What It Actually Takes to Build a Retail Media Federation

Part 3 of my exploration into a possible future of retail media consortiums and federations.

Building retail media federations sounds like a no-brainer: retailers pool their audience and inventory assets to attract a bigger share of ad dollars, while retaining their unique value proposiiton. In practice, it requires solving technical, governance, and competitive challenges that go far beyond good intentions.

Yesterday, I explored the retail media federation models already taking shape—from Valiuz's success in Europe to Rippl's consortium approach in the US. But as industry interest grows, the harder questions emerge: What does it actually take to make these collaborations work? And why do some experienced operators remain skeptical?

The technical challenges are confronting. When you're trying to unify retailers operating on completely different systems—some updating customer data in real-time, others refreshing weekly—the infrastructure requirements go far beyond simple data sharing.

This is part 3 of my series on Retail Media alliances, federations and consortiums. Part 1 covered why the current fragmented model with 200+ networks is unsustainable for brands managing an average of just six relationships. Part 2 examined the federation models already emerging—from Valiuz's success in Europe to Rippl's consortium approach and Best Buy's platform ambitions—plus the scale and measurement problems these collaborations are trying to solve.

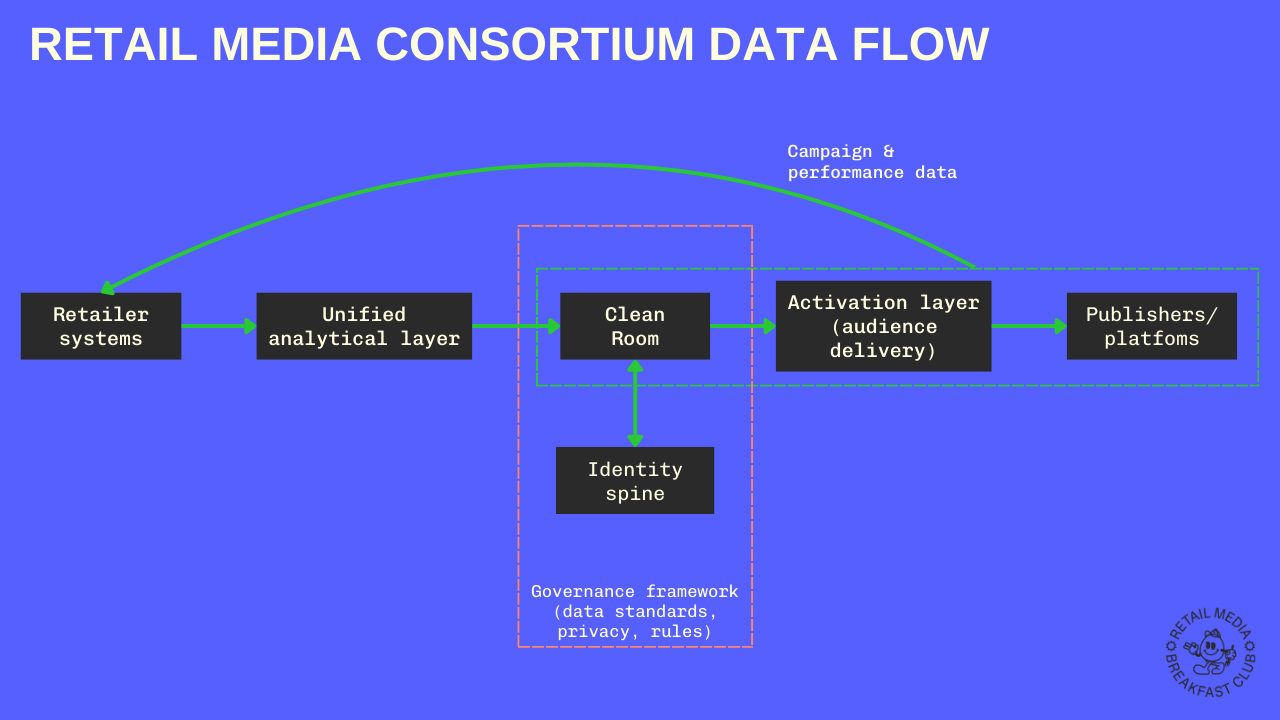

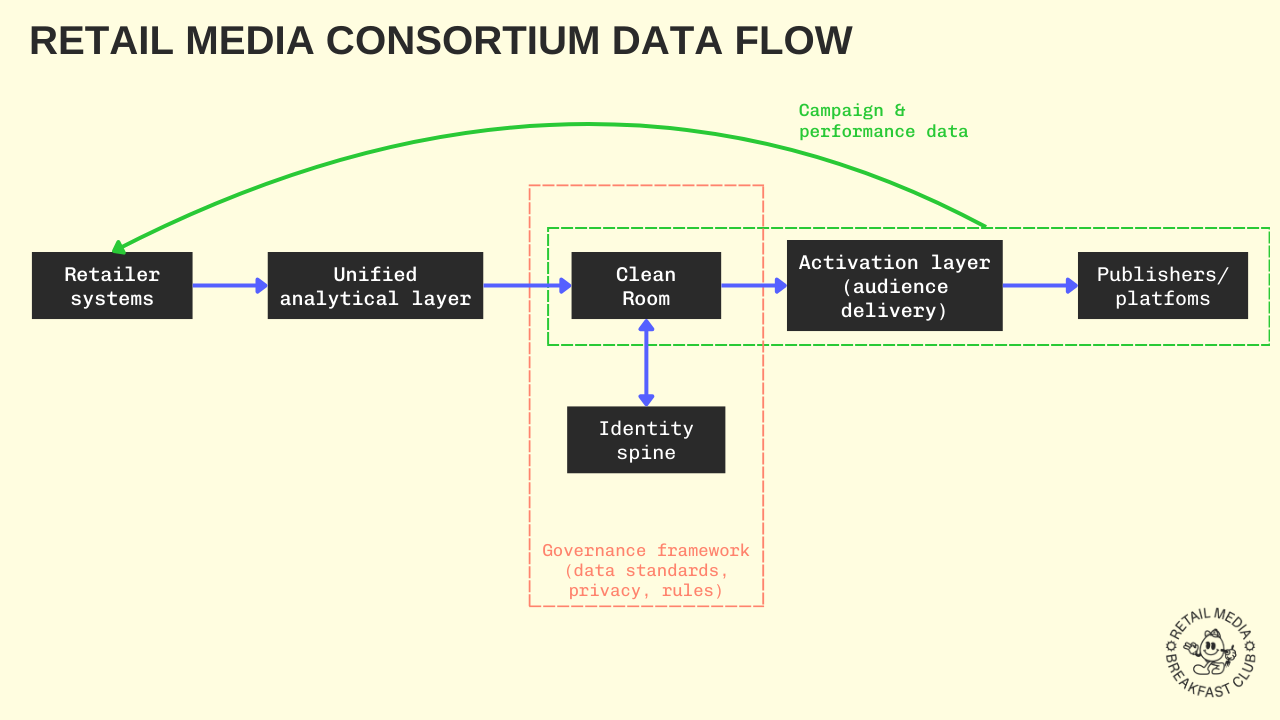

The Technical Foundation: Clean Rooms and Identity Spines

Prabhath Nanisetty is the Global Head of Retail Technology at Snowflake, a company which spans a wide range of use cases including data collaboration. Nanisetty explains the core infrastructure challenge: "You can't ask retailers to rip out systems they've invested millions in just to participate in a federation." Instead, successful federations create "a unified analytical layer that connects to those existing systems without replacing them." Snowflake’s role here is largely enabling and neutral — providing the environment where others can build.

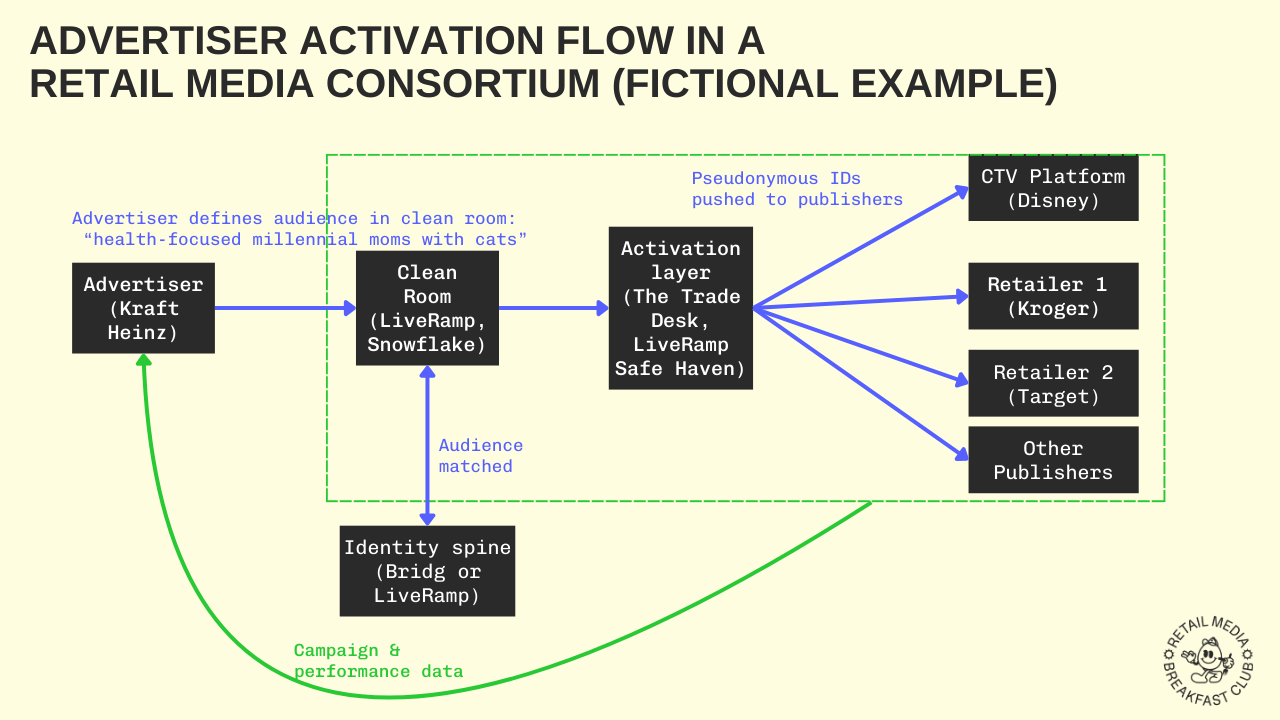

The thornier challenge is identity resolution. Each retailer tracks customers differently — loyalty IDs, online logins, store visits — making federation without exposing PII (personally identifiable information) extremely complex. Bridg’s Rippl network demonstrates one way forward: its identity spine spans more than 240 million U.S. adults, combining partner data with proprietary transaction information. Enrique Munoz Torres, the General Manager of Bridg, explains: “Our systems are designed so that as we grow our identity resolution and Rippl client base, our network effects and quality of results improve for everyone.”

LiveRamp, acts as a buy-side identity provider, often partners with Bridg to ensure that retailer-derived audiences can be activated consistently across publishers and platforms. But LiveRamp also has its own identity spine (RampID), which is already widely adopted by retailers, advertisers, and publishers. Lori Johnshoy, VP Commerce Media at LiveRamp and former head of sales at Target's RMN Roundel, frames the challenge from the advertiser’s perspective: “The most critical thing to get right first would be creating a seamless way for advertisers to self-activate audiences across publishers. Marketers don’t want to navigate a patchwork of rules and restrictions.” That requires a federation-level identity backbone, she adds, one that minimizes waste, enables personalization, and embeds responsible use of data at every layer.

Finally, governance remains a shared concern. The governance framework centers on three elements, according to Snowflake's Nanisetty:

- Clear data contribution standards: Each retailer must agree upfront on what data they'll share and in what format, ensuring consistency across different loyalty programs, transaction systems, and customer touchpoints.

- Pre-approved analysis types: The federation defines which queries and insights can be generated collaboratively, preventing fishing expeditions while enabling valuable cross-retailer intelligence like overlapping customer analysis.

- Automated privacy controls: Technical safeguards ensure that retailers can collaborate on analytics without exposing actual customer records or competitive data to other participants.

What Needs to Be True for Success

For federations to work, they must balance advertiser demands for scale and standardization against retailers' need to protect their core assets.

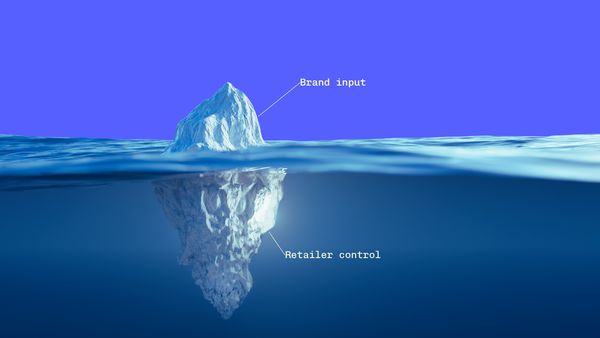

Control Appeals More Than Collaboration Retailers will only join federations if they maintain ownership of what matters most: their customer data, brand relationships, and profit margins. Neal Sheridan, Vice President of Sales at Stingray Advertising and former head of Belk’s retail media network, told me that participation must be "accretive, not dilutive" to the core business. Data sovereignty remains non-negotiable, with first-party data staying under retailer control even as it powers collaborative insights.

Advertisers Need Simplicity, Not More Complexity On the flip side, brands won't invest in federations that create additional operational burden. The whole point is reducing complexity, not adding another layer of vendor management. Lori Johnshoy of LiveRamp captures this perfectly: marketers want to avoid "a patchwork of rules and restrictions" in favor of seamless audience activation across publishers. Self-service capabilities build trust. Without them, brands won't buy in.

More Progress Toward Measurement Standards The technical foundation needs a common currency for retail media success metrics. Retailers have found it difficult to implement industry-defined measurement standards so far, so brands are left with different attribution windows, varying incrementality methodologies, and inconsistent ROAS definitions that make it nearly impossible for brands to compare performance across networks.

Sure, you’re crushing it on Amazon and Walmart. But what about Kroger, Instacart, and the fast-growing regional grocers? Acosta Group builds holistic media plans built on real shopper behavior across all the US retailers that your brand cares about.

They work directly with retailers of all sizes and know where your dollars will drive the biggest sales impact. From digital shelf to retail media to data analytics Acosta Group offers end-to-end Connected Commerce—all under one roof.

Regional Success, National Ambition

Current federation success stories happen primarily at the regional level, at least in the U.S. Regional grocers share common challenges—too small individually to win national budgets, but with strong local loyalty. The governance and revenue-sharing negotiations are simpler when you have five regional players rather than 50 national competitors.

But national federations offer the ultimate prize for advertisers: fewer logins, standardized metrics, and true scale outside of Amazon and Walmart. Rippl's expansion to 140 million unique shoppers shows what's possible, while Valiuz proves it can work at scale. (I explored these existing consortium models in Part 2 of this series.)

Amazon has already begun testing this approach with its Amazon Retail Ad Service, which now has partnerships with Macy's and several other retailers. The value proposition for participating retailers is compelling—access to Amazon's sophisticated advertising technology and demand—but most industry observers remain skeptical. The fundamental question: can retailers trust a direct competitor to fairly distribute advertiser budgets and preserve their unique advantages?

That skepticism extends to federations more broadly. Some industry leaders worry that these models will primarily benefit the convening organizations rather than participating retailers, potentially commoditizing retailer advantages in favor of tech platform profits. One industry insider I spoke with drew parallels to what happened when publishers embraced programmatic advertising: "They were all decimated and commoditized, and all the value accrued to the walled gardens and tech players."

These concerns about power dynamics, revenue distribution, and competitive risks are exactly what I'll tackle in Part 4 of this series. The technical foundation for federations may be solvable, but the business model challenges run much deeper.

Looking Ahead

The technical infrastructure for retail media federations is solvable—clean rooms, identity resolution, and governance frameworks exist today. The real barriers may be cultural – retailers are known to be conservative in general. For federations and consortiums to come to life, retailers must overcome the instinct to hoard data and protect competitive advantages in favor of collaborative value creation.

The retailers who succeed in federations won't be the ones with the most sophisticated individual platforms. They’ll agree on one measurement currency, but still fight to keep their shopper insights proprietary. That means common measurement currencies, shared identity backbones, and transparent revenue models that genuinely benefit all participants.

Next week: The practical barriers that could derail retail media federations—from competitive dynamics to technical integration challenges.