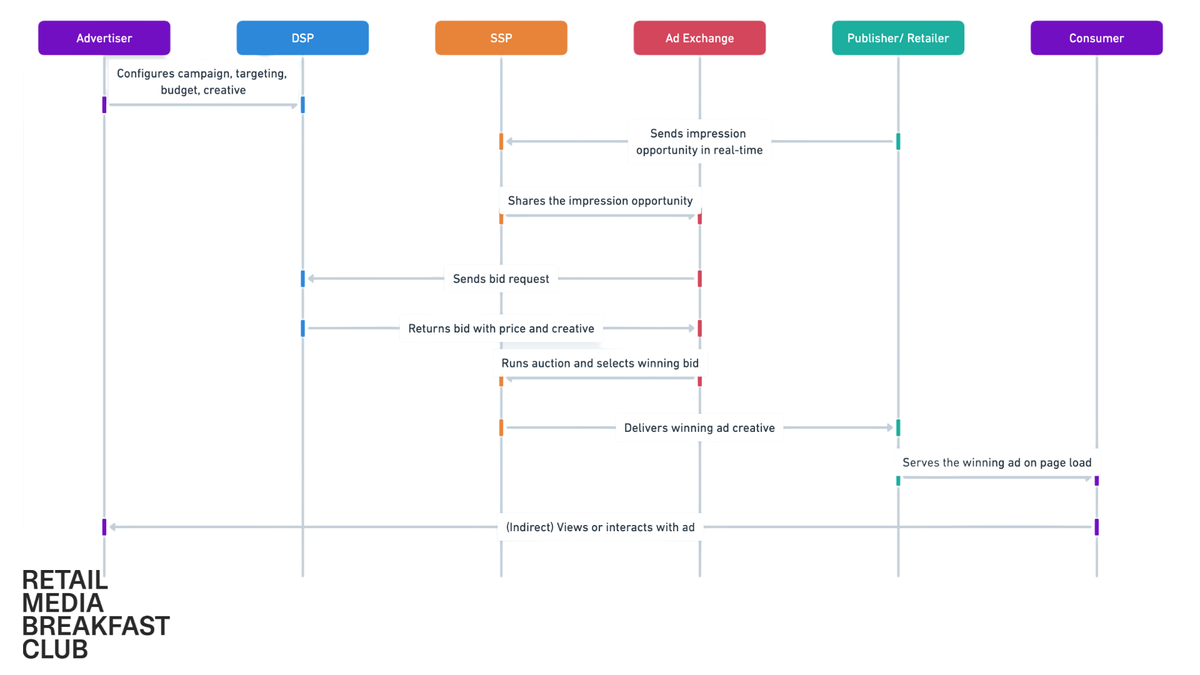

Real Time Bidding lets any DSP match to supply-side inventory in real-time, stripping away the mark-ups that once padded Criteo's managed-service fees. When prices get set in open auctions, the fee that retailers are paying for intermediaries to route advertiser demand to inventory supply suddenly looks like an avoidable surcharge.

CEO of Pentaleap Andreas Reiffen spelled out the dynamic on LinkedIn in a comment on ADWEEK’s article: "with RTB now live, that moat is eroding fast. By the end of the year, challengers like Pentaleap or Koddi will have the same or even more demand flowing through their pipes." (Disclaimer, Pentaleap is a client of mine)

Just like any industry incumbent, the danger is in defending yesterday's business model while the market rewrites the rules around them.

Did you know that 60% of shoppers abandon carts when product info is wrong? Before you ramp up your ad spend, fix the shelf. Acosta Group’s award-winning Connected Commerce crew is trusted by brands like Coca-Cola and Sanofi to deliver critical content updates. Acosta Group handles it all, then layers on media buying.

Learn more about Acosta Group’s Connected Commerce capabilities at Acosta.Group

Awkward Alliances

Here's where things get kind of awkward: Criteo often partners with the very companies now nibbling away at it.

As one industry insider told me, Criteo is uniquely talented at aggregating advertiser demand. "Criteo's strategy went from being 'everything has to be Criteo' to a kind of 'who can Criteo work with'." Because a Criteo is going to become that demand partner," they said.

Adtech startups tend to initially go after a specific segment of the retail media value chain, like ad serving or order management. So initially they need to integrate with incumbents like Criteo who provide the bones of the rest of the stack and bring in the advertiser demand. Criteo may agree to integrate with these newcomers in order to retain a retailer as a customer. The partner may offer such a narrow capability at the time that it doesn’t appear to be competitive.

But the startups have bigger ambitions. Some begin to extend their reach through the value chain by building new capabilities, or partnering up with complementary players, or using technology like RTB that allows them to hook directly into advertiser demand from buy-side platforms, essentially cutting out Criteo – the company that was initially essential to making the whole thing work.

The Inevitable Shakeout: Two Options

So how does this dustup end? Two scenarios seem most likely, and they may not be mutually exclusive.

Scenario One: Criteo goes shopping. They've done it before—acquiring HookLogic in 2016 to vault into retail media, and more recently IPONWEB to bolster their tech stack. Snapping up one of the newer tech players would eliminate a competitor while acquiring the nimble tech they need.

Scenario Two: The challengers consolidate among themselves. These startups already partner extensively—Pentaleap with TEADS, Koddi connecting through Skai. Partnerships are already extensive among complementary players, but there could also be consolidation among direct competitors. The venture capital backing these companies won't wait forever to see their money back.

The clock is ticking. I wrote earlier this week about a future scenario where the shopper audience pendulum swings away from retailers and toward LLMs as a primary surface for shopping and transacting. All retail media tech players need to make hay while the sun shines, or be prepared to reinvent themselves if consumer behavior indeed bends in that direction.

Criteo knows reinvention well— transforming from retargeting pioneer to commerce media platform. They know how to disrupt, even themselves. The question is whether they'll move fast enough this time.

Their own history proves they can evolve. Now they need to remember that playbook—before someone else uses it on them.