Meet The First Retail Media Federations & Consortiums

Federations and consortiums in retail media are already taking shape, hoping to solve the challenge of a 'long tail' of RMNs trying to find a seat at the table.

This is Part 2 of my series on retail media consolidation. Today: the federation models already taking shape. (Read Part 1 here)

Last week Best Buy announced a reinvention of its ads business—positioning itself as an experiential, creative-driven bastion of gaming and sports culture. But what got me most excited wasn't the splashy "We Got Next" branding or the NFL partnerships. It was the whiff of a more collaborative model for retail media.

Speaking at the IAB Connected Commerce Summit, the President of Best Buy Ads, Lisa Valentino, outlined a vision that goes beyond typical network expansion: "We can become a network for other RMNs." In a follow-up interview, she told me Best Buy could partner with "anybody who has a commerce presence"—restaurants, transport companies, and yes – even direct retail competitors.

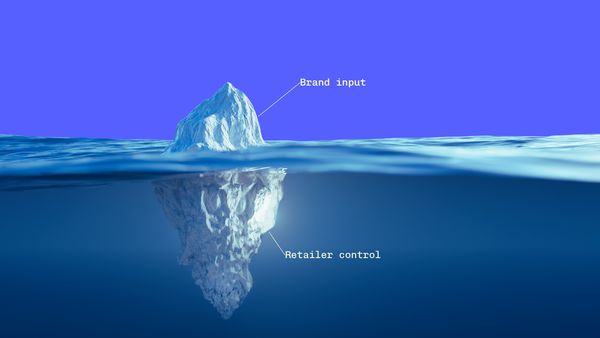

Best Buy said the quiet part out loud: with more than 200 retail media networks live today, and most brands only actively advertising in 5-7 of them (and few having conviction about expanding that number) —any casual observer would agree there's consolidation on the horizon.

A few weeks ago, I wrote about why retail media's fragmented model is breaking down. The response was immediate—industry leaders clearly see consolidation coming. Lynn Rupprecht, an ad-tech veteran now leading the Commerce Media practice at MadConnect, expressed the frustration many feel with the current landscape: "I'm feeling unsettled at best by the over saturation of the commerce media space. The decisions being made are seemingly fueled by a land grab mentality that is taking brands further from their customer."

Mike Mallazzo, the Director of PayPal's Honey app, called consolidation "inevitable," but that opportunity lies in the chaos: "We get a chance at a cosmic reset/do-over."

The interest is there. But what do working federations actually look like? Today I'll examine a couple of models that have already emerged, and the scale and measurement problems they're trying to solve.

The Federation Models Already Taking Shape

While Best Buy teases its platform ambitions, other models are already proving that retail media federations can work in practice.

Valiuz leads the pack in Europe. What started in 2018 as a data alliance among retailers in the Mulliez family ecosystem—including major chains like Auchan, Leroy Merlin, and Decathlon—has rapidly evolved into a full retail media operation. Through strategic acquisitions, Valiuz now covers roughly 80% of French households across 141 million contacts (55M unique customers) and over 4,000 stores.

In the US, Rippl represents the third-party consortium approach. Their recent partnership with Hy-Vee's RedMedia marked a breakthrough moment, expanding their reach to over 140 million unique shoppers. Enrique Munoz Torres is the General Manager of Bridg, which powers Rippl's identity resolution. Torres told me: "Our recent partnership with Hy-Vee has generated significant interest from CPG brands and agencies, leading to an uptick in inquiries about how Rippl can help their advertising needs."

Regional models are gaining traction too. DIGITS Agency operates what I'd call a "proto-consortium" for regional grocers like Coborn's, Schnucks, and Fareway. By providing shared infrastructure—standardized programmatic display, unified first-party audiences—they enable smaller players to access media opportunities that would otherwise require national scale.

Did you know that 60% of shoppers abandon carts when product info is wrong? Before you ramp up your ad spend, fix the shelf. Acosta Group’s award-winning Connected Commerce crew is trusted by brands like Coca-Cola and Sanofi to deliver critical content updates. Acosta Group handles it all, then layers on media buying.

Learn more about Acosta Group’s Connected Commerce capabilities.

Consolidating the long tail

With over 200 retail media networks active today, brands are managing relationships with an average of just six platforms.

Case in point: just last week I spoke with retail media leaders from two multinational CPG companies. Both actively buy media through only 5-10 RMNs, with no plans to expand that roster—despite their brands being sold across hundreds of retailer banners. Instead, they've developed tight scorecards for their existing networks that set a high barrier for any new entrants. From their perspective, they're containing the chaos and staying focused. For the 190+ aspiring RMNs still trying to break through? That's a sobering reality check.

Andreas Reiffen, Cofounder and CEO of ad-tech firm Pentaleap frames the scale challenge differently. "There's no way brands can talk to 500 little retailers," he told me. His solution aligns with Best Buy's vision: vertical category leaders should become ad networks for their sectors. "Home Depot should become an ad network," he argues. "If you go by vertical, it would make total sense that whoever leads that space tries to double down on the brand relationships and resell ads to the others." (Note, Pentaleap is a client of mine)

For long-tail networks, federations might be the only path to survival. Neal Sheridan, Vice President of Sales at Stingray Advertising and former head of Belk’s retail media network told me, "federated models can be a lifeline for long-tail RMNs that otherwise lack the scale to compete for national budgets."

Standardization in measurement: the prize, or the catch?

Alex Arnott, Sr. Director of Retail Media Monetization at New Stream Media captures the brand-side frustration: "Managing the complexity of multi-faceted programs across a myriad of retail media networks, each with their own unique measurement methodology, makes it nearly impossible for brands to measure holistic success and determine the best place to invest their next dollar."

Inconsistencies include things like varying attribution windows for clicks and views, viewable conversion requirements, probabilistic vs. deterministic data sources and differing incrementality methodologies. Such challenges make it extremely difficult for a brand to evaluate a campaign's success across media networks, according to Arnott.

Individual networks have little incentive to standardize—it's additional work with no immediate payoff. But federations face a different reality: they must solve measurement consistency to justify their existence. If brands can't compare performance across a federation's member networks, what's the value proposition?

This is where federations could deliver their biggest win.Successful federations will need the same measurement language across different channels – while retaining what's unique about their retail ecosystem and value proposition.

But here's the catch: measurement standardization is also federations' biggest implementation challenge. Getting competitors to agree on common standards involves both technical complexity and political negotiation.

What This Means Going Forward

The examples are multiplying. Valiuz proves federations can work at scale in Europe. Rippl shows third-party consortiums can attract major grocery partners in the US. DIGITS demonstrates that regional models create immediate value for smaller players. Best Buy hints that category leaders might become the convening platforms.

But building functional federations requires solving technical, governance, and competitive challenges that have derailed similar efforts in other industries. The identity resolution alone—matching customers across different retailer systems without exposing personal information—represents a significant technical hurdle.

These models are gaining traction, but their success depends on getting the fundamentals right: technical infrastructure, measurement standards, and business models that benefit all participants rather than just the platform operators.

Next in this series, I'll explore what it actually takes to build a retail media federation—from clean room architecture to revenue-sharing agreements—and why some industry leaders remain deeply skeptical about whether retailers will sacrifice competitive advantages for collaborative benefits.

Next: The technical and business requirements that determine whether retail media federations succeed or fail.

More from me on this and related topics: