Online Channels Set to Drive CPG Growth in 2025: Why Retail Media is Taking Center Stage

While physical store sales declined last year, digital channels delivered all of the growth for CPG brands. But not all digital channels are created equal - and the data finally proves which ones actually work.

I’m pulling from 2 excellent sources today — Stratably’s 2025 CPG OUTLOOK, and Media Ads + Commerce’s most popular research from last year about the 3rd wave of Incrementality.

And here’s the story these 2 sources tell us: While physical store sales declined last year, digital channels delivered all of the growth for CPG brands. But not all digital channels are created equal - and the data finally proves which ones actually work.

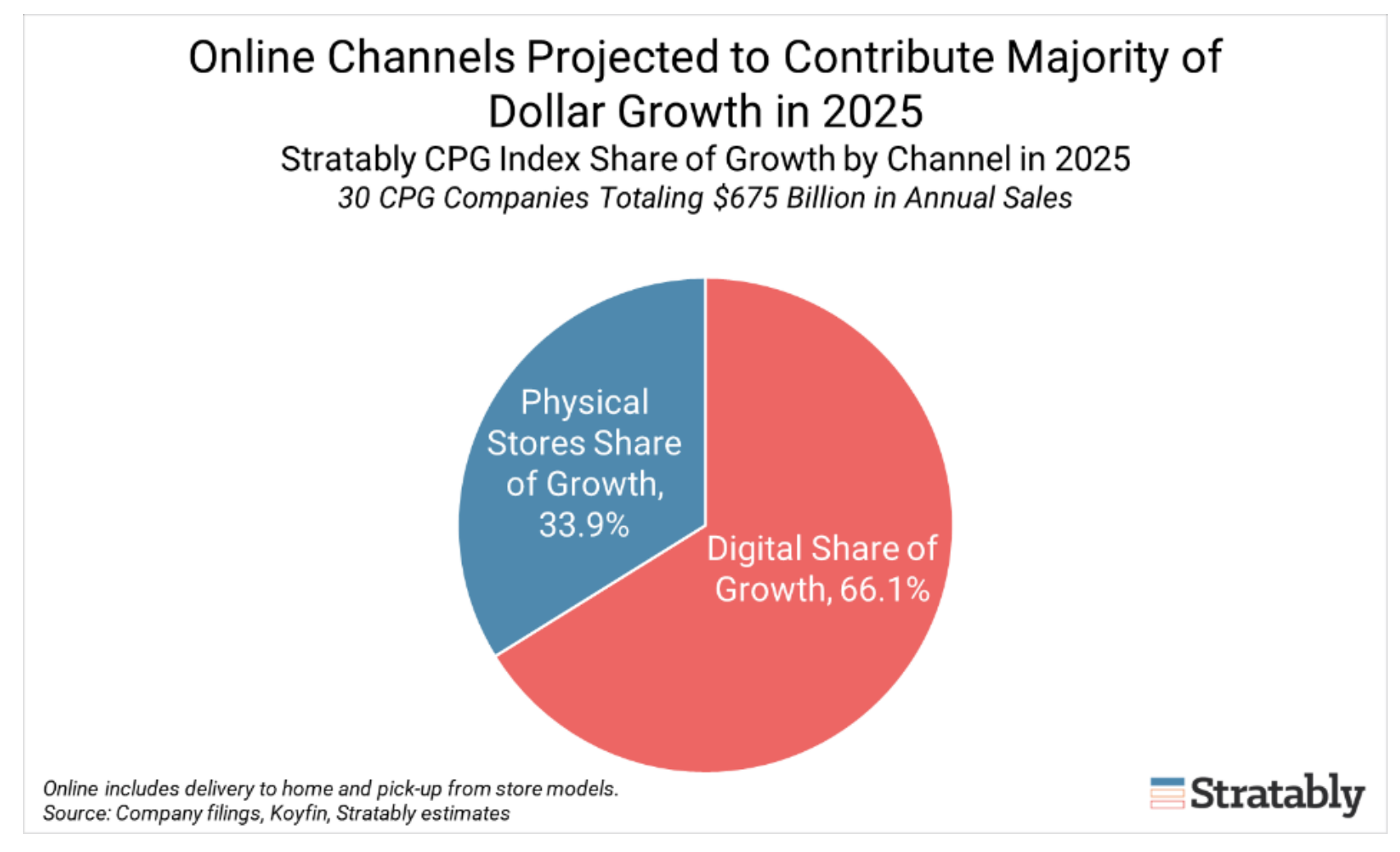

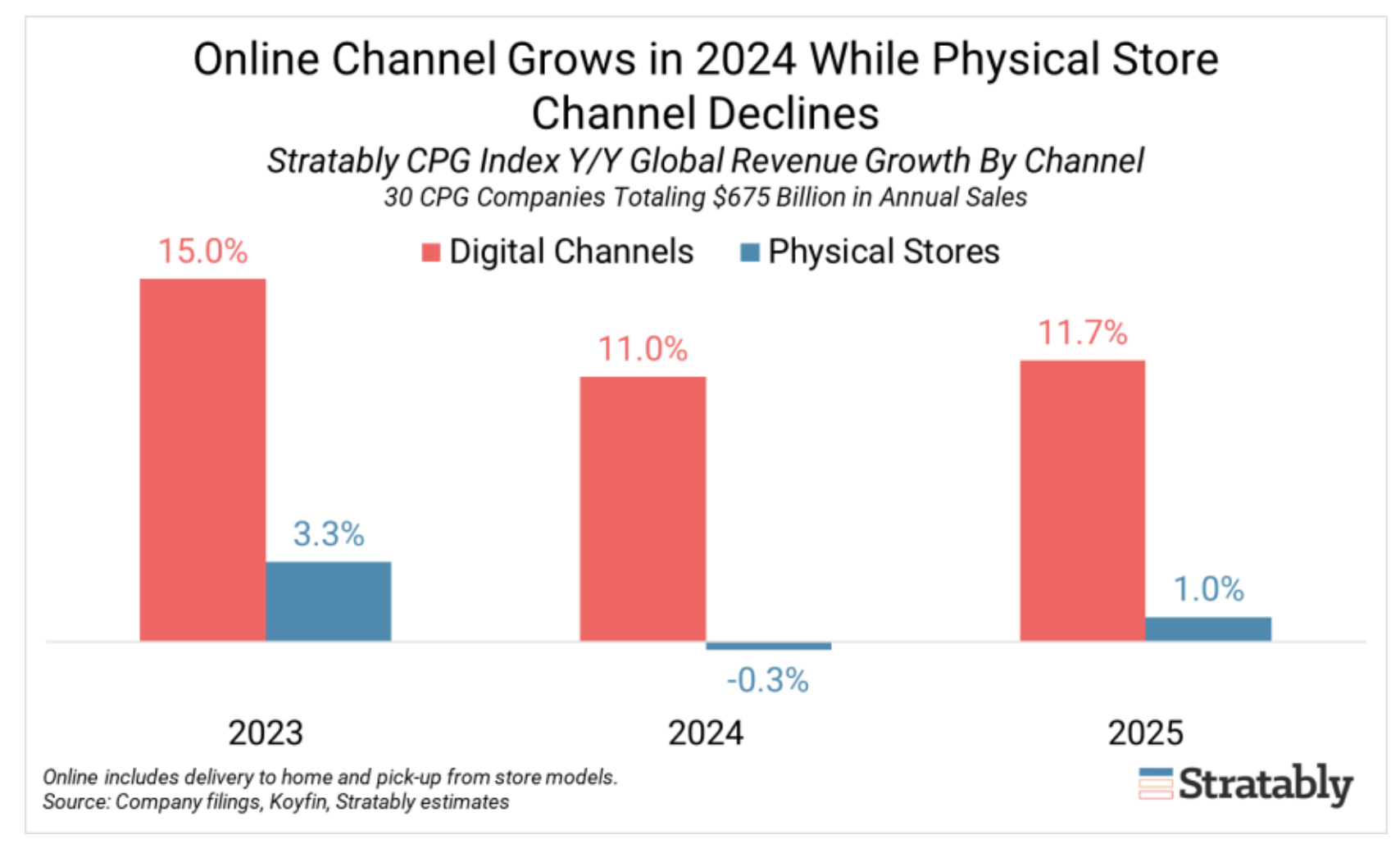

According to Stratably's extensive analysis of 30 major CPG brands - collectively representing $675 billion in global sales - we're witnessing a decisive shift in how CPG brands achieve growth. The data tells a compelling story: digital channels were responsible for all CPG growth in 2024, while physical store channels actually declined by -0.3%. This trend is accelerating, with digital projected to drive two-thirds of all CPG growth in 2025.

Why This Matters Now

The timing of this shift is critical for three reasons. First, CPG growth has been anemic, trending at just 1.4% YTD in 2024 - well below the 3-5% long-term growth targets most brands aim for. Second, profit margins are at historic highs (45.8% gross margins in 2024, up 180 basis points from 2023), giving brands the financial flexibility to reinvest in digital growth.

Retail media to the rescue

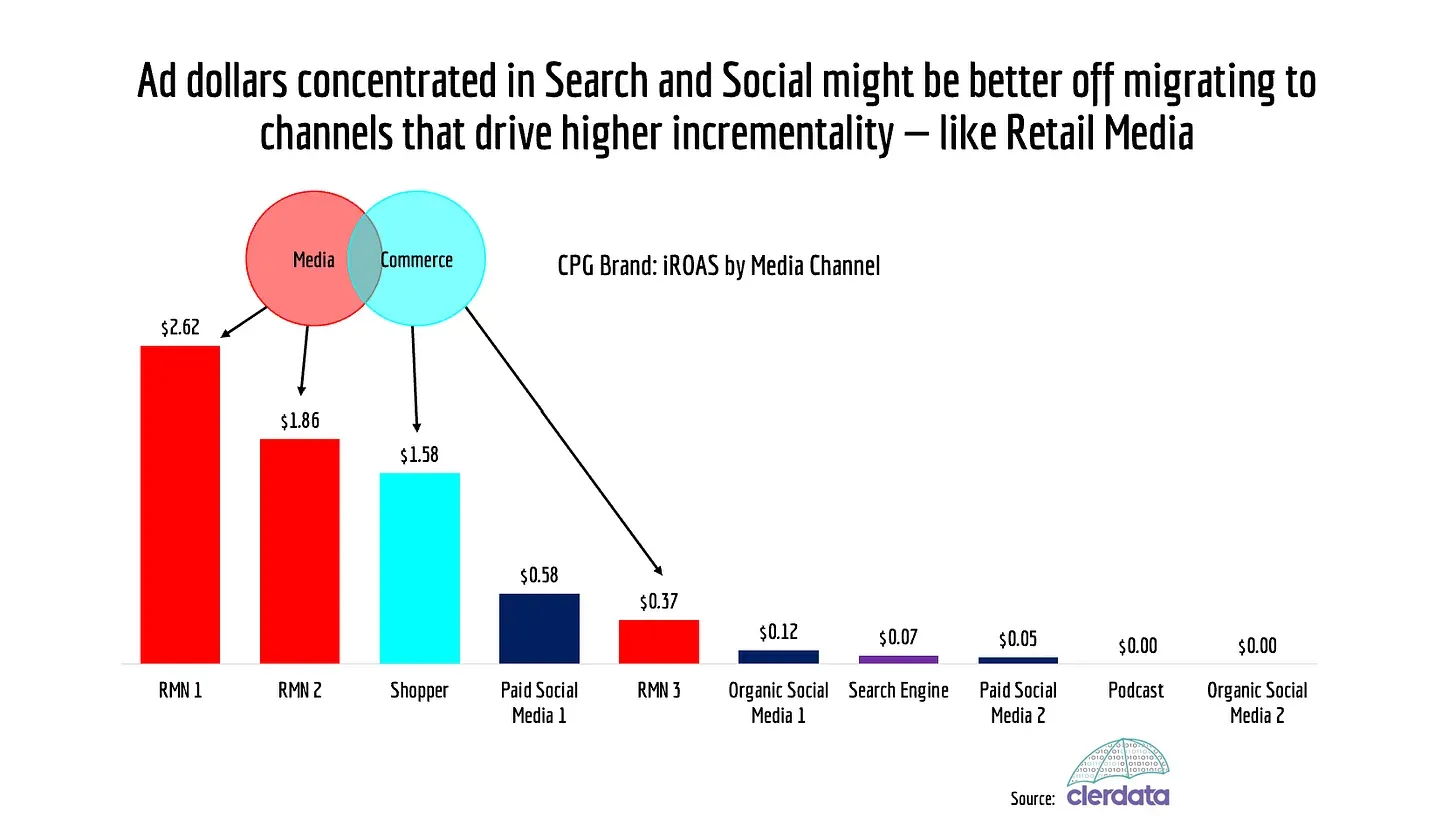

Third, the digital ecosystem, particularly retail media networks, has matured significantly, and this is where Media Ads + Commerce’s research using data from analytics provider Clerdata comes in. One CPG brand that Cleardata has tracked showed leading RMNs generating $2.62 in incremental return on ad spend. Of the ten digital advertising channels studied, retail media networks ranked as the top two performers overall for driving incremental sales growth.

The evidence of this shift is showing up in brand budgets. One large CPG holding company in the Stratably report shifted 85% of their advertising to digital channels, increasing marketing to 12.3% of net sales - up 80 basis points from the previous year.

These aren't isolated examples. Across the CPG landscape, brands are moving dollars away from traditional paid social media - which often struggles to generate positive incremental returns - toward retail media networks and retail media-powered CTV, despite their higher costs.

Measuring What Matters: The Case for iROAS

While brands are rapidly shifting dollars to digital channels , there's a critical question they need to address: How can they ensure these investments are truly driving growth?

The current problem is that ad dollars are being algorithmically allocated according to 'proxy metrics' like ROAS and click-through rates. ROAS is a blunt instrument, and highly flawed as a metric, yet difficult to discard entirely.

Andrew Lipsman from Media Ads + Commerce says:

"The resilience of ROAS stems from its ubiquitous use in retail media and across digital media more broadly. Ad investments—not to mention people's bonuses—are often predicated on this metric. And inertia is a powerful force.”

The data bears this out. When Clerdata analyzed Amazon's ad formats, they found Sponsored Brands Video delivered the highest incremental returns despite having lower ROAS on average. Digital endcaps outperformed Sponsored Products on driving new sales, though traditional metrics would suggest otherwise.

For CPG brands investing heavily in digital channels, Lipsman argues this is the moment for change and bring in incrementality metrics as standard. This means CPG brands will have to adapt to maximize actual advertising effectiveness, which will mean breaking some bad habits like buying sub-prime ad inventory and relying on proxy metrics.

Looking Ahead: The Digital Growth Engine

The implications for 2025 and beyond are clear: Stratably projects digital penetration to grow another 130 basis points, reaching 16% of total CPG sales. Digital channels are expected to grow at 11.7% next year, while physical channels will see modest 1% growth. By 2029, digital channels are projected to represent 21% of total CPG sales.

For brands still heavily invested in traditional channels, the evidence suggests an urgent need to reevaluate their media mix. With retail media networks delivering proven incremental growth and the digital ecosystem continuing to mature, the path to growth increasingly runs through digital channels.

The key question for CPG brands isn't whether to invest in digital - it's how quickly they can optimize their digital presence to capture this growth. The combination of direct sales impact and incremental growth makes retail media networks uniquely positioned to drive CPG growth in the coming years.