Retailer AI Assistants: Are Shoppers Actually Using Them?

70% of shoppers have experimented with AI tools to help them shop, yet less than 15% use retailer AI shopping assistants.

Here's a number that should stop every retailer cold: 70% of shoppers have experimented with AI tools to help them shop, yet less than 15% use retailer AI shopping assistants. That gap shows where we are versus where retailers think we are.

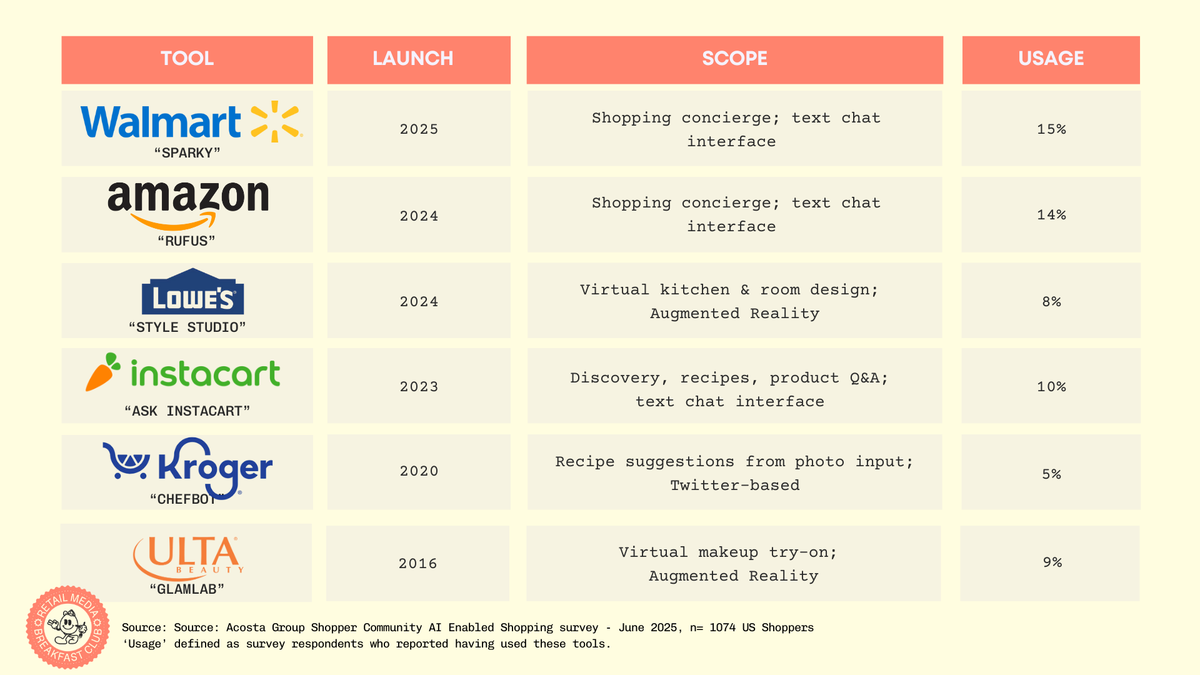

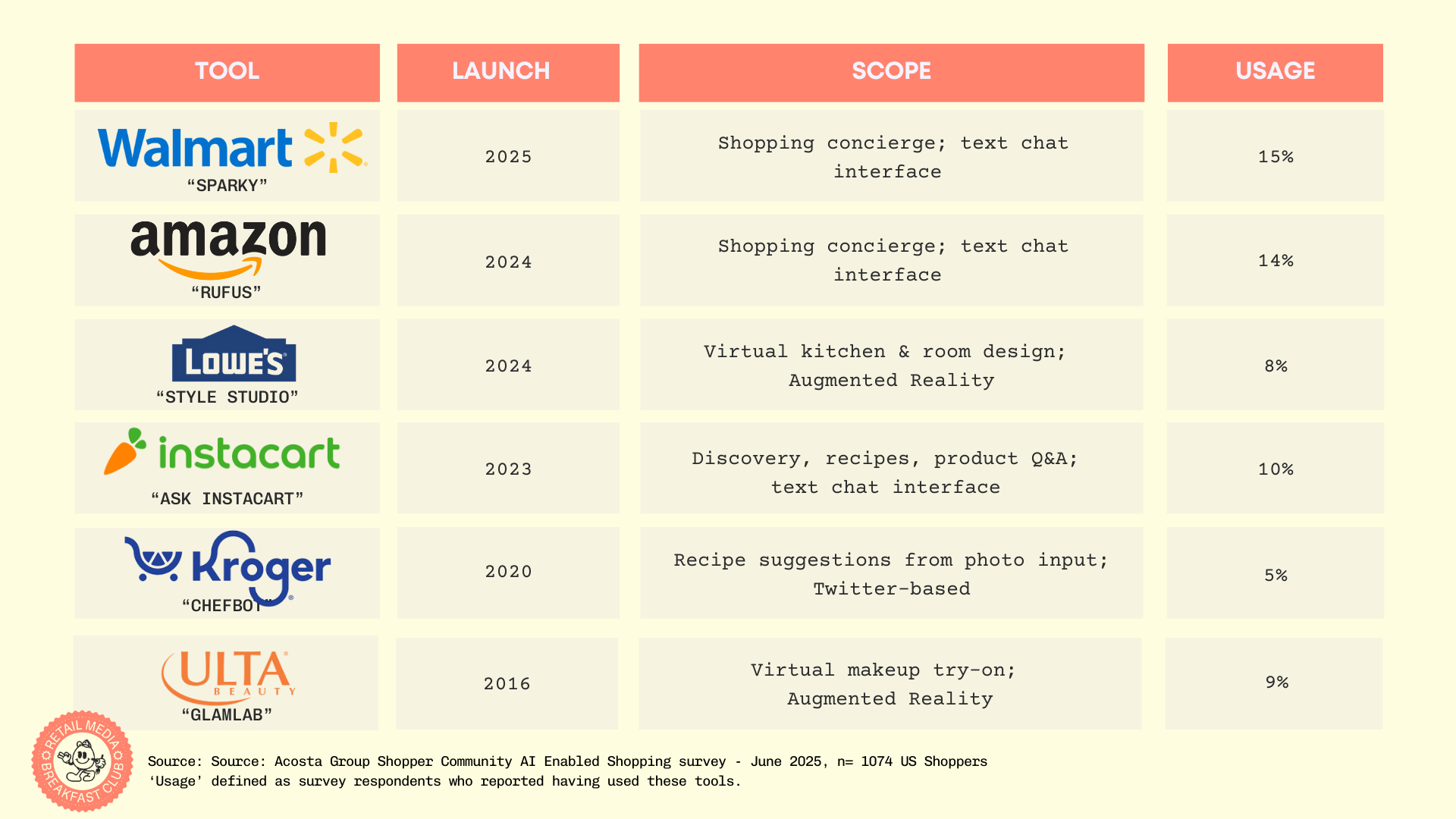

New data from Acosta Group's shopper panel shows what's happening. Amazon's Rufus? Just 14% of shoppers have tried it. Walmart's Sparky? 15%. Meanwhile, Kroger's ChefBot—which launched back in 2020—sits at 5% usage with 80% of shoppers having never heard of it.

What matters: launch timing has nothing to do with success.

Tenure Doesn't Matter

Take Ulta's GLAMlab, which pioneered AR try-on tech in 2016. After nearly a decade in market, only 9% of shoppers have used it and 73% have never heard of it. Compare that to Amazon's Rufus, which launched in February 2024 and already exceeds GLAMlab's awareness levels.

GLAMlab's AR capabilities overlay digital makeup with shade matching and personalization. ChefBot can identify 2,000 ingredients from photos and suggest recipes from a 20,000-item database. Yet both lag behind simpler conversational assistants that launched months ago.

Launch timing alone doesn’t explain success with these tools.

The Front Door Always Wins

Rufus and Sparky succeed in part because they're unavoidable. Open the Amazon app to search for batteries, and Rufus sits right there at the bottom of your screen. Shop on Walmart's app, and Sparky sits prominently in the main interface. You encounter them while doing what you came to do—shop.

ChefBot debuted on Twitter with links into Kroger.com; despite talk of expanding channels, it remained a peripheral experience versus an in-app default.

ChefBot lived on Twitter at first. You had to know it existed, leave your shopping context, tweet a photo, and wait for a response. Even after Kroger brought similar functionality into their app, people still see it as a peripheral tool.

GLAMlab faces the same problem. It's buried within Ulta's app as a separate experience. You actively seek it out rather than stumbling upon it during normal browsing. Ask Instacart sits inside the app’s search experience but isn’t always the starting point for shoppers—and its 10% usage reflects that middling position.

As I wrote in my analysis of Walmart's AI roadmap, the retailers getting this right think less about showcasing AI and more about embedding it invisibly into existing behaviors.

Mass Market Beats Specialization (For Now)

There's another dynamic at play: reach. Amazon and Walmart touch every demographic, every category, multiple times per week. That frequency compounds awareness. A shopper might hit Amazon weekly but Ulta monthly. Those extra touchpoints matter when you're trying to build new habits.

Specialist retailers face a choice. Build narrow, purpose-built tools that excel at specific tasks? Or compete as general shopping concierges in limited domains?

To me, the data points toward specialization. As I explored in "Why Agentic Shopping Poses an Existential Threat to Retail Media", consumers will pick their own personal AI agents that know their full shopping history across all retailers. In that world, a specialized tool that does something ChatGPT can't—like rock-solid AR try-ons—works better than yet another general assistant with limited context.

Did you know that 60% of shoppers abandon carts when product info is wrong? Before you ramp up your ad spend, fix the shelf. Acosta Group’s award-winning Connected Commerce crew is trusted by brands like Coca-Cola and Sanofi to deliver critical content updates. Acosta Group handles it all, then layers on media buying.

Learn more about Acosta Group’s Connected Commerce capabilities at Acosta.Group

What Retailers Need to Accept

Three realities show up in this data:

- Awareness is your biggest enemy, not competition. Even tools that have existed for years stay unknown to 70-80% of shoppers. If people don't know your AI exists, years in market won't save you.

- Placement. A basic assistant in the main shopping flow will outperform a sophisticated tool hidden in a submenu every time.

- You can't sit on the fence. Either commit to creating a unique tool that owns a specific use case, or go all-in on interfacing with consumer-facing AI agents. The middle ground – launching an ineffective chatbot – will just tick shoppers off.

What Brands Should Prepare For

This fragmented landscape creates new challenges for brands. Each retailer's AI demands different content formats and optimization strategies. Natural language queries like "best shampoo for oily hair under $15" will replace keyword searches. The brands that invest early in structured, AI-ready product data will shape what these assistants recommend.

And yes, advertising will follow. As these assistants gain trust, expect "sponsored recommendations" to show up within their suggestions. Start budgeting now.

The Reality Check

In terms of the hype cycle, it's still early days. The gap between general AI usage (70%) and retailer AI adoption (15%) represents both the challenge and the opportunity.

The race centers on who can make their assistant an invisible, essential part of how people already shop. The winners will be the ones whose customers don't realize they're using AI at all.