Long-Tail Advertisers Are A Quiet Growth Engine For Top Performing RMNs

RMNs shouldn't overlook the smaller end of town as an alternate, or even complementary, growth strategy.

Retail media networks (RMNs) are ponying up the big bucks to match Amazon and Walmart's advertising capabilities. Better measurement, self-serve platforms, sophisticated targeting—all in hopes of breaking into the top tier where big CPG brands allocate their budgets.

But there's a problem: those big brands aren't expanding the number of RMNs they're working with. As I wrote last week, they've hit a hard ceiling at 5-6 retail media relationships, and no amount of capability improvements will change that.

Data from Pentaleap's new H2 2025 Sponsored Products Benchmark Report reveals what's actually driving RMN growth—and it's not just about clocking in more more Fortune 500 advertisers. A key strategy for retailers is in activating the "long-tail" of smaller brands and third party sellers.

Retailers who've cracked this are seeing massive results while their competitors chase displacement strategies that won't work.

The Ceiling: Why Big Brands Won't Expand

At Path to Purchase Institute LIVE in November, Kelly Spehar, Mars's Global Retail Media Strategy Director, described the company's formal "investments matrix"—a scorecard evaluating networks on capabilities and scale. The output is a ranked list with tactical guidance for each region.

Mars, like many large CPGs conglomerates I've spoken with, isn't really interested in expanding the number of RMN partners they work with. They are focused on optimizing allocation across existing partners.

That's because the operational burden compounds with each network: different platforms, inconsistent measurement, fragmented reporting, complex commercial negotiations. Even with dedicated teams, most large brands cap around six relationships because the marginal value doesn't justify the marginal effort.

If the biggest CPG advertisers stop at 5-6 networks, that's a ceiling on industry growth.

The Data: Long-Tail Is Already Winning

Fresh data from Pentaleap's H2 2025 report shows where actual growth is happening, and the numbers are striking. (Note, Pentaleap is a client of mine.)

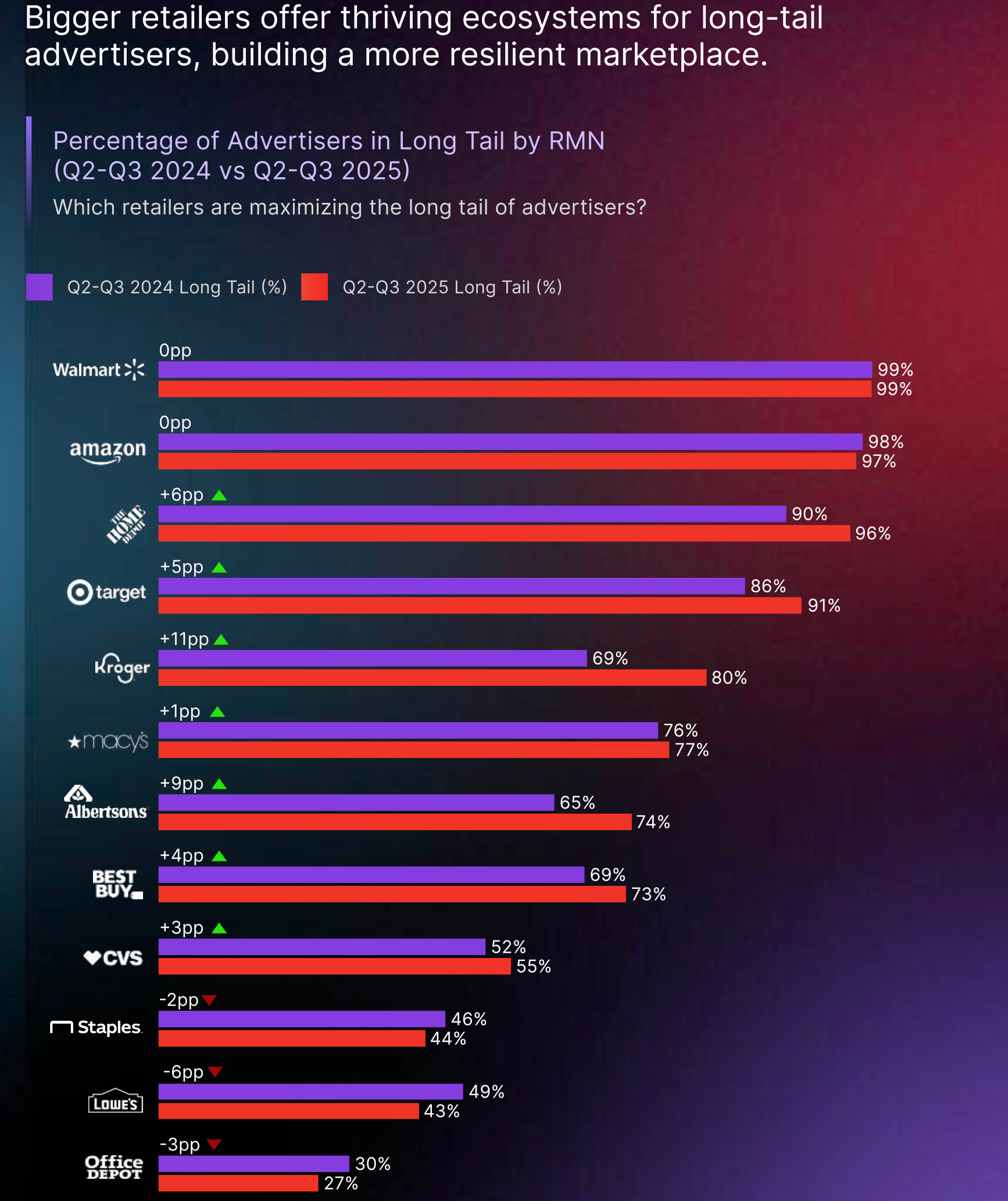

Industry-wide, the long-tail share of impressions grew from 69% to 71% year-over-year. That sounds incremental until you look at specific retailers:

- Kroger: Long-tail advertiser share jumped 11 percentage points, rising from 69% to 80%. Meanwhile, head advertiser share fell 21 percentage points.

- Albertsons: Long-tail advertisers increased 9 percentage points, from 65% to 74%.

- Home Depot: Long Tail impressions surged 15% while head advertisers dropped 16%.

But the standout example to me here is Lowe’s. After launching its 3P marketplace in late 2024, Lowe’s saw an immediate expansion of long-tail advertisers on the platform. The Pentaleap report explicitly highlights this, noting that Lowe’s increased its share of head impressions as it onboarded larger marketplace sellers, while simultaneously expanding total long-tail advertiser count by 23% year-over-year. This shows how 3P sellers, when provided with the right tools, can drive considerable incremental advertising revenue for retailers.

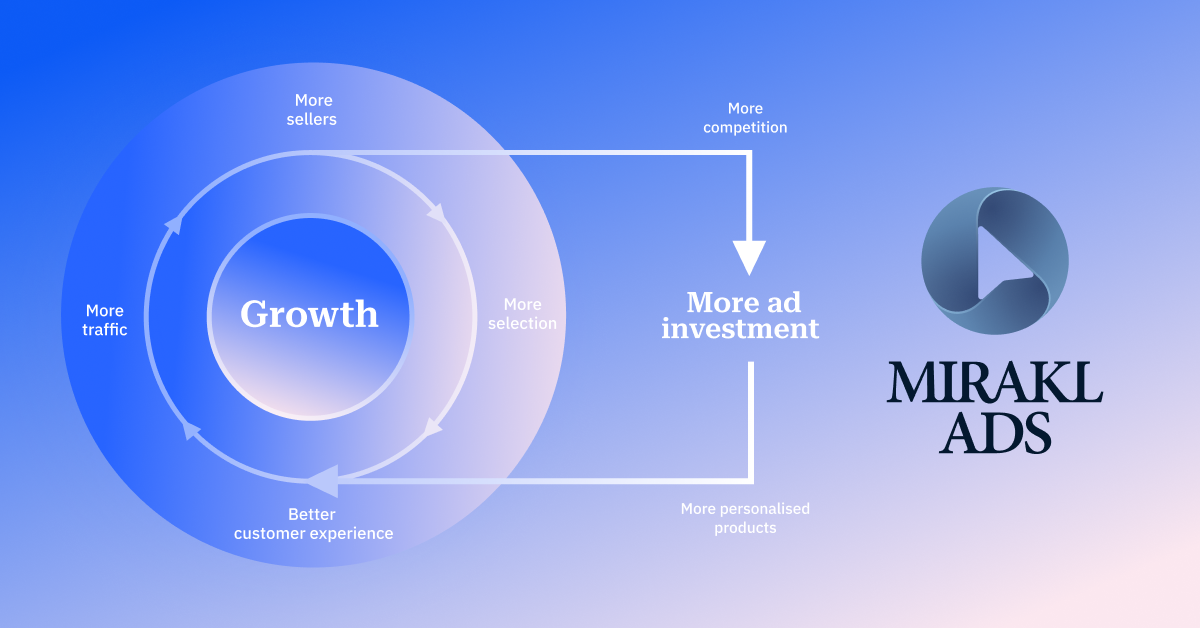

Retailers know that a marketplace model can dramatically boost product assortment, shopper engagement, and total revenue. But, to get the most out of your marketplace, you need an ad tech solution that can really engage sellers. Mirakl Ads is powering the future of retail media for leading retailers — to activate both 3P sellers and 1P brands.

Forrester research commissioned by Mirakl validates what Pentaleap's numbers suggest. The average retail media network gets 28% of revenue from mid- to long-tail advertisers.

Here's an example of how advertising economics can be bolstered by marketplace sellers. Rakuten's marketplace in France supports more than 10,000 potential mid- to long-tail advertisers. When Rakuten shifted to Mirakl Ads—a platform built specifically to scale automated, self-serve campaigns among a larger group of advertisers—they saw immediate results. Within three months, monetization improved 53% as more sellers were able to participate without added operational burden. (Mirakl Ads is the sponsor of this newsletter)

The Execution Gap

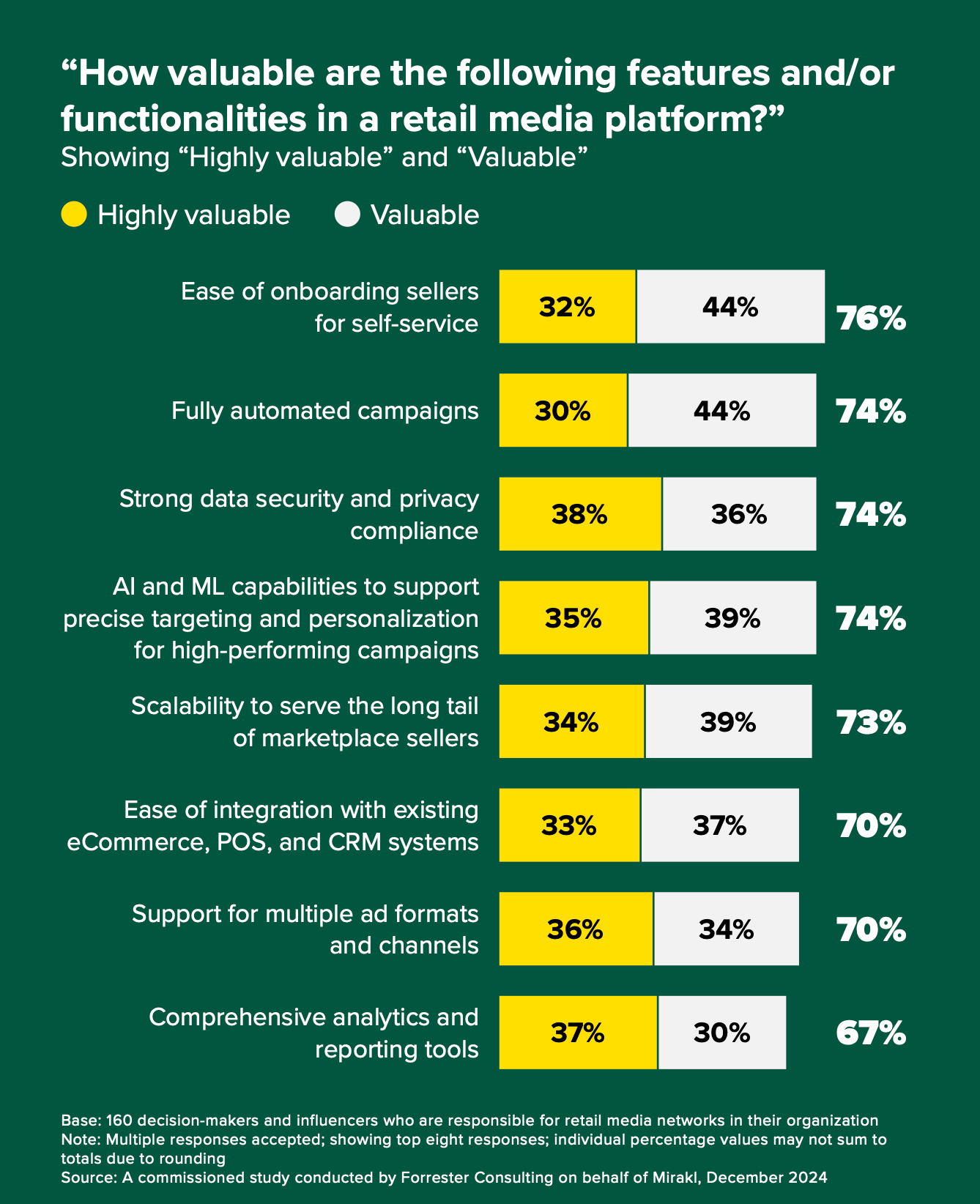

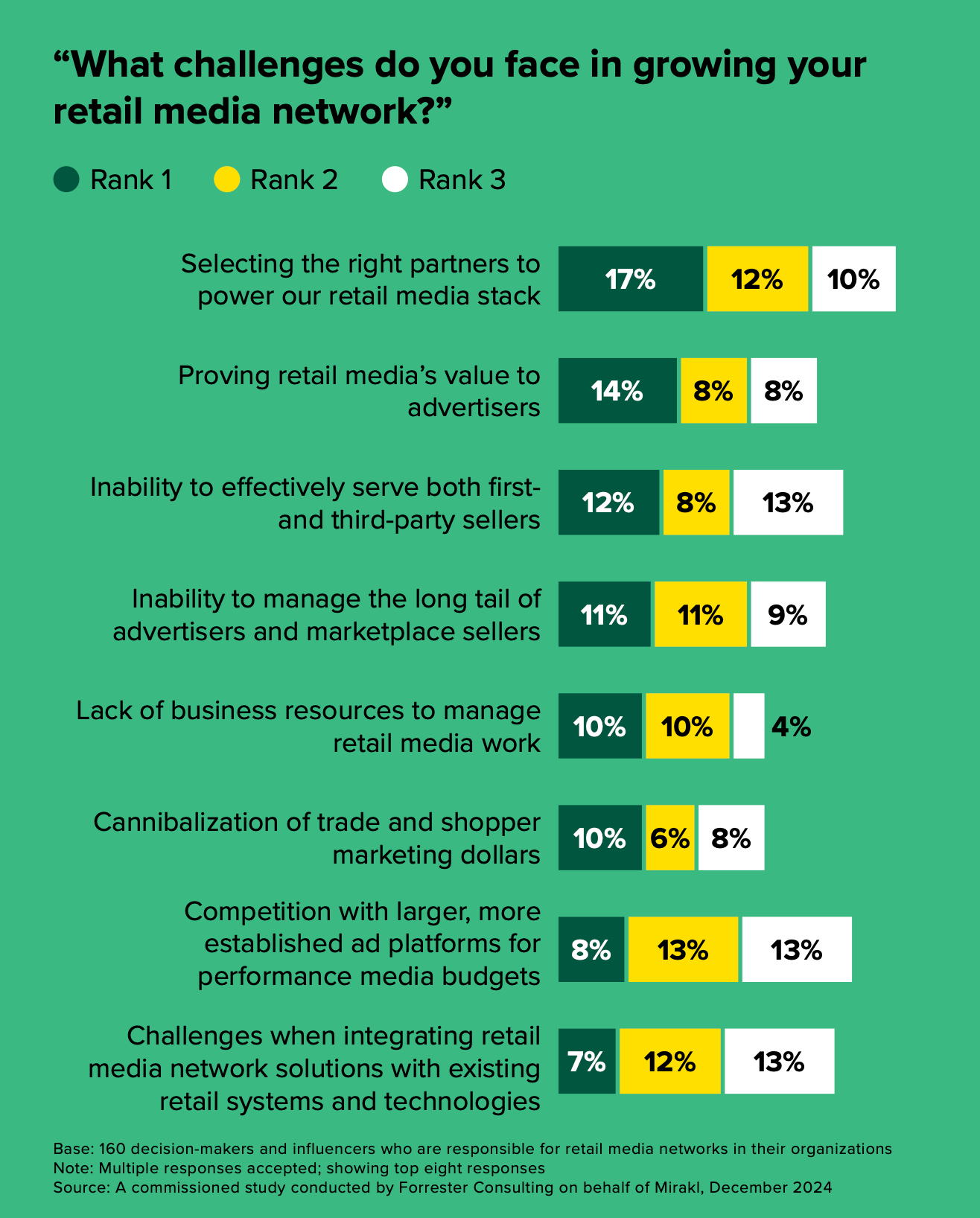

Forrester's research reveals a gap between what retailers recognize as valuable and what they're actually satisfied with.

Among their top challenges in scaling retail media: "Inability to manage the long tail of advertisers and marketplace sellers" ranked fourth, while "Inability to effectively serve both first- and third-party sellers" ranked third.

The problem is that most retail media tech stacks were built for managing 50-100 relationships with major suppliers, not 5,000 marketplace sellers. Long-tail requires frictionless self-serve onboarding, and automated campaign management.

When Smaller Is Better

Many big brands say they've hit their ceiling and won't expand to new RMN relationships.

While many RMNs pursue national brand budgets as a growth lever, as I shared yesterday, that requires a very specific and long-term sales motion. To win national brand advertising budgets, RMNs need to invest in building relationships and capabilities with advertising agencies.

But RMNs shouldn't overlook the smaller end of town as an alternate, or even complementary, growth strategy. Rethink your 'minimim viable advertiser.' With the right model and ecosystem, retailers may be able to drive future growth through quantity, but it likely requires completely different infrastructure than what most networks have built.

PS – I'll be diving into the findings of the Pentaleap H225 Sponsored Products Benchmark report with Pentaleap co-founder and CEO Andreas Reiffen on Thursday next week at 11AM ET! Join us LIVE here

PPS – Retail Media Breakfast Club is off for Thanksgiving this week! Catch you on Monday.