Trade vs. Retail Media: Who's Really Eating Whom?

Trade dollars are flowing into retail media channels. Retail media platforms are absorbing trade's operational complexity. Who wins?

Two experienced voices in retail media are making seemingly opposite claims about where the industry is headed. James Taylor from Particular Audience argues "retail media is eating trade." The hosts of The Middlemen podcast, after interviewing Troy Townsend from Zitcha, framed his perspective as the inverse: "trade is eating retail media."

Both can't be right—or can they?

Their perspectives aren't just philosophical—they're shaped by what they're building. Taylor runs Particular Audience, an AI-native platform that monetizes on-site search and recommendations, so he has a front-row seat (and clear incentive) to argue that as soon as spend demands proof, it migrates from opaque trade lines into measurable retail media formats. Townsend runs Zitcha, a "unified front door" platform that catalogs and sells all retailer inventory—on-site, off-site, in-store screens, and analog trade assets like shelf wobblers and endcaps—with strong merchandising and Joint Business Plan integration. His bias (and expertise) points toward trade logic and merchant ownership subsuming retail media, not the other way around.

Same supplier dollars, different operating systems.

Let me break down what each is really saying, where they actually agree, and what it means for the brands and retailers navigating this collision.

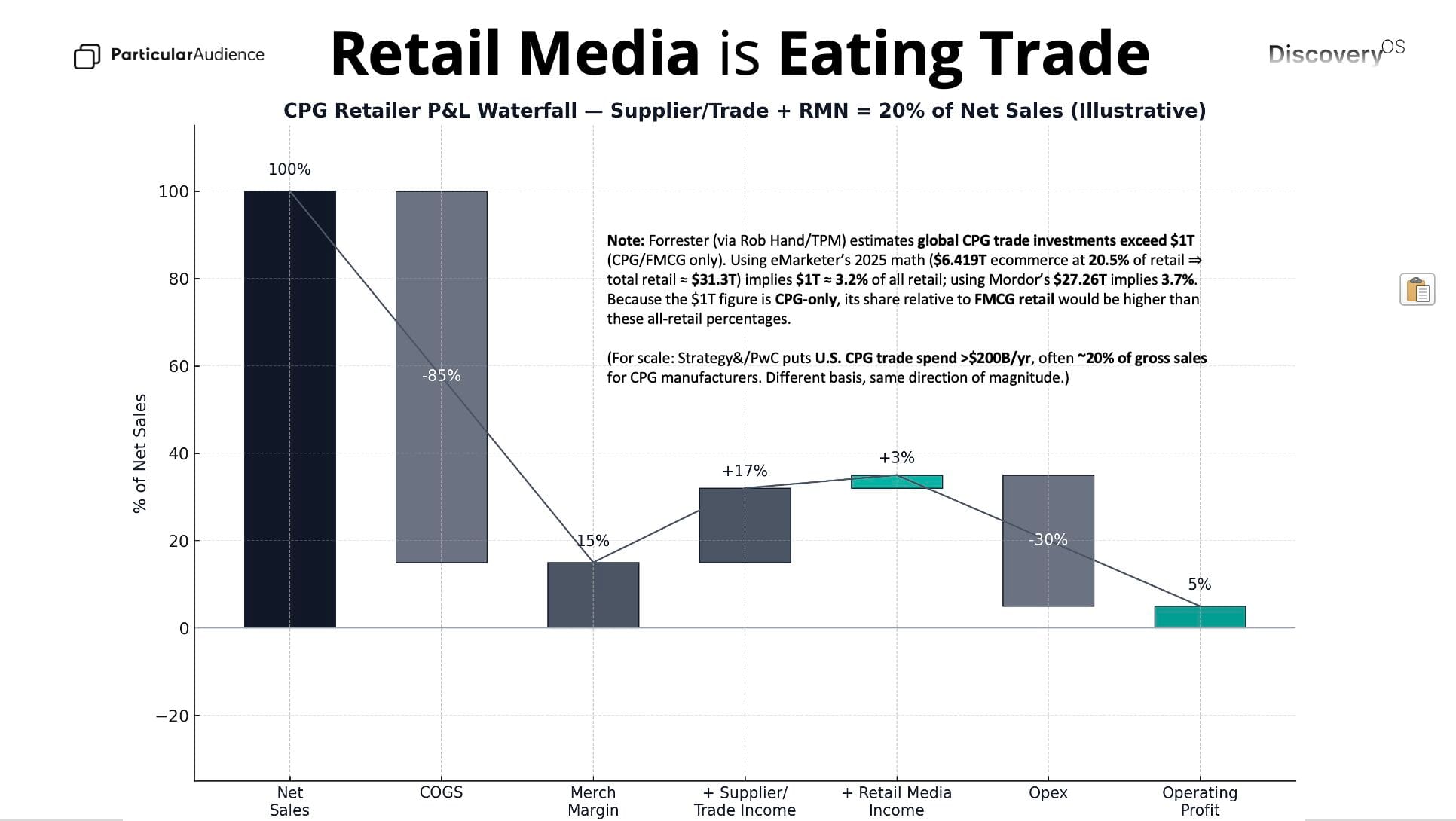

James Taylor's Case: RMN Is Absorbing Trade Dollars

Taylor's thesis starts with the money trail. Retail media hit roughly $160-175B in 2025 and is tracking toward $250-300B by 2030. But here's the key: much of that growth isn't coming from net-new budgets. According to Forrester data Taylor cites, about 36% of U.S. retail media spend already comes from trade budgets, with another 26% from shopper marketing. That's over 60% of retail media dollars flowing from what used to be opaque co-op funds and promotional agreements.

Why the migration? Three reasons Taylor emphasizes: transparency, CFO pressure, and supplier choice.

Trade marketing has historically been a black box—rebates, co-op funds, and promotional allowances negotiated in closed-door meetings with little proof of what actually worked. Retail media networks changed that game by offering targeting, attribution, and incrementality measurement. When finance leaders see those reports versus vague promises about "increased visibility," the choice becomes obvious.

Taylor points out that even when retailers hold negotiating leverage, brands can reallocate spending across retail partners. Retailers must now sharpen their value proposition—audience quality, loyalty program scale, category strength—to compete for both endemic and non-endemic budgets.

His guidance to retailers: expect cannibalization and plan for it. Your profit still relies on trade, but supplier funds will increasingly demand proof. Retail media is where that proof lives.

Acosta Group’s retailer intimacy is legendary—merchants answer their calls. You're not going to find that access at the same scale with any other partner out there. That expertise with both retailers and shoppers fuels its Connected Commerce team, which offers digital shelf, retail media, and data analytics all under one roof. Tap into 100 years of retailer relationships and award-winning digital commerce capabilities.

Troy Townsend's Counter: Trade Logic Is Taking Over

Townsend doesn't dispute the dollar flows—but the framing of his perspective as "trade is eating retail media" actually came from Tom Limongello and Scott Messer, hosts of The Middlemen podcast, after their conversation with him. What Townsend articulated was more nuanced: what we call "retail media" is really trade marketing modernizing and absorbing digital tactics.

The useful split isn't "trade vs. RMN" but endemic versus non-endemic spending. Endemic dollars (brands selling products at that retailer) have always been trade. They're just wearing new clothes—sponsored search instead of endcap fees, display ads instead of shelf talkers. Non-endemic spending (banks, travel companies, anyone not selling through that retailer) represents the truly incremental opportunity for retail media.

Townsend's call to arms: retailers need a "unified front door"—one system cataloging every sellable asset across on-site, off-site, in-store, and yes, even analog trade marketing. This includes shelf wobblers, displays, and all the physical placement fees that predate digital. Without this inventory visibility, retailers can't price coherently, package effectively, or understand what's actually being sold versus what sits in the joint business plan.

Importantly, Townsend argues that merchants must drive this system, not media teams. Long-term success depends on merchandising and retail media operating as one, tightly connected to Joint Business Plans. Otherwise, you're just "robbing Peter to pay Paul"—shifting supplier dollars between line items without creating real value.

He also pressure-tests the viability question: not every retailer should run an RMN. His informal threshold sits around $500M+ GMV for a true network. Below that, cataloging inventory still creates efficiency gains, but you're unlikely to attract meaningful non-endemic spend.

Where They Actually Agree

Strip away the framing and these two aren't as opposed as they sound at first blush:

They're both chasing the same pool of money. Whether you frame it as trade dollars migrating into RMN or RMN becoming a modern extension of trade, we're talking about the same supplier budgets getting reclassified and remarked. The direction of flow matters less than recognizing the bucket isn't getting bigger—it's just moving around.

Transparency wins. Taylor sees CFOs demanding proof before releasing trade dollars. Townsend sees merchants needing to know what the media team promised versus what's actually in the joint business plan. Both are describing information silos that retailers built themselves and now can't navigate.

Governance and standardization matter. Taylor talks about fixing query coverage and broadening SKU eligibility. Townsend focuses on catalog management, packaging, pricing discipline, and creative operations. Both recognize that messy operations kill value.

Creative is evolving. Both see brands moving away from static product shots on white backgrounds toward SKU-level video that shows products in context—the kind of storytelling that works on social platforms. But actually producing that content at scale, getting it through retail brand approval processes, and matching it to the right placements? That's where the theory hits the operational reality most retailers aren't equipped for.

Organizational politics are real. Taylor calls it "fear of cannibalizing trade profit." Townsend points to merchants and media teams working at cross purposes. Neither is being polite about it—retailers are stuck because nobody can agree who owns what, and every dollar that shifts from one bucket to another means someone's bonus just got complicated.

The Real Question

Both Taylor and Townsend are describing the same collision from different vantage points. Trade dollars are flowing into retail media channels. Retail media platforms are absorbing trade's operational complexity.

It's not really about who's eating whom. The choice retailers actually face is the hard work of integrating merchant strategy with media execution, or the harder work of explaining to your CFO why supplier dollars keep leaving for competitors who figured it out. Neither path is clean or easy. One system requires rethinking org charts, rebuilding tech stacks, and navigating internal politics. The alternative is watching Taylor's thesis play out—watching your trade dollars migrate to more measurable formats at another RMN.