Retail Media Growth Will Slow in 2025: Here’s Why

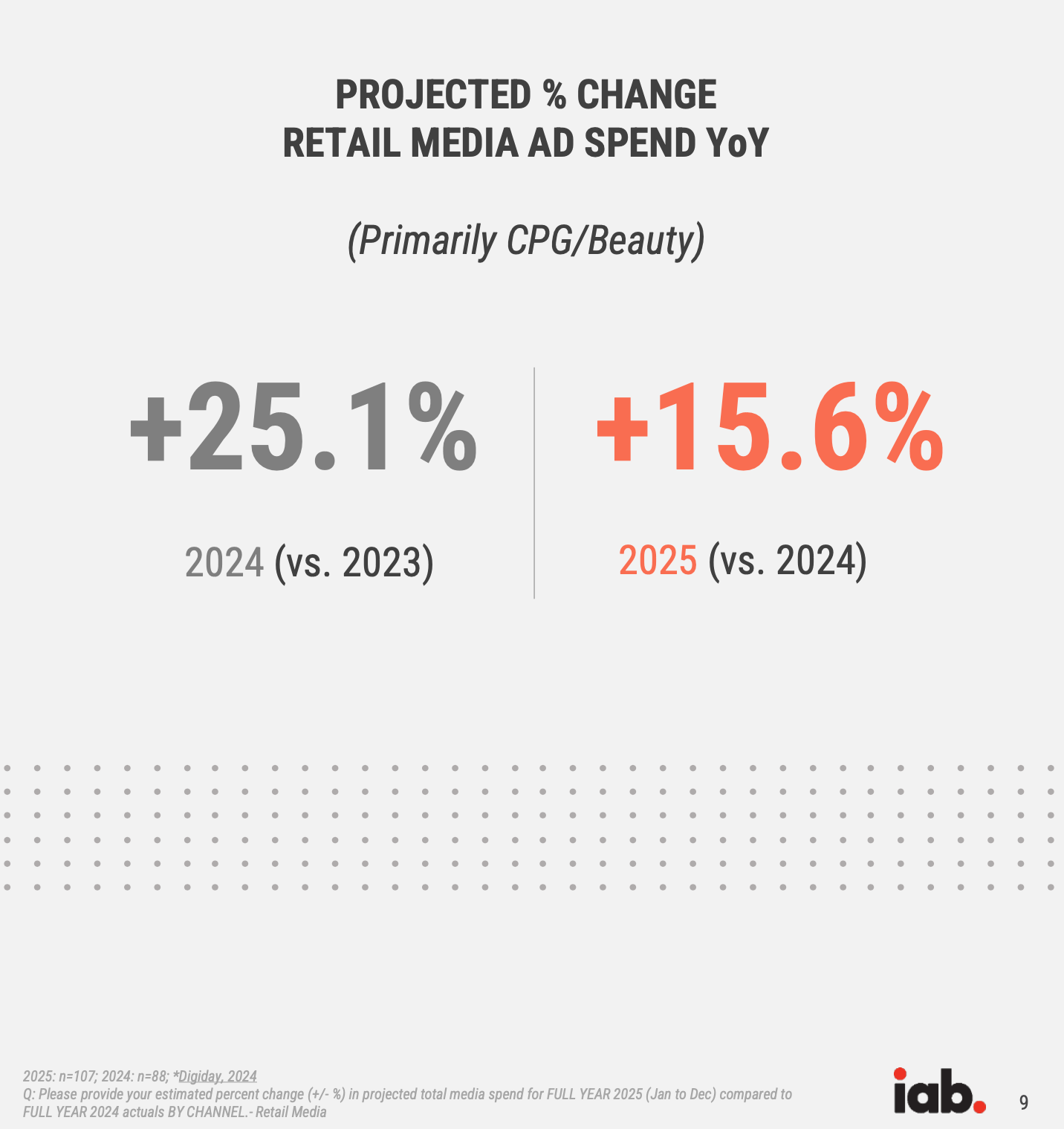

Retail media networks (RMNs) have been digital advertising's golden child, but 2025 marks an inflection point in their growth trajectory. According to new IAB data, retail media spending growth will decelerate to 15.6% in 2025, down significantly from 25.1% in 2024.

While still outpacing the broader digital ad market's projected 7.3% growth, this slowdown signals deeper structural challenges facing the retail media ecosystem.

The deceleration stems from three key factors: post-pandemic normalization, increasing ecosystem complexity, and mounting resistance from brands over measurement standards and costs.

1 - Post-Pandemic Reality Check

Much of retail media's meteoric rise was fueled by the pandemic-driven surge in e-commerce, which created a natural tailwind for advertising on retail platforms. As e-commerce growth stabilizes to more normal levels, the explosive growth in retail media spending is following suit.

Additionally, many brands initially funded their retail media investment from trade and shopper marketing budgets – and at least some of that budget is starting to flow back there.

2 - Ecosystem Fragmentation Creates Friction

Despite dozens of retail media networks launching in recent years, brands are concentrating their spending with just a handful of major players. Research from Stratably found that the average brand activates on only five to six networks, typically including Amazon, Walmart, and category-specific leaders. This concentration creates challenges for smaller retail media networks trying to achieve the scale needed for sustainable operations.

The fragmented ecosystem has led to a lack of standardization across networks. Each platform operates with different measurement approaches, buying mechanisms, and performance metrics. This complexity increases operational costs for brands and makes it harder to compare performance across channels.

3 - Brands are frustrated by measurement standards and transparency

As retail media networks seek to maintain their growth rates, many have resorted to aggressive tactics to capture brand budgets. Some retailers in the past have required brands to commit to media spending to maintain favorable merchandising terms. This has created resentment among brands already struggling to allocate their media budget in a deliberate way.

To maintain even modest double-digit growth, retail media networks must now compete for traditional brand and national media budgets. This requires proving incremental value versus established channels like social media and paid search.

Andrew Lipsman of Media Ads + Commerce says in a recent post:

"RMNs generally can't outcompete Meta and Google on ROAS, but iROAS is a game they can win. And with good reason: contextually relevant ads powered by better data and closed-loop attribution are all the ingredients an advertiser should need to drive incremental sales."

However, cross-platform measurement remains a significant hurdle.

The Path Forward

Despite these headwinds, retail media's projected 15.6% growth in 2025 still represents a healthy expansion rate. The channel offers unique benefits through its combination of upper-funnel brand building and lower-funnel conversion capabilities.

Success in 2025 will require retail media networks to address brand concerns around measurement standardization, prove incremental value, and shift away from strong-arm tactics.

For the broader digital advertising ecosystem, retail media's growth deceleration may actually be healthy – forcing needed improvements in measurement, standardization, and value demonstration. The networks that adapt to these higher expectations will be best positioned to capture their share of brand budgets in an increasingly competitive landscape.