The Retail Media Doom Loop

The cycle that traps networks—and why transparency could be the key to breaking free.

Recently I did something that felt like the nerdiest possible way to spend a Friday afternoon—I jumped on a live LinkedIn stream with Tom Limongello and Scott Messer from The Middleman podcast for what we dubbed "Retail Media Tech Jam." Three retail media geeks dissecting the backbone of retail media networks for 45 minutes straight.

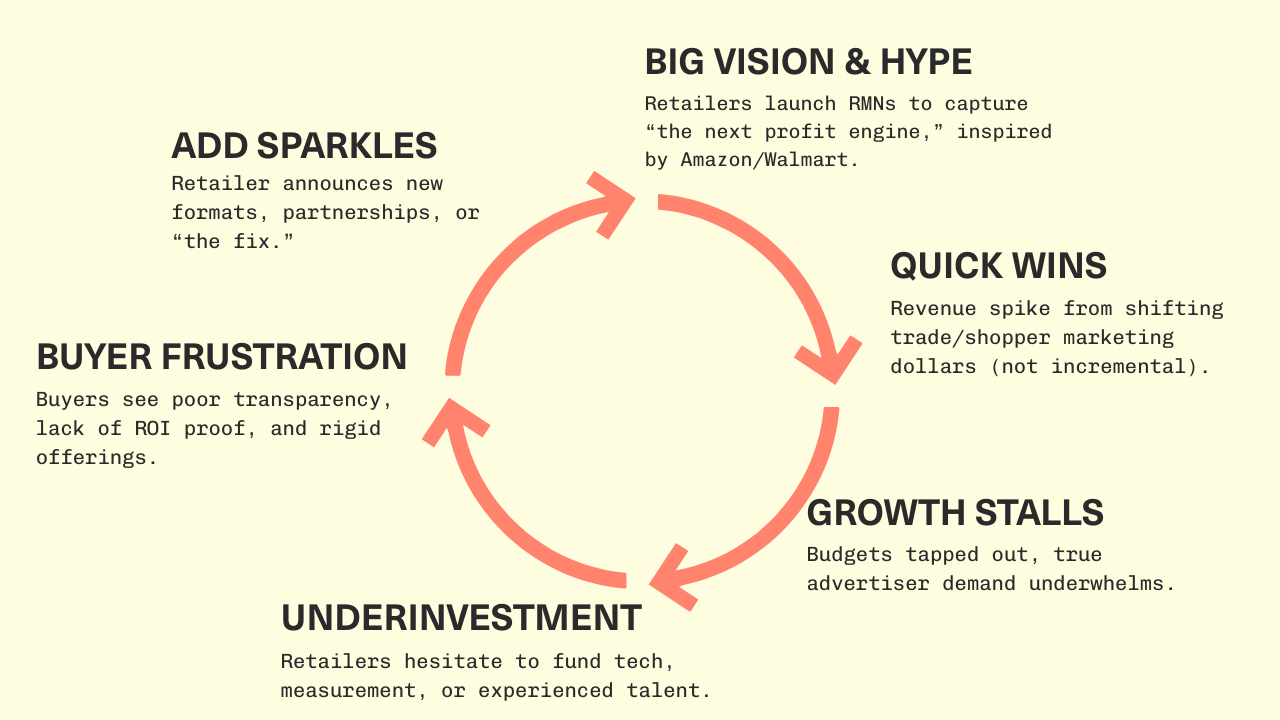

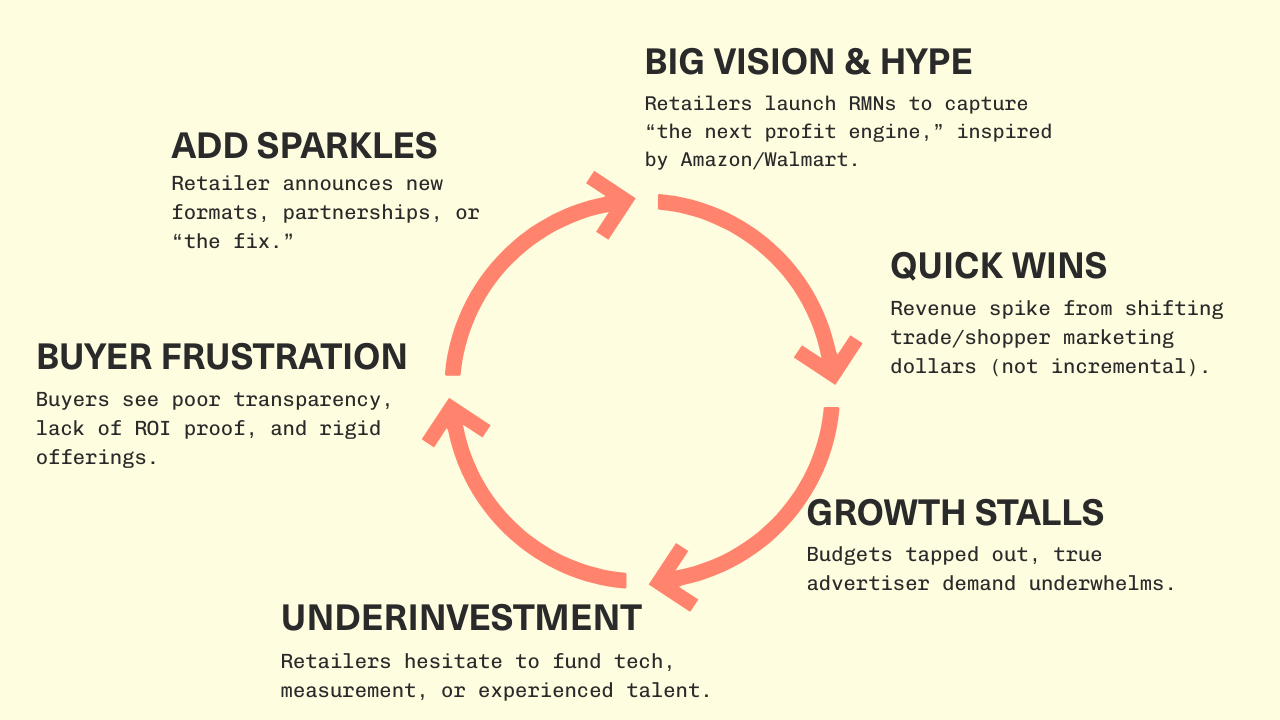

What started as a casual conversation about why retailers are so secretive about their tech stacks quickly evolved into something much more revealing: a diagnosis of what I'm calling the "retail media doom loop"—and why it explains so much of what's broken in this industry right now.

The Doom Loop Explained

Here's how it works, and once you see the pattern, you'll recognize it everywhere.

Amazon and Walmart command the lion's share of retail media spending today. Every other retailer looks at those numbers—$60+ billion in annual ad revenue between them—and thinks, "We need a piece of that." So they stand up a retail media business and team, often pulling initial revenue from existing trade marketing and shopper marketing budgets.

Initially, there's a growth spike. The retailer sees quick wins because they're essentially repackaging existing trade and shopper marketing spend as "retail media." But then growth slows down hard, because those trade dollars run out. At this point, the retailer faces a choice: invest in better technology, hire experienced ad tech talent, and build a real media business, or coast on the initial momentum.

Too often, they find themselves in a bind. When growth plateaus, it becomes increasingly difficult to justify the substantial investments needed for the next phase—especially when competing priorities demand attention and budgets are tight. The business gets caught in that uncomfortable middle ground between early-stage experimentation and fully scaled media operations.

Scott Messer captured this perfectly during our stream: "You can't increase ROAS forever. If you start with a situation where you have products in a search grid with no sponsored placements, there's real opportunity to create high initial ROAS. But over time, if it becomes a competitive market where everybody's spending, you sort of go back to where you were at the beginning."

The Transparency Problem That Makes Everything Worse

What makes this doom loop even more vicious is the bizarre secrecy around technology choices. As I've written about extensively, retailers treat their tech stack partnerships like state secrets, even after deals are signed and implemented.

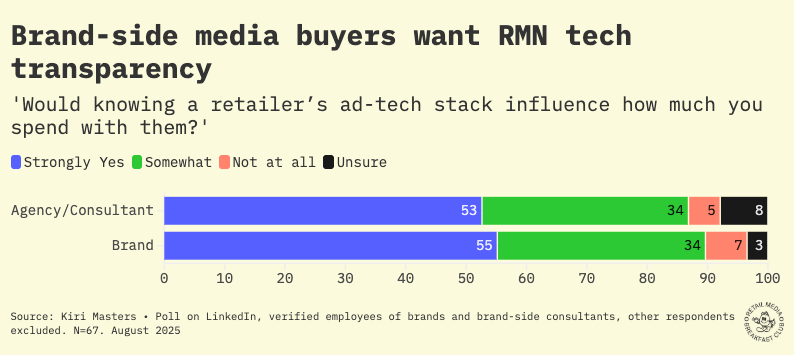

During our conversation, I shared poll data that drives this point home: when I asked 67 verified brand-side buyers whether knowing a retailer's tech stack would influence their spending decisions. These aren't casual observers—these are people managing billions in retail media spend collectively.

Yet retailers continue operating as if their technology choices don't matter to advertisers. It's completely backwards.

Tom Limongello made an astute observation about what buyers actually want: "If I were on the brand side, what I would want is a unified platform to move budget in a more agile way away from non-performing channels. Because one of the challenges with retail media networks is that they're looking at things in a very rigid way—mobile budgets, digital display budgets are stuck, and that removes performance possibilities."

Sure, you’re crushing it on Amazon and Walmart. But what about Kroger, Instacart, and the fast-growing regional grocers? Acosta Group builds holistic media plans built on real shopper behavior across all the US retailers that your brand cares about.

They work directly with retailers of all sizes and know where your dollars will drive the biggest sales impact. From digital shelf to retail media to data analytics Acosta Group offers end-to-end Connected Commerce—all under one roof.

The Five Forces Behind the Secrecy

I previously wrote about the five reasons behind the opacity:

The Shame Factor: Many retailers know their tech stacks are suboptimal but can't change due to internal politics or prohibitive vendor contract exit fees.

Financial Narrative Control: Some retailers delay announcing technology partnerships to align with their financial storytelling to investors.

The Knowledge Gap: Most retailers lack experience selling media directly and don't understand what matters to media buyers.

Margin Protection: Retailers believe opacity lets them capture higher margins than transparent, standardized systems would allow.

Competitive Paranoia: The misguided belief that revealing tech choices gives competitors an advantage.

The irony? As Jordan Witmer from the agency Salt pointed out during our discussion, sophisticated agencies already reverse-engineer these tech stacks through reporting patterns and targeting capabilities. The secrecy is ultimately futile—it just creates unnecessary friction.

What Buyers Actually Experience

Here's where the conversation got really interesting. Scott raised a crucial point about the gap between what people say they want and what they actually do: "What people say in a poll is very different from what they actually do during the day. As a media seller, you hear 'we want transparency, we want fraud-free,' and then they go 'yeah, but can you just spend my money and tell me what I got as ROAS?'"

This hits at something deeper about the retail media market's maturity. Many buyers are still operating in a world where they hand over budget and hope for the best, rather than demanding the kind of granular control and transparency they get from other digital channels.

But that's changing. The brands that are scaling their retail media investments are the ones demanding better technology, clearer reporting, and more strategic partnerships. They're the ones asking hard questions about measurement, incrementality, and cross-channel optimization.

The Path Forward

What became clear during our hour-long deep dive is that the retailers who will win are those that break out of this doom loop entirely. They're the ones investing in real technology infrastructure, hiring experienced talent, and treating media buyers as sophisticated partners rather than ATMs.

Home Depot's Melanie Babcock has been refreshingly transparent about their technology overhaul, calling it one of the top five things they've done for their retail media network. Meanwhile, sophisticated agencies are learning to identify quality technology platforms through careful questioning and performance analysis, making the secrecy game increasingly pointless.

The doom loop isn't inevitable—it's a choice. Retailers can continue playing hide-and-seek with their infrastructure while wondering why growth has stalled, or they can embrace the transparency and investment needed to build sustainable media businesses.

Tomorrow, I'll dive deeper into what this means for the hundreds of smaller retail media networks trying to compete with the giants, and why the current approach might be fundamentally flawed.

And if you want to see the full conversation—complete with audience questions and some genuinely funny moments between three people who clearly spend too much time thinking about ad servers—check out the livestream replay on LinkedIn.

The Middleman podcast, hosted by Tom Limongello and Scott Messer, features career ad tech experts sharing war stories and lessons from retail media leaders.