Will The Retail Industry Welcome The 'Commerce Media' Newcomers?

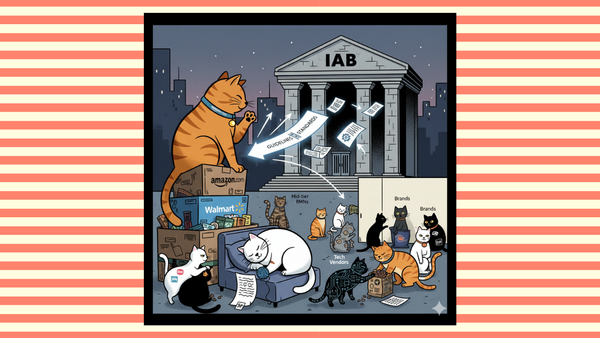

Commerce media is the new Retail Media. It's new definition by the IAB marks a transition that has already been occurring as brands consider any viable mechanism to meet the consumer where they are.

Back in January when I named this thing "Retail Media Breakfast Club," I thought I'd nailed it. Seven months later, the Interactive Advertising Bureau (IAB) has basically declared my brand name outdated. The new term? Commerce media.

Before I panic-rebrand, I wanted to dive into how the different players in the game think of this evolution.

Inside The Retailers' Brains

I dug into the IAB's new definition in a WARC piece this week (grab while it's free, it gates in 7 days). That piece explains their categories – six different verticals, three activation environments, and why retail media leaders mostly welcome the change.

The WARC article also explores tensions, like how retail media tracks item-by-item sales while new commerce players often can't. Yet some commerce networks like PayPal claim data advantages over retailers.

But what matters here – what that piece doesn't cover – is how brands are responding. After all, they're spending the money.

The Definition

The IAB moved from "retail media" to "commerce media" as the umbrella term. Their definition (stay with me through the jargon): commerce media is any business that "transforms its physical assets, digital properties, first-party data, and proximity to customer journeys into advertising opportunities."

Six verticals: retail media (most mature), plus travel, financial services, automotive, telecom/utility, and B2B media. Think PayPal ads, airline seat-back screens, bank app advertising – all now officially alongside Amazon and Walmart Connect.

Why do non-retail entities want in on the hot retail media market? And why are retailers welcoming them?

Retail media historically feeds on trade and shopper marketing budgets. Commerce media can tap broader brand budgets. That's a major unlock – if it happens.

Here's the catch: True retail media tracks down to specific products. When Oreos buys a sponsored placement through Walmart, they know how many boxes and which variations you bought after seeing the ad. Other commerce players might know you purchased something after seeing their ad, but can't provide granular, SKU-level attribution.

Did you know that 60% of shoppers abandon carts when product info is wrong? Before you ramp up your ad spend, fix the shelf. Acosta Group’s award-winning Connected Commerce crew is trusted by brands like Coca-Cola and Sanofi to deliver critical content updates. Acosta Group handles it all, then layers on media buying.

Learn more about Acosta Group’s Connected Commerce capabilities at Acosta.Group

What The Money-Spenders Think

Jason O'Toole, Head of Connected Commerce and Media at Hanes Brands International, tells me his team has actually reorganized around this broader thinking. They've renamed from retail media to "connected commerce and media" because they're placing the consumer at the center, recognizing that people don't follow neat funnel patterns.

"It's possible today to discover a product through on-site search and decide to purchase during a connected TV pause ad. We win by honoring that experience and delivering brilliant media activation," he says. That's exactly the kind of cross-platform thinking the IAB's framework tries to capture.

Ben Galvin, Senior Director of Omnichannel Retail Sales and eCommerce at Monster Energy, tells me they're considering buying media through non-retail platforms like Instacart, Uber, and DoorDash because of their direct influence on purchase behavior. But he also notes brand-side media buyers remain cautious due to fragmented measurement: the "ability to prioritize unit/case sales impact or projections and unclear ROI compared to retail media giants like Amazon, Kroger, Walmart."

Roger Dunn, a consultant and Global Media Lead at a bevalc conglomerate, currently focuses on key customers – marketplaces, supermarkets, quick commerce, and alcohol specialists – but actively explores commerce media players and data providers. "Despite not being at the point of purchase, there are clearly valuable audiences and environments becoming available," he notes.

For Dunn, the distinction is clear: "Retail media is a subset of commerce media. It's tied directly to retailers with closed-loop attribution, SKU-level granularity, with on-site placements or leveraging retailers' audiences directly offsite. Commerce media is broader – encompassing any digital environment where a transaction can happen or be initiated, whether that's finance players, travel companies, shoppable ads, or social platforms."

These non-retail platforms aren't waiting for official invitations. They were absolutely out in force at Cannes this year with huge cabanas and activations to get the word out to marketers. Ben from Monster mentions they're getting approached both through agencies and directly, with promises of closed-loop measurement and incremental sales. But he notes there are inconsistent standards across platforms – a challenge the IAB is also trying to solve.

Roger Dunn confirms the momentum: "We've definitely seen a noticeable uptick in pitches from non-retailer commerce platforms, both directly and through agency partners. The conversation often centers around exclusive data access, emerging audience signals, and category fit. It's still early days for many of these players, but we're excited to hear about any new opportunities that can drive measurable sales and growth."

Cody Tusberg, EVP Digital Commerce & Retail Media Services at Acosta Group (disclosure: Acosta Group sponsors this newsletter), reinforces how this aligns with their vision. They leverage several non-retail platforms, but all focused on specific content or deal trial components. "So far results have been received well. In CPG the more product we can get initial trial on the better the longer-term outcome," he says.

Ash McMullen, Head of Ecommerce at Advantice Health, raises a really intriguing question about what this means for direct-to-consumer brands. "Whoever has the most rock-solid first-party data gets a head start," she suggests. Could this breathe new life into DTC brands who've been building customer lists while everyone else relied on third-party cookies? Since commerce media thrives on data-rich targeting and closed-loop measurement, DTC brands with robust CRM data could punch above their weight when activating across these new platforms.

Why Brands Are Already There

What struck me talking to these brands is that the organizational shifts are happening now. Teams are restructuring. Budgets are moving from trade allocations to brand spend. New partnerships are forming. These platforms are pitching hard, both directly and through agencies.

The IAB isn't pushing for a revolution; they're documenting what's already rolling. It's recognition that "retail media" was always too narrow for what was happening.

Want the full breakdown of how retail media incumbents are reacting and what the IAB's framework actually means? Check out my WARC piece here – but grab it quick before it goes behind the paywall.