Is Retail Media Actually Kinda 'Mid'? PART 2

On a recent Jason + Scot Show podcast episode, Jason Goldberg argued that all the excitement around retail media fizzles once you step off Amazon’s turf: Sponsored Products Ads dominate, small 3P sellers fund most of them, and regional or specialty networks lack true incremental dollars.

I totally took the bait, and wrote up a quick response in the hopes of buying some time to procure good data and formulate a better argument.

To be clear, Jason and I are friends, so consider this 'beef' pasture-raised, not cage-fought. But his POV put words to what many people are thinking. Three weeks of community debate and three fresh data sets later, it’s time to pull the thread again.

Lens 1: Efficiency > Share of Wallet

Keen Decision Systems —a marketing-mix-modeling platform that pools multi-year spend and sales data from dozens of CPG advertisers—finds a widening gap between where dollars sit and where returns accrue.

In 2024 Amazon absorbed 64% of retail-media budgets yet posted just $0.71 in marginal ROI (mROI)—what the next incremental dollar is expected to earn. Walmart, with a modest 8% share of RMN budgets, delivered $0.90 mROI.

|

Retailer |

Share of RMN budget |

mROI (next $) |

|---|---|---|

|

Amazon |

64 % |

0.71 |

|

Walmart |

8 % |

0.90 |

|

Target |

4 % |

1.08 |

|

Kroger |

2 % |

1.63 |

Despite absorbing nearly two-thirds of spend, Amazon sits on the flattest part of its response curve: each new dollar returns only $0.71 in incremental profit.

In the long term, advertisers chase efficiency.

When I shared these initial findings, the response from industry veterans was telling. As my old boss, agency CEO Jared Belsky commented on the original post: “Media planners always ask ‘How will this dollar do versus the next available spot?’”

If you manage a finite budget, your next incremental dollar should follow the steepest response curve, not the biggest pie slice. The data suggest that curve is starting to bend away from Amazon, and smart media buyers will follow.

Lens 2 — Inventory & Advertiser Mix Are Broadening

Jason argued that most of retail media is Sponsored Product Ads, which are mainly purchased by small 3P sellers.

Its true that Sponsored Products still bankroll most RMNs, but coverage and formats are evolving. Pentaleap’s H1 2025 Sponsored Products Benchmark Report shows Home Depot, CVS and Best Buy have added brand carousels and are even dabbling in video. (Disclosure, Pentaleap is a client of mine)

To show why the new formats matter, we can look to Best Buy. After it introduced bottom-of-page brand carousels, Pentaleap found that overall Sponsored-Product coverage leapt by 19% up to 97% coverage, overtaking Walmart in one quarter. Carousels unlocked inventory the top grid couldn't reach, giving brands extra reach without crowding the prime slots.

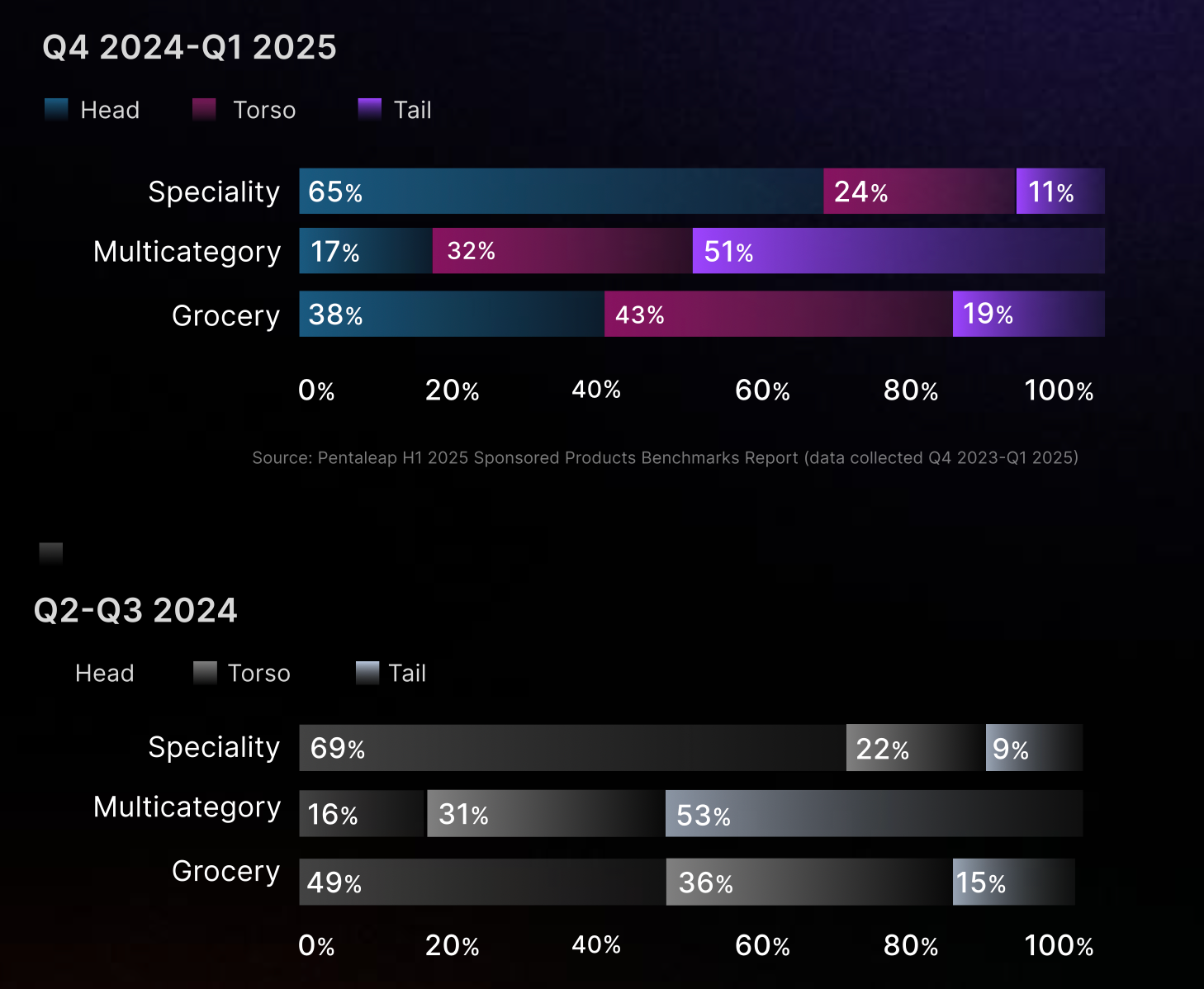

The very shape of the marketplace is widening on two fronts—what can be bought and who is buying it. Pentaleap's report shows how the makeup of advertiser base is broadening.

From 2024 to 2025, Torso and tail advertisers have expanded rapidly for grocery, more muted diversification for specialty, and consistent for multicategory (which had a very small 'head' to begin with.)

When we say “torso-plus-tail advertiser share,” we’re talking about the combined footprint of those mid- and small-sized advertisers. A jump in torso-plus-tail share means more of those mid-market and long-tail brands are buying ads, not just the handful of giants.

The discussion that followed my original piece revealed just how much innovation is happening outside of SPA ads. Alex Lawson, Chief Digital Officer at Market Media, jumped into the comments with a challenge:

“In-store video, non-endemic advertisers, off-site programmatic with first-party audiences, full-funnel campaigns, giant in-store displays— we even painted stores pink for Barbie. Jason, come down to Australia or New Zealand and we’ll show you where the real retail-media excitement is happening beyond Sponsored Products on Amazon. I’ll pick you up at the airport.”

Lens 3 — Offsite is where Amazon's media moat starts to drain

Format evolution and broader advertiser participation signal a maturing ecosystem, but the real disruption happens when retail media breaks free from retailers' own properties entirely.

eMarketer's Retail Media Forecast Update H1 2025 dropped this month, authored by rockstar analyst Sarah Marzano. Among the many gems in this report is data showing an ecosystem that's shifting beyond onsite search ads:

- Off-site retail-media spend will jump 36% in 2025, with CTV at +43%

- On-site still rules, but its share slides to 73% by 2029 .

- Crucially, Amazon’s share tumbles from 79% on-site to 69% off-site—about a $4B opening for others.

Off-site is where Amazon's media moat starts to drain.

Off-site ads run on partner channels—think streaming apps or news sites—where a handful of retailers with those deals all appear in the same arena. At that point, it’s no longer about who owns the biggest storefront; it’s about who can wield the best shopper data to hit the right person with the right message.

Ananda Chakravarty, a VP at Inmar Intelligence noted in a comment:

“We’re at the very start of retail media. Alex Holtz and I are mapping how RMNs will converge with CTV and DOOH beyond Amazon’s sphere—plus the AI-ification of programmatic retail media. CPGs, agencies, and other advertisers still need a full-funnel mix; retail media lets them reach consumers they haven’t touched before, well beyond social or Amazon search.”

In conclusion

Andrew Lipsman, Principal Analyst for Media Ads + Commerce, offered perhaps the most balanced take in the comment thread:

“I’m basically OK with Jason’s near-term assessment—call it a subtweet if you like—but we’re simply in the ‘trough of disillusionment.’ RMNs are tightening belts after the easy-growth money, yet there’s still tons of upside in the other 15 percent—on-site monetisation, in-store activations, you name it.”

Look, Amazon earned their dominance. Sponsored Product Ads built the retail media category because they work—delivering predictable, measurable results for brands of every size. It made perfect sense that 'retail media' became shorthand for 'SPA on Amazon.'

But the data shows we've hit an inflection point. Amazon's response curve is flattening while competitors are hitting their stride. New formats are scaling, advertiser bases are broadening, and off-site inventory is leveling the playing field. The question isn't whether retail media will evolve beyond Amazon—it already is. The question is which brands will be smart enough to follow the efficiency signals before their competitors catch on.

Before you go, I want to preview a couple of topics I'm working on that are related to this evolution of retail media. Make sure you're subscribed to my newsletter (or the podcast) to catch these upcoming topics!

- Retailer collaborations in the form of data co-ops, federations etc. Retailers are coming together to offer something valuable to advertisers and compete more effectively against the big guys.

- The "DSP arms race" in retail media, and how future partnerships between DSPs and retailers will open up ad inventory and make it more accessible to media buyers.