Why Are Display Ads In Retail Media Still So Bad?

Melanie Zimmermann's insights from building Macy's retail media operation and now overseeing retail media globally at Criteo provide a roadmap for what needs to change.

When Melanie Zimmermann launched onsite display for Macy's Media Network, she quickly discovered a frustrating reality: the fragrance category had more advertising demand than available traffic could support, while apparel experienced the opposite problem. Fixed CPM pricing—where advertisers pay a set rate per thousand impressions—couldn't adapt to the unique demands of retailers. Attempts to create more granular, category-specific media pricing often required updating insertion orders (their already-agreed pricing with advertisers) and created operational complications.

This experience, which Zimmermann detailed in a recent essay on the Criteo blog (Read: Legacy display is failing retailers) highlights a much larger issue plaguing retail media today. Traditional display advertising technology simply wasn't built for retail environments, yet most retailers are still trying to force a square peg into a round hole. Zimmermann's insights from building Macy's retail media operation and now overseeing retail media globally at Criteo provide a roadmap for what needs to change. In this post I'll recap her analysis and add some additional industry perspectives.

A Brief History of Display Advertising

To understand why retail media display is broken, it helps to know what display advertising actually is. Display ads are the banner ads, video ads, and rich media placements you see on websites—distinct from sponsored product ads, which are the product listings that appear in search results.

Display advertising evolved in the traditional publishing world, where companies like newspapers and magazines needed to monetize their content. The technology stack that emerged—ad servers, supply-side platforms (SSPs), and demand-side platforms (DSPs)—was designed for publishers whose primary goal was selling ad inventory to generate revenue.

(I've written previously about how these various technologies work together in the retail media ecosystem here: How an RMN's tech stack impacts your advertising results)

The mismatch becomes clear when you consider how this technology operates in retail environments. As Brian Gleason, CRO and President of Retail Media at Criteo, noted in a January 2025 AdExchanger interview, most retailers are still "running display on Google Ad Manager, and there was no way to connect them" to their sponsored product campaigns. Andreas Reiffen, CEO and co-founder of adtech company Pentaleap (disclosure: Pentaleap is a client of mine), puts it even more bluntly: "Google Ad Manager wasn't built for retail media. It's a general display tool for companies that don't sell products. There's no auction by design. [They] sell impression packages—like, 'X million impressions for this price.'"

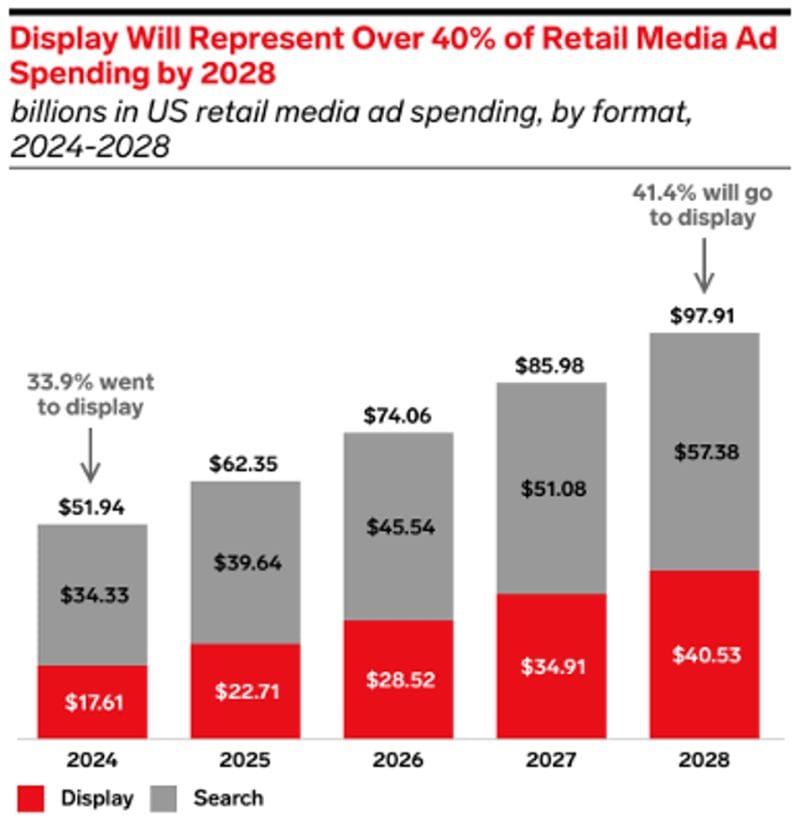

This infrastructure problem is only going to be exacerbated in the coming years. According to eMarketer, display advertising will jump 130% from $23 billion to $41 billion by 2028, with display's share of total retail media spend rising to over 40% by 2027.

Why Legacy Display Falls Short in Retail

The fundamental problem lies in a basic misalignment of objectives. Traditional ad-tech platforms were designed for publishers whose primary goal is driving ad revenue. But retailers have dual objectives: they need to generate advertising dollars while also selling the products in their catalog.

While most retailers undoubtedly want to grow an uber-profitable revenue stream like media, some – understandably – refuse to compromise the customer experience. Mark Williamson, who leads Costco's retail media network, says that member value comes before advertising metrics. (Read more in my past post: My Notes From an Interview with Costco's RMN leader, Mark Williamson)

At Macy's, Melanie Zimmerman experienced this tension firsthand. The team eventually moved to bundled packages—selling groups of ad placements together—which provided operational flexibility but made it harder to optimize revenue. But brands and agencies unequivocally despise this model. It feels like a black box, without meaningful control over campaign pacing, optimization, or keyword strategies. Such workarounds contribute to distrust between brands (and their agencies) and retailers.

Why Retail Media Needs Different Ad Tech

The core issue is relevance, and Andreas offers a perfect analogy: "It's like a store window. Whatever you put out has to be relevant. Otherwise, it's just an ad. But people are there to shop—that's the core of the business model."

As Andreas explains, this creates jarring shopping experiences: "You don't want to show a tablet when someone searches for a laptop. If you do that, you'll kill more of your business."

This disconnect between what shoppers want and what they're shown in display ads undermines the entire shopping experience.

What Modern Retail Display Should Look Like

Melanie Zimmermann's vision for modernizing retail display centers on three core principles, which industry developments are beginning to validate.

Dynamic, Retail-Specific Auctions

Amazon and Walmart have already validated auction-based models for retail media, but many retailers remain stuck with fixed-price approaches better suited to legacy publishing. What retailers need is a retail-optimized auction solution that complements direct deals with premium auction demand.

The key difference lies in how relevance gets factored into the auction. Andreas from Pentaleap explains how his company's tech approaches the problem: "Our tech maps every banner—could be a video too—to a specific product or product range. When an ad impression comes in, and we have 10 competing banners, we don't just pick the highest bidder. We look at which banner's related products have the highest organic coverage for that search."

This approach is similar to how sponsored product ads work. If a banner doesn't align with what users want, it needs a much higher bid to win the slot, ensuring relevance while maximizing both click-through rates and revenue.

True Self-Service Capabilities

The managed service model that dominates onsite display today leaves brands feeling powerless. While smaller brands may appreciate simple placements, larger brands and agencies want control—the ability to adjust pacing, placements, and keyword strategies in real-time.

Real self-service requires supporting multiple buy types, from lockouts (guaranteed ad placements at fixed prices) and preferred deals (priority access to inventory at negotiated rates) to auction-based purchasing.

Commerce-Native Ad Formats

Retail media isn't traditional publishing, so the ad formats need to be different too. Modern retail display should support retail-native formats including static ads, rich media, and onsite video specifically tailored for brand storytelling in commerce environments.

More importantly, hybrid formats that blend display or video ads with shoppable elements like sponsored products create cohesive shopping experiences that bridge brand and performance goals. With real-time conversion reporting available directly within the platform, retailers and brands can optimize campaigns mid-flight instead of waiting for post-campaign insights.

The Path Forward

The technology to solve these problems exists—it's about retailers choosing retail-first solutions over legacy publishing tools. As Melanie emphasizes, the focus must be on "prioritizing the shopper experience through retail-native, shoppable formats" while "maximizing retailer revenue opportunities via flexible purchasing models."

The competitive implications are significant. Brands are increasingly withholding spending from platforms that can't demonstrate true incremental value. In a market where display spending is set to nearly double, retailers using outdated technology risk being left behind.