The Back-Channel: Industry Insights From Behind the Scenes

Today, I'm sharing "The Back-Channel" - an anonymized grab-bag of snippets from conversations with industry insiders that I've had in the past week. The point is to identify updates on the big themes that are happening in the industry, just like if we were having a hallway conversation.

Today I'm sharing:

- The future of AI means custom software for all

- 40% of Retailers say they have 'fully implemented AI'.... but are still not letting employees use ChatGPT?!

- Freud's guide to onsite vs offsite retail media

Let me know what you think of this format!

Custom Software Built With AI

I spoke with the CEO of a software provider in our space who built an entire new feature release with zero code. In their words, the size of your dev team is not a competitive advantage today. This is incredible. The whole nature of software and tech is changing under us right now. I really think we'll see custom software at the user level. If you haven't checked out tools like "replit" or "vercel" by Google, go spend 30 mins doing that. This is the future of software.

For this company I spoke with, whose solution includes a lot of analytics and dashboarding, they have an opportunity to become the replit of their category - building the pipes for their user base to make their own mini-apps, dashboards etc. A Replit-style platform for retail media so every client can spin up their own custom apps in weeks or even days.

...While Retailers Ban ChatGPT

By way of huge contrast, I spoke with a technical leader at a major US retailer whose company-owned laptops cannot access ChatGPT. Again to underscore, this person is in a tech leadership role. It's a perfect vignette of where retail (specifically retailers) sit as an industry in terms of innovation.

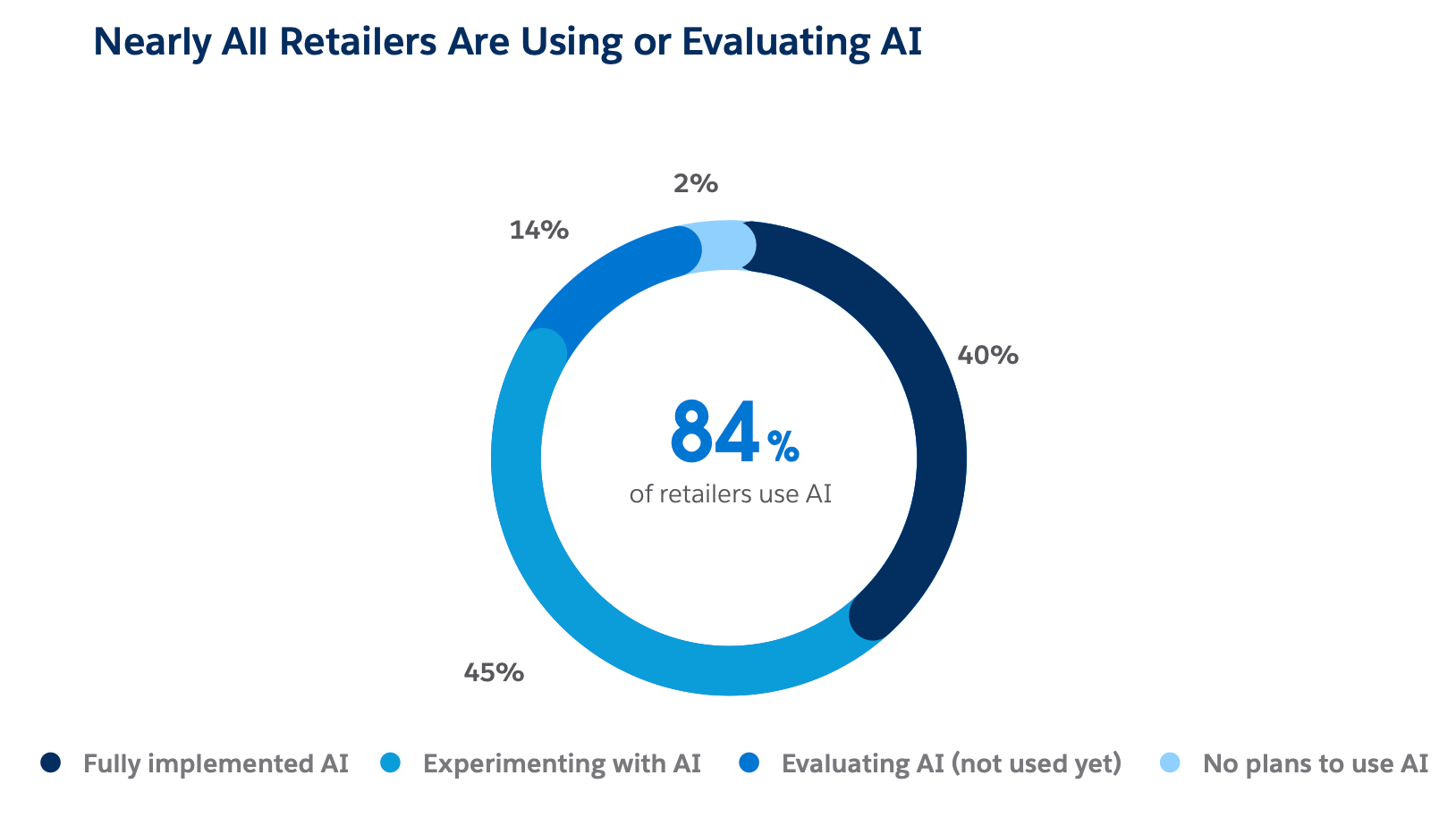

I don't think we're the slowest industry to adopt technology, but probably in the bottom 50%. That's why I was very skeptical of this stat from a Salesforce study called the "Connected Shoppers Report".

I'd love to speak with these retailers who have fully implemented AI, because the capabilities we have with AI are quite literally changing from day to day.

Takeaway here is that employees at retailers and brands alike have a lot of work to do to educate internally on what is possible with AI, and what's next after using it to re-write your PDPs or resize your ads – which are perfectly good initial use cases. But as we start mapping a world where consumers begin using personal AI agents to make buying decisions, and Amazon has already shipped several variations of AI agents, there's a lot of work still to do.

Freudian Analysis Of Offsite Retail Media

I've been doing a deep dive into offsite retail media lately and this was a big topic of conversation in my recent calls. Offsite spend is smaller (10% of retail media vs onsite at 90%) but is set to grow in the coming years. (Read more in my explainer post for WARC this week)

Coming from a background focused on onsite, self-serve retail media (Amazon, Walmart, Instacart) I was surprised to learn that offsite is often the first type of retail media a retailer executes.

Melanie Babcock from Home Depot's Orange Apron Media confirmed to me that offsite was their original route into retail media some years ago in my recent profile for Forbes.

And this episode of the Middlemen podcast (a new favorite for me) included some banter on the evolution of offsite relative to onsite. Podcast host Tom Limongello says in the intro,

"Tier 1 retailers like Walmart basically started with on-site only and then are now starting to figure out off-site, and then eventually, hopefully, they will get to in-store. For tier 2 and down, because they didn't have as much on-site traffic, it was all off-site, and it was super easy to do off-site. And then on-site happened during the pandemic, and that really accelerated. And now they, to differentiate themselves, are starting to do in-store."

You can learn a lot about someone's psychology by looking at their childhood – how their experiences from childhood shaped their world view and behaviors as adults.

I think we can learn a lot about retail media networks from whether they established offsite or onsite first. Today, some of them are trying to unite their offsite and onsite capabilities to make it a better buying experience for brands. They likely have different profitability profiles for retailers (another source told me that onsite is vastly more profitable for retailers than offsite), but I imagine that advertisers are "stickier" when they use both, too.

Perhaps Freud would say that retail media networks are experiencing their own form of integration therapy – trying to reconcile their offsite origins with their onsite ambitions.