Three Companies Monetizing Moments That Most Retailers Ignore

RMN leaders privately admit agentic AI keeps them up at night. These three companies might have stumbled onto something useful.

My original article, Beyond Banner Ads: How Retailers Are Monetizing the Moments That Actually Matter published in The Drum on October 21. Read the full piece for deeper analysis on why these approaches work now and what it means for mid-tier networks trying to escape the doom loop.

New research from eMarketer and Bain asked retail media network leaders what actually worries them. 36% put "zero-click/genAI search disrupting discovery" at the top of their concerns list. Another 28% flagged "agentic AI changing ad buyer decision-making."

If AI shopping agents handle product discovery and purchase decisions, sponsored search revenue is at risk. The audience data driving offsite display becomes less scarce. Retail Media Leaders are right to worry about the long-term future of their P&L.

Stephen Mewborn, Partner & Global leader of Bain's retail media practice, said on the webinar sharing the survey results "retailers need to experiment with alternate ways of working with brand partners."

Here are three companies who offer unique approaches to help retailers build a win-win model with their brand partners.

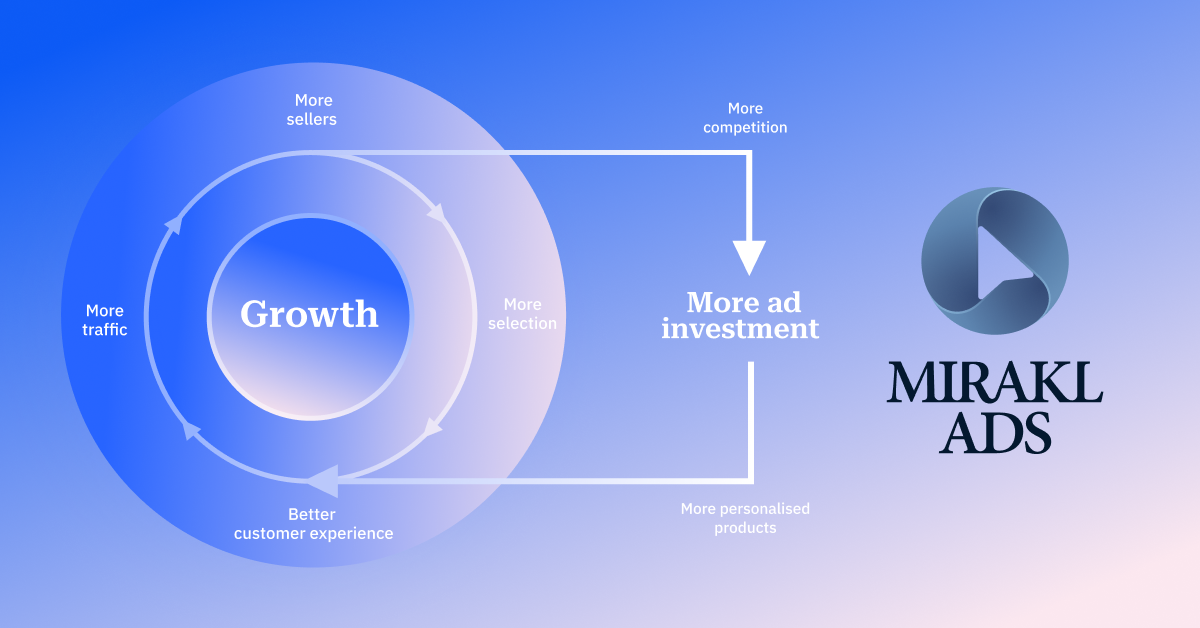

Retailers know that a marketplace model can dramatically boost product assortment, shopper engagement, and total revenue. But, to get the most out of your marketplace, you need an ad tech solution that can really engage sellers.

Mirakl Ads is powering the future of retail media for leading retailers — to activate both 3P sellers and 1P brands.

Three Companies Doing Something Different

Rokt: Post-Purchase Advertising

The bet: People are most receptive to offers right after they complete a purchase—not during checkout when 62% would rather abandon their cart than see irrelevant offers.

How it works: Rokt uses machine learning to serve ads on "thank you" pages and order confirmations. PayPal just signed on, making this mainstream. The network will power 7.5 billion transactions in 2025.

Results that matter:

- BJ's Wholesale Club: 300% year-over-year growth in member acquisition while maintaining cost per acquisition

- Captured members averaging 10 years younger than existing customers

"When someone's just completed a purchase, they're open, excited—it's a little dopamine rush," said Dani Kelley, director of member acquisition at BJ's. "That energy translates into higher intent."

Swish: Programmatic Product Trial

The bet: Treat the product itself as media. Put full-size samples directly into online grocery orders based on purchase behavior via Swish.

How it works: CPG brands fund product additions to grocery orders targeting specific households. Every trial counts as a full sale for the retailer and enters shopper purchase history.

Why it matters: Product trial is the fundamental goal of all CPG marketing, per Jonathan Opdyke, managing partner of BD Ventures (who just led Swish's seed round). For emerging brands or new product launches, this solves the cold-start problem by removing choice friction entirely.

Swish launched with Stater Brothers Markets in September 2025.

Nift: Gifting as Acquisition

The bet: Turn thank-you moments into brand discovery opportunities through personalized gifts delivered after reviews, payments, loyalty point transfers, or app downloads.

How it works: Nift's AI matches consumers with relevant gift offers from 12,000+ merchants at receptive moments throughout the customer journey.

Results that matter:

- Klarna reported 30% click-through rate and 40% gift activation rate

- 88% of recipients rate gifts positively

- 70% plan to use the brand again

Why This Matters Now

These three companies share something interesting: they're AI-proof in ways that sponsored search isn't.

When an AI agent handles your grocery order, you won't see sponsored product ads. Shoppers aren't browsing your site. It won't click your display ads. But it will still complete transactions. Products will still arrive (maybe with a fun sample). Confirmation pages will still load. And customers will still enjoy discovery moments.

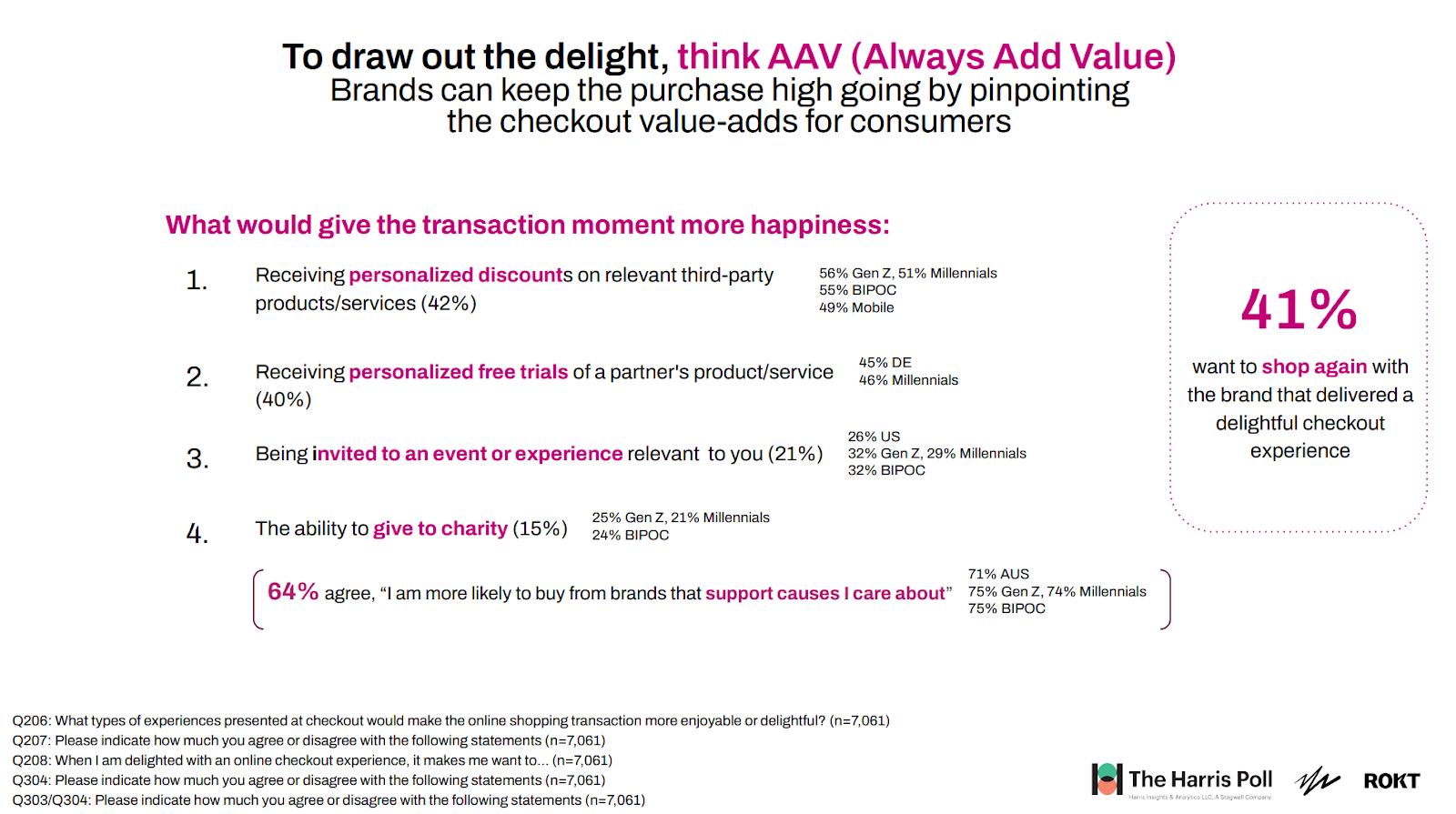

Harris Poll research commissioned by Rokt backs up the opportunity:

- 70% want shopping experiences that surprise and delight them

- 41% want to shop again with brands that delivered delightful checkout experiences

These companies won't replace existing retail media revenue streams alone, but they do offer unique ways for retailers and brands to partner together.

I'll be covering more opportunities like these in the future - stay tuned!

Read more from me on related topics: