Sam's Club Cracked the Code on In-Store Retail Media—Here's How They Did It

After touring their Murfreesboro club with Harvey Ma (who runs Sam's Club's Member Access Platform), I saw something rare: a retailer that actually figured this out.

Most retail media networks are still stuck in pilot purgatory with in-store advertising. Sam's Club isn't. After touring their Murfreesboro club with Harvey Ma (who runs Sam's Club's Member Access Platform), I saw something rare: a retailer that actually figured this out.

The numbers tell you why this matters. EMARKETER's latest report pushed the projection of when in-store retail media would reach the $1 billion milestone out to 2029—a year later than expected.

Meanwhile, Sam's Club is scaling aggressively, targeting 5X growth in large-scale event activations for 2026.

Read the full piece in The Drum for the complete tour, measurement specifics, and Ma's unfiltered take on what's working.

Why In-Store Gets Stuck

The infrastructure required to make in-store work is brutal:

- Physical tech deployment across locations

- Computer vision, screens, audio systems

- Organizational alignment between merchants and media teams

- Measurement that connects impressions to baskets

Most retailers can't clear those hurdles. Sam's Club invested early and coordinated across teams from the start.

The Secret: Retail Experience Network

Sam's Club doesn't treat activations as isolated marketing stunts. They orchestrate everything as part of what they call a "retail experience network."

What this looks like in practice:

| Location | Format | Purpose |

|---|---|---|

| Parking lot | Event activations (IndyCar simulators, brand RVs) | Member acquisition, engagement moments |

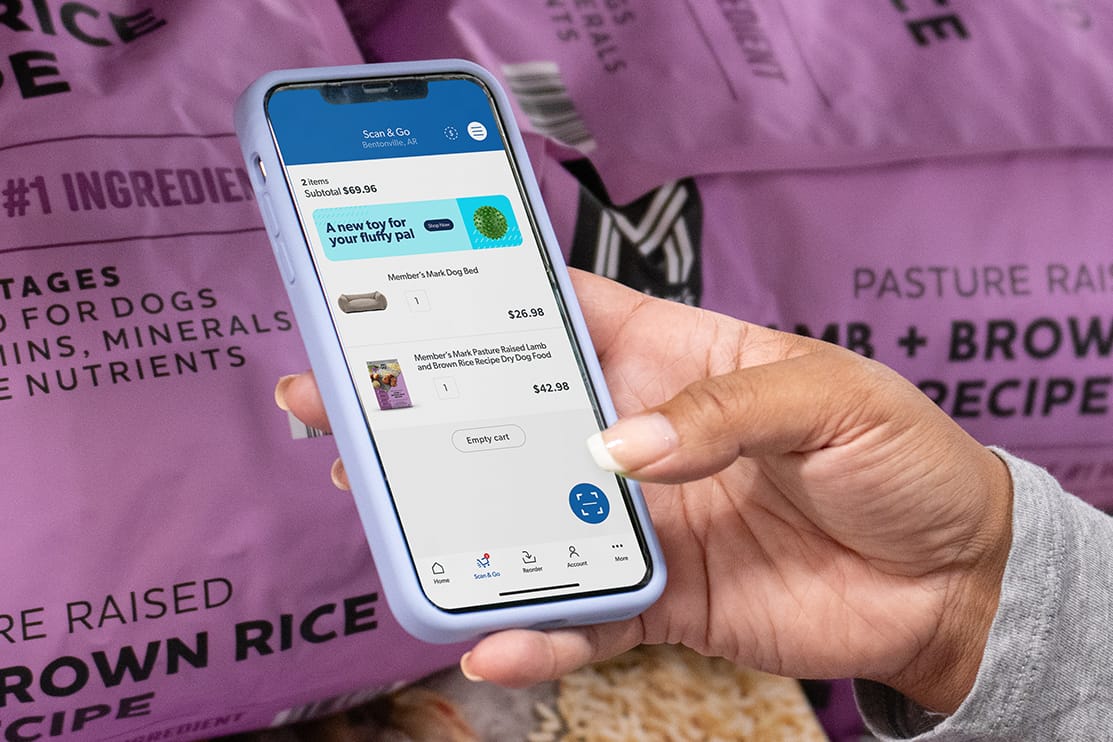

| Entrance | Scan & Go contextual ads | Location-based targeting |

| Throughout club | Strategic screen placement | High-traffic conversion moments |

| Exit | Computer vision tech | Frictionless checkout, dynamic messaging |

| Floor | Autonomous scrubbers with CV | Traffic patterns, dwell time, OOS monitoring |

Each touchpoint feeds data back into their longitudinal measurement system. They promise is to be able to connect a parking lot interaction to what someone buys a year later.

In-store retail media activations in Sam's Club, left to right: The exit archway, ads on TV screens, and scan-and-go within the app.

Aligning JBPs And Retail Media

Traditionally, JBP conversations ended once merchants secured shelf space. Ma says that today at Sam's Club every JBP includes a discussion of What do you want to do with this product once it's in the club?

Grocery Doppio research shows 86% of grocers keep print, digital, and in-store media completely siloed. Two-thirds of advertisers want connected strategies, but most retailers haven't solved the organizational challenge.

Sam's Club positioned their growth team within merchandising, reporting to merchant leadership. This forces alignment with core business objectives rather than operating as a separate profit center.

When your time, budget and team are already maxed out, keeping up with retailer platforms and media requirements can feel like a never-ending labyrinth. That’s why even the best brands bring in an execution partner.

Acosta Group makes retail media execution simpler. They stay ahead of every platform update, tech shift, and media spec. So your campaigns actually show up and perform—without draining your team.

Measurement That Actually Proves It

Sam's Club built what Ma calls their "omni impact tool"—multi-touch attribution combined with marketing mix modeling tracking 12-month member journeys.

The system operates at member level with SKU-level precision. They track every touchpoint—on-site, off-site, displays, audio, events—and use AI to determine what drove engagement and conversion.

Ma claims they're the first to combine MTA with MMM at this scale, and the first to build propensity models that tell brands when they've saturated a channel.

The Reality Check

Even if executed perfectly, in-store won't dominate retail media revenue. EMARKETER projects it'll hit just 3.3% of non-Amazon retail media spend by 2029.

But here's the thing: for retailers with significant physical presence, that 3.3% can be meaningful revenue—if they can execute. That's the qualifier most miss.

Sam's Club has advantages most can't replicate:

- 140 million weekly U.S. store visits

- Membership model enabling closed-loop measurement

- Learning from Walmart's retail media playbook

- Tech and testing approaches borrowed from their bigger sibling

The Bottom Line

With 91.5% of food and beverage sales still happening in physical stores, the transaction volume is massive. But limited advertising scalability means in-store will remain a small slice of retail media spending.

For retailers with Sam's Club's advantages—scale, membership model, organizational alignment, measurement infrastructure—it's still a slice worth fighting for.

Further Reading:

- Sam's Club Bets Big on 'Experiential' Retail Media - Sam's Club is taking its advertising dollars to racetracks, country music concerts, and county fairs.

- Brian Monahan's 'Bloody Obvious' Bets Are Shaking Up Albertsons Media Collective - Why Albertsons is betting on gamified scavenger hunts and workflow integration

- Trade vs. Retail Media: Who's Really Eating Whom? Trade dollars are flowing into retail media channels. Retail media platforms are absorbing trade's operational complexity. Who wins?