The Lazy Girl's Guide to Social Commerce

Social commerce—buying products directly within social media apps—is laziness as a business strategy. Meet customers where they're scrolling, remove friction, make buying as effortless as double-tapping a video.

Domino's has been in the social commerce game longer than most people realize—they just called it something else.

Back in 2015, the pizza chain launched "Anyware"—let customers order from wherever they already are. It started on Twitter, years before TikTok Shop existed. Today, DominosAnyWare.com offers ordering via Apple CarPlay, Alexa, text, and Apple Watch.

Kate Trumbull, Domino's Executive Vice President, Chief Marketing Officer, summed up the philosophy:

"At the bottom line, you need to empower laziness. It sounds bad, but empower laziness because people want convenience. Social commerce is a perfect example of that."

Social commerce—buying products directly within social media apps—is laziness as a business strategy. Meet customers where they're scrolling, remove friction, make buying as effortless as double-tapping a video.

I've been hearing more noise about social commerce lately and decided to finally wade in. This is my 80/20 breakdown: just enough to understand what matters.

What Social Commerce Actually Is (And Isn't)

Social commerce means buying and selling goods directly within social media platforms. It's when shoppers make in-app purchases where they already spend time, integrating shopping into their lifestyle with personalized content.

What it's not: influencer posts that send you off-platform, social ads redirecting to retailer websites, or retail media on Amazon and Walmart. If you leave the app to complete the purchase, it's not social commerce.

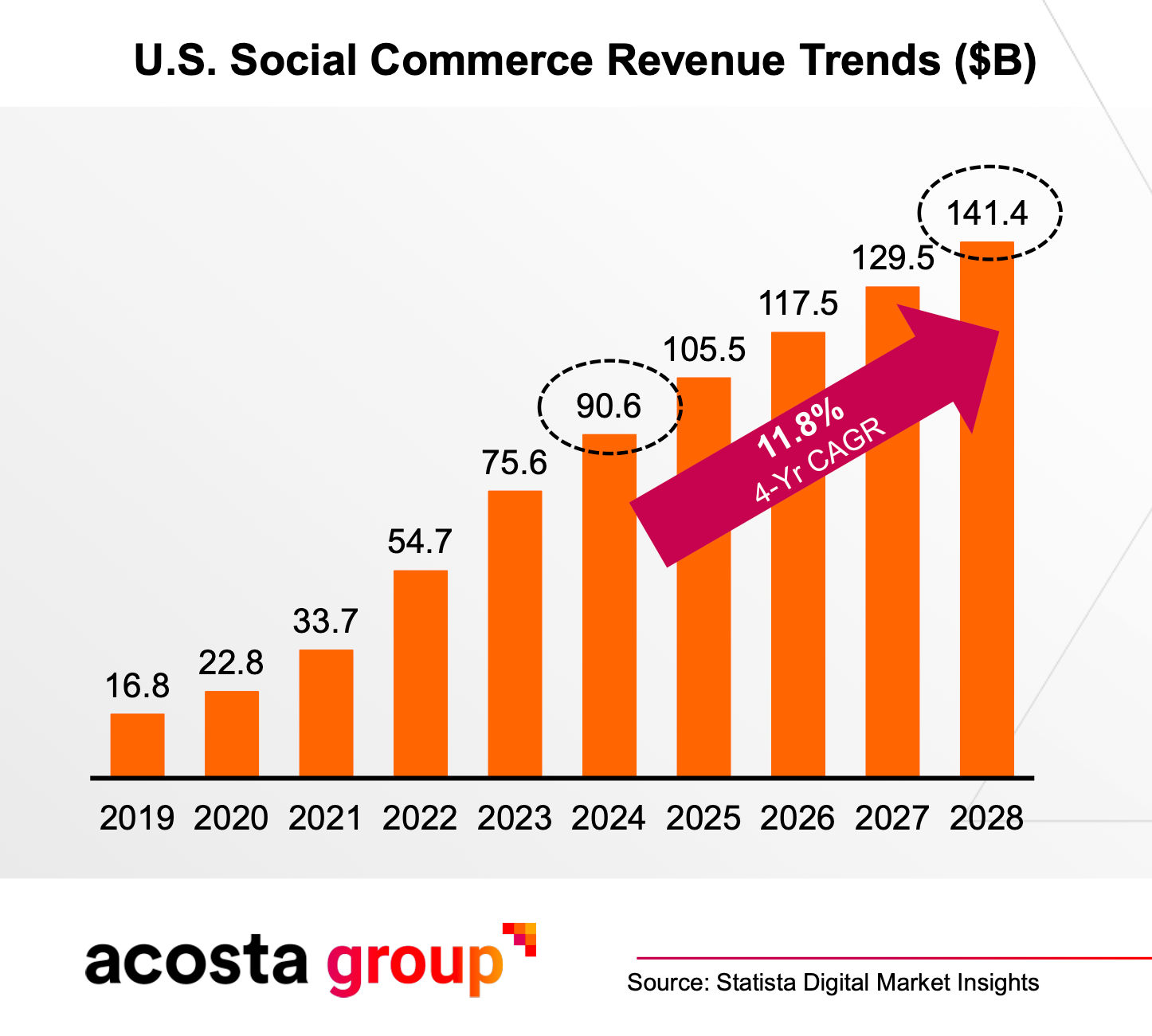

The numbers tell an early-stage story. 24% of social media users made in-app purchases in the past three months, per a shopper panel conducted by Acosta Group in December 2024. But the growth curve is steep: U.S. social commerce revenue is projected to hit $141 billion by 2028, up from $75 billion in 2023—an 11.8% compound annual growth rate.

TikTok Shop Leads the Pack

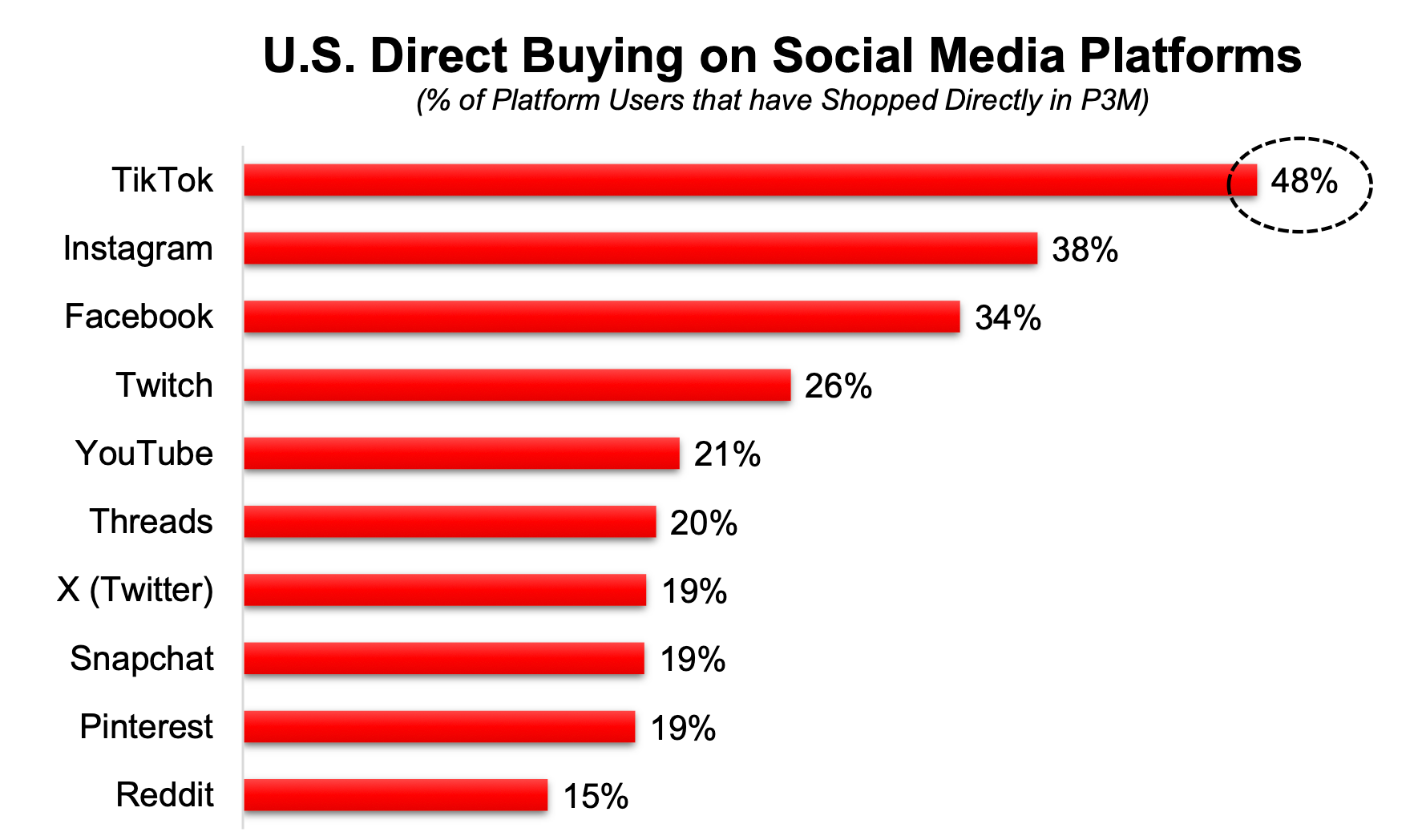

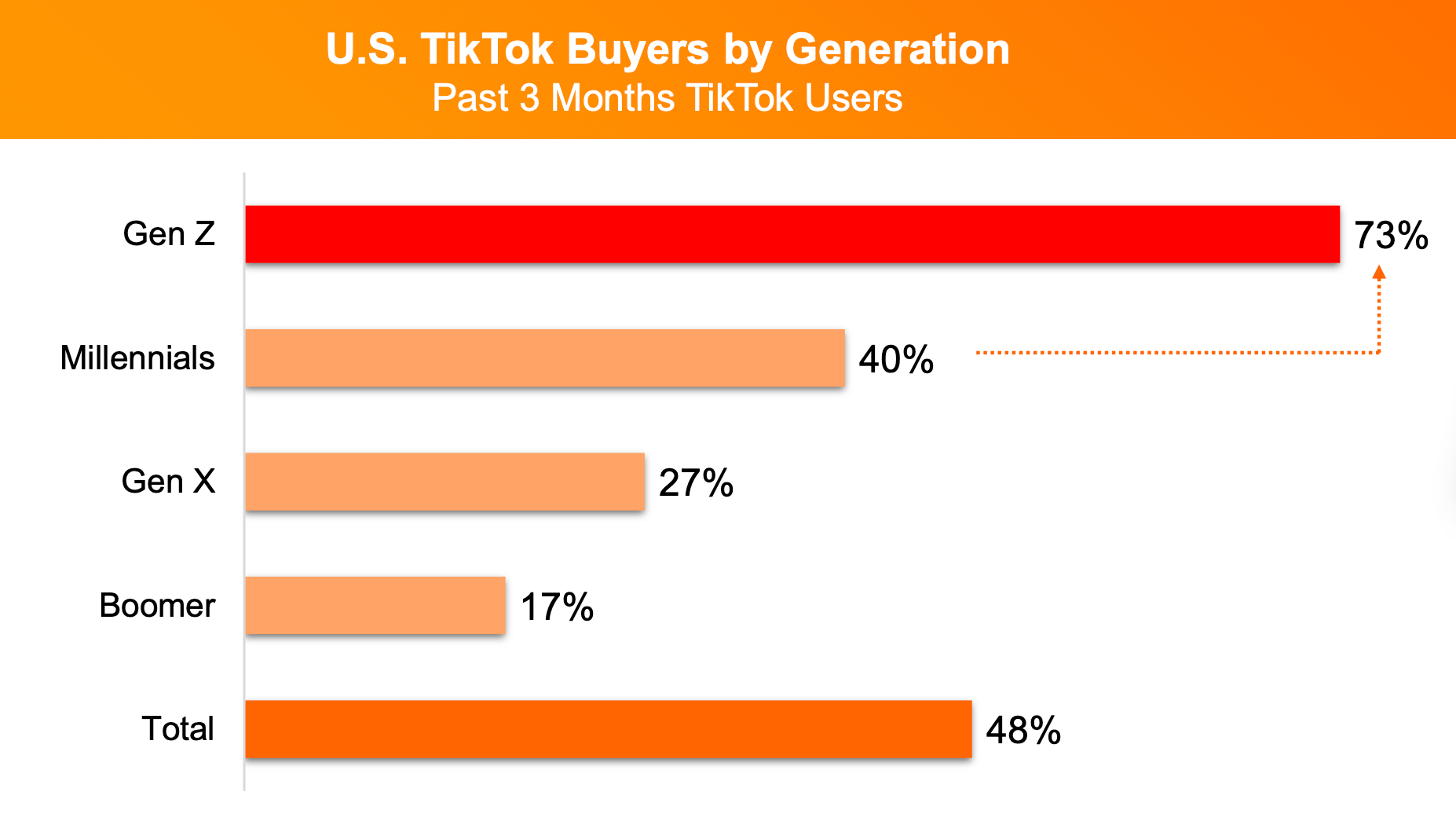

TikTok Shop dominates the social commerce landscape. Among TikTok users, 48% have made direct purchases on the platform—significantly higher than Instagram (38%) and Facebook (34%).

A demographic skew also stands out: 73% of Gen Z TikTok users have purchased in-app compared to just 17% of Boomers.

TikTok's advantage comes from its seamless purchase path, expanded shopping tools, and creator affiliate program that turns influencers into a distributed sales force.

Take Tarte Cosmetics. The brand joined TikTok Shop in 2023 as part of its push to re-engage Gen Z shoppers. CEO Maureen Kelly reported that over 90% of TikTok Shop customers were new to the brand. Even better: TikTok Shop created a halo effect on the brand's DTC and wholesale channels, and products trending on TikTok grew three times faster year-over-year in physical retail.

Brea Keating, Senior Director of Ecommerce at Wilton Brands, recently stood up her company's TikTok Shop and saw similar appeal. "The ability to inspire a new purchase occasion" was key, she told me—TikTok drives incremental sales, not just channel shifts. The platform lets brands reach passion-based, super-niche audiences amidst relevant content. Plus, she says that TikTok creators are accessible with relatively low rates compared to other influencer channels.

Retailers Are Getting In On This Too

Social commerce isn't just for DTC beauty brands anymore. TikTok is explicitly chasing established retailers to fill out its marketplace assortment and credibility.

Case in point: Carrefour, the major French supermarket chain, now operates as a merchant on TikTok Shop. Mass merchandise poses a very different challenge than fashion or beauty. We're talking about mass merchandise—groceries and CPG products—with lower margins, higher volume, and complex logistics. How do you make toilet paper and produce compelling in short-form video format?

The partnership is recent and there are no public results yet, but it’s a signal to follow. TikTok clearly wants established retailers to round out its marketplace, while Carrefour gets access to younger shoppers and a discovery channel it couldn’t build alone. Whether this becomes a repeatable model for other grocers will depend on how well TikTok can align short-form video with the realities of mass-merchandise retail.

Sure, you’re crushing it on Amazon and Walmart. But what about Kroger, Instacart, and the fast-growing regional grocers? Acosta Group builds holistic media plans built on real shopper behavior across all the US retailers that your brand cares about.

They work directly with retailers of all sizes and know where your dollars will drive the biggest sales impact. From digital shelf to retail media to data analytics Acosta Group offers end-to-end Connected Commerce—all under one roof.

The Operational Reality: Don't Be Lazy Here

Understanding social commerce can be lazy. Executing it cannot. Platform operational challenges are real.

Experiment Beauty, a clean beauty brand, saw TikTok as high-potential and joined TikTok Shop in 2023. What followed was an operational headache. TikTok's AI moderation repeatedly misclassified products—its "Buffer Jelly" serum was flagged as food, "Softwear" SPF as pajamas. Listings were taken down for days, jeopardizing revenue. The brand dedicated staff time to appealing automated takedowns and relied heavily on TikTok account managers to troubleshoot barriers.

Wilton's Brea Keating flagged structural challenges brands face even when TikTok Shop shows promise.

- First, internal politics: "Is it a brand or retail media initiative? Who owns the TikTok experience and budget?" Without clear ownership, execution stalls regardless of platform capabilities.

- Second, fulfillment complexity. TikTok has cycled through multiple models over three years—its own logistics, merchant fulfillment, DTC shipping. Recent Amazon partnerships have helped, letting brands fulfill TikTok orders via Amazon. "That opened new doors and higher velocity," Keating said.

Past platform experiments also offer cautionary tales. Instagram launched native Checkout in 2019 with luxury and beauty partners like Prada, Dior, and Ouai. Brands quickly saw trade-offs around customer data—limited access to emails and CRM—and tighter control by Meta over consumer relationships. Instead of continuing, these brands walked away and reverted to linking out to their own DTC sites.

The Creator Economy Is the Unlock

Social commerce works because influencers aren't just discovery—they're the sales force. But integration matters. Creators need seamless tools to sell, not just promote.

Wavytalk, a mid-tier hair tool brand, partnered with creator Danielle Athena, who promoted a hair tool set through TikTok videos linking directly to TikTok Shop. In just 30 days during November-December 2023, Athena's content generated roughly $1 million in sales for Wavytalk, according to Kalodata. This made her one of the top TikTok Shop creators during the holiday season.

Categories that work best, per Acosta's data: apparel and accessories (most frequently mentioned purchases), skincare and beauty, and home goods. What struggles: groceries, commodities, anything where trust and safety are paramount.

You Can Be Lazy About Learning, But Not About Execution

You can take the 80/20 approach to understanding social commerce—that's what this guide is for. But you absolutely cannot be lazy about execution. Platforms are finicky, operations are complex, and consumer trust is hard-won.

The universal truth: 76% of social media users still haven't bought in-app yet, per Acosta. This is still early. The brands and retailers that figure it out now will have an advantage when adoption scales.

Social commerce removes friction between discovery and purchase for shoppers. For brands and retailers, it adds friction on the back end—moderation hassles, data limitations, platform fees, and the constant risk that the platform changes the rules.

The future of shopping might be effortless for consumers. For brands and retailers? Not so much.