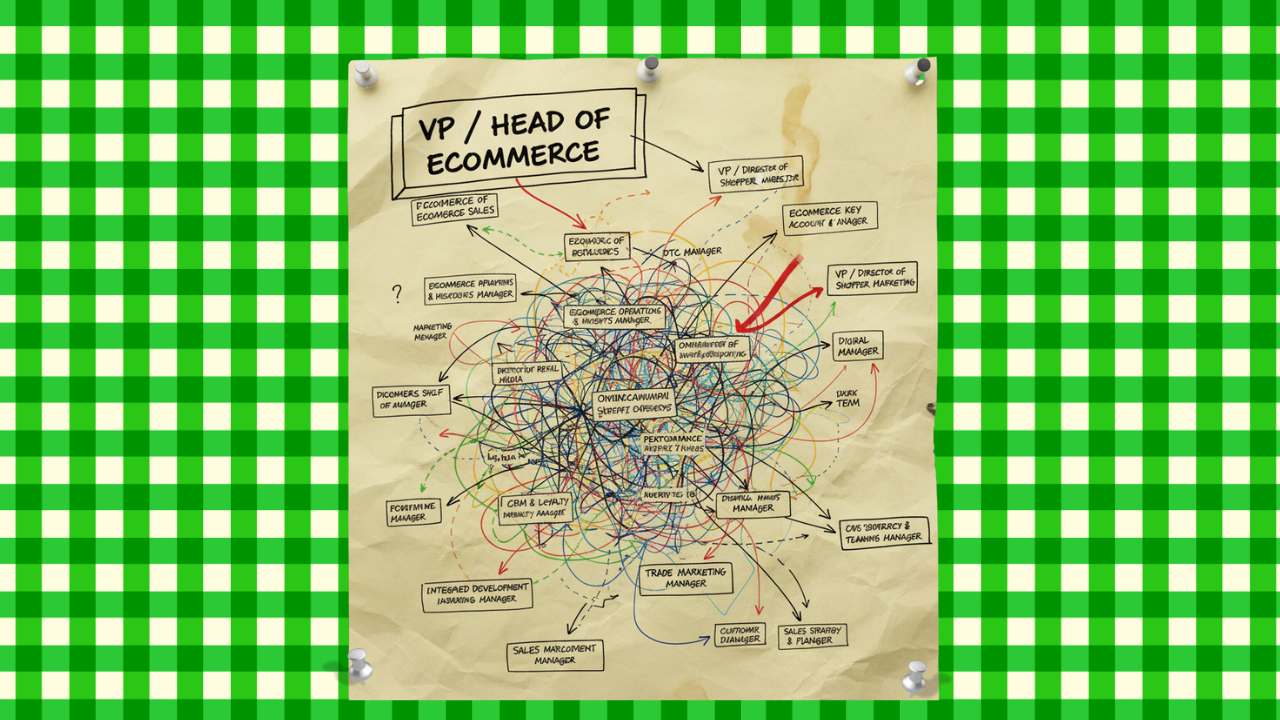

Why 'Omnichannel' Misses the Point

The old question of "where should ecommerce sit?" feels increasingly irrelevant. The consumer journey doesn't respect departmental boundaries, so why should your organization?

"What are your thoughts on going omni-channel in today's world?" an audience member asked the panel.

"I recommend against it," said ecommerce expert Jason Goldberg.

His reasoning cuts to the heart of why organizational debates miss the point:

What I meant is that "Omni-Channel" puts the focus on the wrong thing... Channel. Who cares where she pays? What matters is: how is she discovering new products, how does she choose what to buy, does she buy it, and how does she want to recieve it? So I'm way more focused on who the potentially profitable customers are, exactly what they want, and then try as hard as possible to give it to them!

And that is the crux of a new research report from The Digital Shelf Institute, a commerce industry research organization. "Reinventing the Organization for Omnichannel Success: Beyond 'Where Ecommerce Sits'," released on September 17th, surveyed over 90 brand leaders and conducted 33 interviews across functions like marketing, sales, supply chain, and ecommerce to understand how successful organizations are adapting to digital commerce.

What follows are my key takeaways from their research, combined with what I'm seeing in the field working with brands navigating these same organizational challenges. The report covers everything from AI integration to talent development, but I want to focus on the core insight that's reshaping how smart CPG companies think about growth.

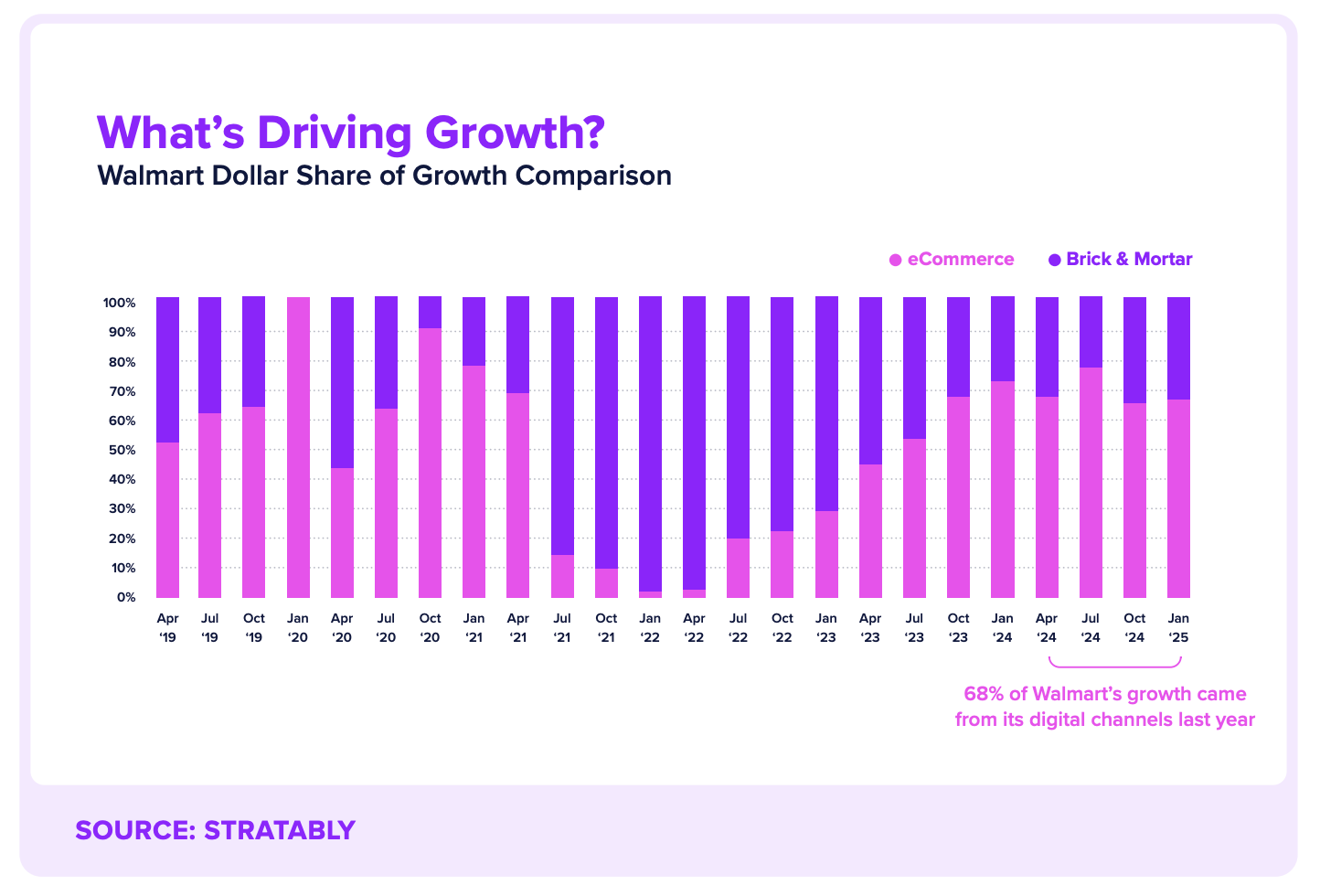

'Digitally Influenced' > Digital Sales

68% of Walmart's growth in 2024 came from digital channels. And while digital commerce still represents a fraction of total retail sales, this growth trajectory tells us that consumer behavior continues to migrate to digital channels, or at least be affected by them throughout the purchase journey.

Consider this: a consumer might research a product on Instagram, read reviews on Amazon, check availability on a retailer's app, then ultimately purchase in-store. Traditional metrics would classify this as an "in-store" sale, but every step except the final transaction happened digitally. Organizations still measuring success through channel-specific metrics are missing how consumer behavior actually works.

This digitally-influenced reality is why the perennial question of "where should ecommerce sit?" feels increasingly irrelevant. The consumer journey doesn't respect departmental boundaries, so why should your organization?

Did you know that 60% of shoppers abandon carts when product info is wrong? Before you ramp up your ad spend, fix the shelf. Acosta Group’s award-winning Connected Commerce crew is trusted by brands like Coca-Cola and Sanofi to deliver critical content updates. Acosta Group handles it all, then layers on media buying.

Learn more about Acosta Group’s Connected Commerce capabilities.

Why Joint Commercial Leadership Is Having a Moment

The DSI research highlights something I've been seeing more frequently: companies appointing chief growth officers or chief commercial officers who own both sales and marketing. As the report notes: When sales and marketing report to different leaders, silos and competition can occur within the organization. This structure also reduces end-to-end visibility.

This makes practical sense when you consider modern retail realities. Retail media spending planning happens during joint business planning sessions. Trade marketing dollars and performance advertising budgets are increasingly fungible. The old model where sales managed retailer relationships while marketing handled brand building breaks down when your "marketing" includes sponsored product ads that are sometimes now a discussion point in joint business planning. (Read more on this topic in my recent post, Brands are From Mars, Retailers Are From Venus)

The Quiet Edge That Small Brands Have

The DSI report includes a striking statistic from consulting firm Bain: The 97 small brands on Bain's Insurgent Brands 2024 list account for less than 2% of market share, but they've captured nearly 30% of incremental category growth.

I've seen why this happens. Smaller startup competitors focused on ecommerce don't spend trade marketing dollars since they aren't distributed in-store. This means they can push significantly more budget into performance retail media advertising. When retailers benchmark large brands against these competitors, they'll say: "These guys are spending 30% more on retail media—we need you to get there too."

Large brands will never match that percentage of revenue on performance retail media because they have other required costs to maintain shelf visibility. But they have something smaller brands don't: scale and resources for technology investments and training programs.

As Donna Sharp from MediaLink notes in the DSI research: "At smaller businesses where they have no choice but to lean into automation and provide a single voice to Walmart and their consumers, there is a focused strategy, execution and optimization approach. When scale is applied to technology investments, training, and speed of new model roll outs, it wins again."

The Unilever Extreme: Reorganizing Around Consumer Behavior

For a real-world example of what consumer-first reorganization looks like, consider Unilever's recent strategy shift. Mike Shields, writing for his Next in Media newsletter, interviewed Selina Sykes, VP and Head of Digital Marketing & Social First at Unilever Beauty & Wellbeing, about the company's ballsy plan to spend 50% of its media budget with creators while working with 20x more creators than before – announced just this March by its incoming CEO.

This isn't just a media strategy shift—it requires completely different organizational capabilities. As Sykes explained to Shields, traditional marketing required "copywriters, designers, analytics people, media buyers—drowning in meetings... taking weeks to launch anything." Their creator-focused approach enables "a single smart marketer with AI agents... testing tons of marketing angles in real-time."

But don't be fooled into thinking its all vibe marketing happening over at Unilever these days. The interview reveals how difficult this approach is to operationalize, scale, and measure. It requires different team structures, budget allocation processes, and success metrics. There's been skepticism from the broader retail marketing community about whether Unilever's approach can work at scale and deliver results on a quarterly earnings drumbeat. But if a company the size of Unilever can figure out how to restructure around consumer behavior, any brand can build more digitally-minded organizations.

Shared Goals Trump Perfect Structure

The DSI survey reveals that companies with shared goals have more cross-functional alignment, a better understanding of ecommerce across the organization, and a higher percentage of online sales. Just over 47% of respondents currently have shared goals in place.

Eric Tarnowski, former Senior Vice President of Connected Commerce at Kenvue, captured this shift perfectly in the DSI paper: "We used to divide and conquer when it came to sales and marketing. Sales was focused on the shopper in [the] store and marketing on the consumer at home. They were separate universes with separate teams, but that separation no longer exists."

Instead of asking where ecommerce should sit, start with different questions: What are our company's goals? What strategy will achieve those goals? What jobs need to be done? What teams and capabilities do we need to execute effectively?

The brands winning aren't the ones with the most elegant org charts. They're the ones that have stopped forcing digital commerce into traditional retail structures and started building organizations that think digitally first.