Unfiltered Thoughts From Unboxed

Candid takes on Amazon Unboxed: where various advertising features were announced to a huge audience of agencies, some big-spending brands, and tech vendors in the ecosystem.

"What is Unboxed? Is that a packaging event?" I was asked by a fellow elevator companion at my hotel who caught sight of my lanyard yesterday.

Well, packaging is one way to describe Amazon's flashy advertising event this week. While Amazon hosts an annual Upfront event, spruiking their content lineups across their media properties (primarily TV), Unboxed is arguably the more critical media buying event for the company, with various advertising features announced to a huge audience of agencies, some big-spending brands, and tech vendors in the ecosystem – ostensibly "Amazon Partners" (more on that later). An Amazon spokesperson told me the attendees on-site in Nashville this week numbered "in the thousands," and many more streaming the event online.

Earlier this week, I dashed off an overview of the major announcements, and did a deeper dive for my column at The Drum about the company's approach to their new automated ad algorithm, endearingly framed as "a crystal box versus a black box."

Now I've had some time to percolate and get POVs from other attendees, here's some more reflections on what Amazon announced this week.

Reinvention is not just lip service

To give credit where credit is due, Amazon has built an amazing advertising product. And despite the company's extreme dominance in the retail media ecosystem, they just keep on reinventing their ad product – making it easier to use for a larger range of advertisers, creating more owned-and-operated properties, and extending their tentacles to further reaches of the web.

My old boss, Jared Belsky of Acadia, told me that Amazon Ads' console is markedly more accessible and simple to operate than competing DSPs like Google DV360, The Trade Desk, or Meta. Advanced tactics like ad tagging are less necessary. This simplicity allows Amazon to tap into the budgets of all kinds of ad buyers – regardless of their sophistication.

Ash McMullen, head of ecomm at brand Advantice Health agreed, telling me:

There is a real accessibility advantage that [Amazon] seems to be keeping — and that’s what’s really interesting. Meta has grown significantly and gotten more complicated. Google has grown significantly and gotten more complicated.

Amazon has grown — and they’re simplifying it. They started with SQL queries that made it impossible unless you were a data scientist, but now they’re simplifying what the data looks like, making it more visual, more readable, and easier to act on.

'Relentless' was one of the favorite names that Jeff Bezos came up with, before eventually being convinced of a better name for the company.

That sense of paranoia and continual improvement clearly persists today at Amazon Advertising. Their ability to grow their advertising revenue at an incredible clip, despite their existing extreme dominance, is truly something to behold.

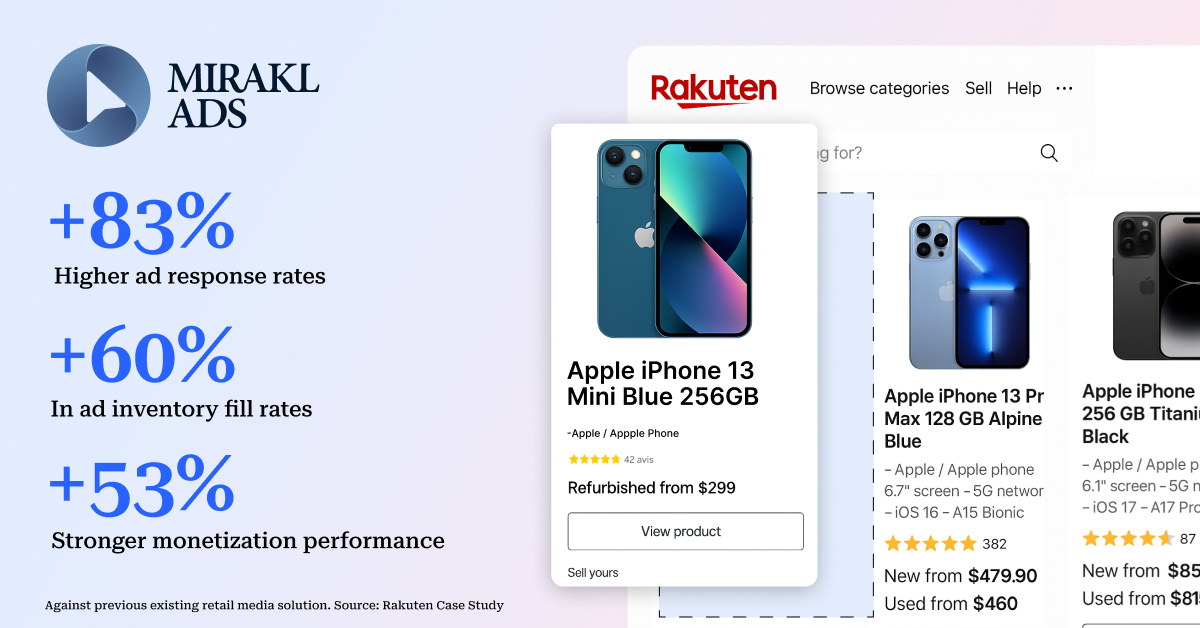

Mirakl Ads is the ad-tech solution trusted by Rakuten and 50+ global enterprise retailers.That’s because Mirakl Ads was built with both 3P marketplace sellers and 1P suppliers in mind. Both advertiser audiences demand a seamless advertising journey from onboarding to reporting. You can offer everything from Sponsored Products to video all in one solution

The open web for us, but not for you

Amazon is not content with building one of the largest, strongest, tallest, double-brick-reinforced walled gardens in the industry. They now want to go after the open web – a clear shot across the bow at rival DSP The Trade Desk.

According to advertising rag ADOTAT, "Amazon’s DSP now charges 4–8% platform fees, and sometimes waives them entirely just to prove a point. Meanwhile, The Trade Desk still sits in the 15–20% range."

I was told of much lower tech fees than that on open-internet buys specifically – perhaps acting as a loss-leader for Amazon's ads platform.

The irony is delicious: the most powerful walled garden wants to “enable” the rest of the web while keeping its own walls intact.

A distinct absence of Rufus

I noted halfway through the event that Rufus hadn't been mentioned. By the end of the hour-long keynote that spanned performance ads, new agentic features, connected TV, and Amazon's doubling-down of live sports, Rufus still hadn't been mentioned. Fellow attendees pointed out a passing remark about sponsored questions as an upcoming feature – but still, that never was mentioned as a feature within Rufus. This was perplexing to me as Andy Jassy made a fairly big deal about the scale and performance of Rufus in the company's Q3 earnings call.

Something is not adding up here. Rufus apparently is a beloved customer feature, and ads have been populating within it for the better part of a year. Advertisers still can't target these placements specifically. This leads me to believe that these placements don't perform well enough for Amazon to split them out as their own ad unit – much like offsite sponsored product ads which many advertisers are thoroughly unimpressed by and would not knowingly bid on.

Partners are back in vogue... or are they?

A few years ago Amazon avoided the word “partner”; now it’s everywhere. I was grateful to attend the partner awards and see my old team pick up the Challenger award.

A few long-toothed attendees spoke of the time where "partner" was a 4-letter word at Amazon. But today, a whole program exists for partners, and the best-of-the-best (or at least those with the strongest stomachs for delivering high-effort case studies as award entries) are celebrated on stage as enablers and champions of the ecosystem.

My old colleague Ross Walker, Director of Retail Media at ad agency Acadia, reminded me how Amazon transitioned from a managed service model to more of a self-service model around 2019.

Independent agencies like mine, Bobsled Marketing, benefitted from this. (I sold Bobsled to Acadia in 2022.) Agencies that understood the Amazon ecosystem and had the right positioning captured demand as brands scrambled to find help. It was a win for Amazon too – shifting headcount and spend risk to agencies, while still capturing ad spend and platform fees.

What began as an efficiency move for Amazon ultimately professionalized and scaled an entire industry of Amazon-focused agencies. I could make a similar argument for tech companies. Amazon initially provided fairly basic tools to enable media buying, and a raft of developers rushed in to fill the gaps and solve specific use cases.

Fast forward to 2025, when previewing the Ads Agent and Creative Agent features for Unboxed, I thought of the software companies I'm personally familiar with whose business models and value props would be eroded by these new features. Amazon is launching their own tools for enhanced reporting, automating and optimizing ad campaigns, even AI-led creative development – making those third party software tools seemingly unnecessary.

Most of the tech vendors I spoke with at the event are a bit disappointed, but not surprised. Such is the life of a software company. Some are even seeing it as a net-positive.

"The announcements haven't phased me at all," Adam Epstein, founder of ad-tech company Gigi, told me. "Amazon has in fact validated the agentic approach. They are raising the floor for advertisers, but we are raising the ceiling."

Wrapping Up

Unboxed captures the perilous euphoria and relentlessness of the Amazon ads ecosystem: ambitious players doing the best they can with all they got. Amazon needs its partners to thrive, but the more it simplifies and internalizes capabilities, the closer it comes to competing with them.

One thing is clear, Amazon remains in a league of its own within the advertising world. Partners, advertisers, and competitors are along for the ride, whether they like all the thrills it comes with or not.