How retailers 'Do' Sponsored Product ads: 4 takeaways for brands

The follow-up to a killer benchmark report last year from Pentaleap just dropped today, comparing how major retail media networks perform across search terms, categories, and bidding models.

I'm doing a 2-parter breaking down my biggest takeaways from the report. In this post today, I'll share some of the takeaways for brands & advertisers.

And next week, I'll share some takeaways for retailers.

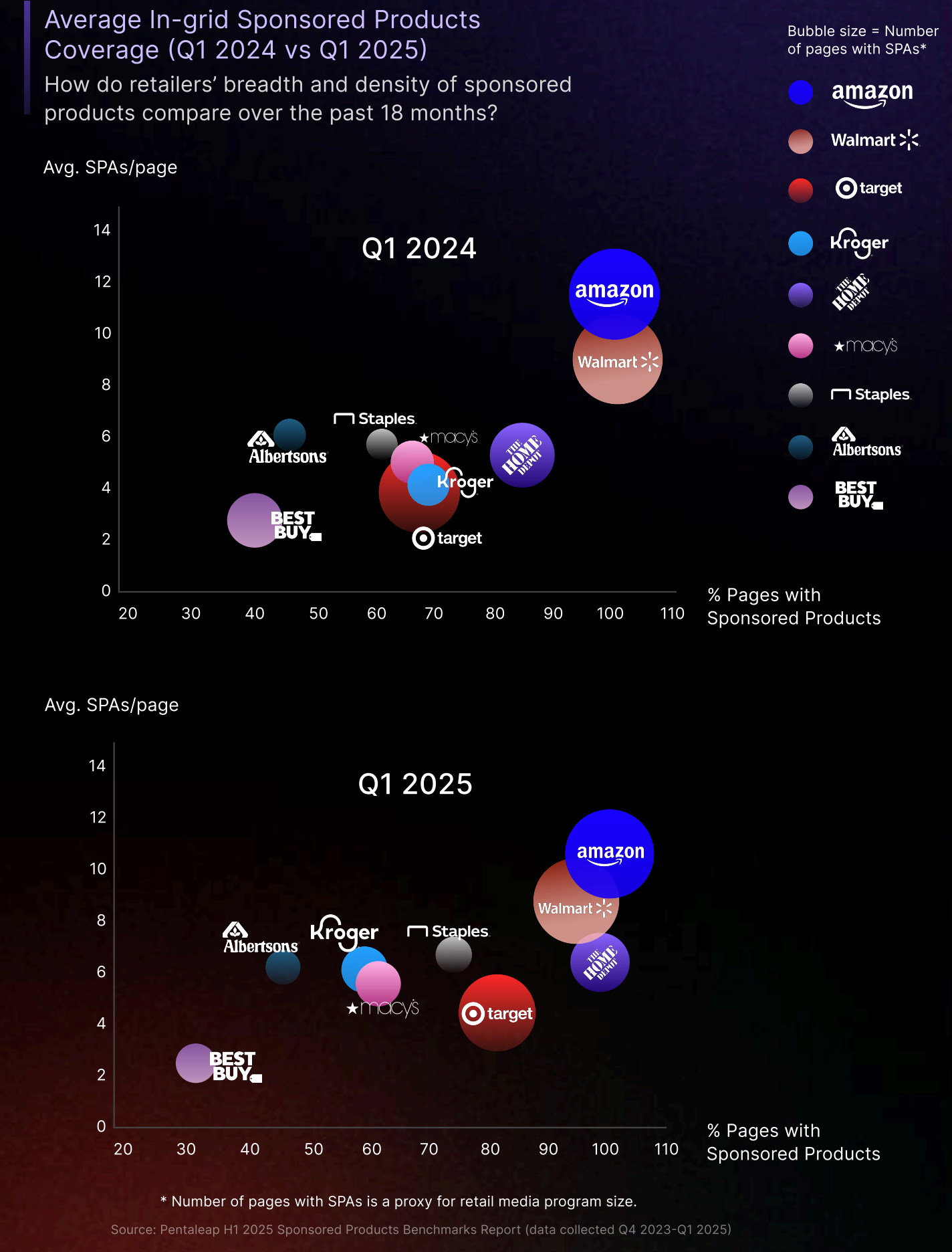

Firstly, let me cover the methodology so you can appreciate just how robust this benchmark data is. Pentaleap runs a continuous crawl of major U.S. retail media sites (Amazon, Walmart, Home Depot, Target, etc.) using tens of thousands of real shopper search terms refreshed each quarter. They identify sponsored-product badges for each search, and aggregate the data across four rolling quarters (so the current edition covers Q2 2024 to Q1 2025).

This methodology matters for three key reasons. First, it provides true independence with no reliance on self-reported retailer dashboards; everything is verified via front-end reality. Second, it offers us granularity with slot-level and word-count views that expose nuances a retailer might obscure (for instance, a platform might boast 70% overall coverage yet show zero ads on 5-word queries). Finally, it ensures consistency through the same crawler, cadence, and taxonomy across every retailer, enabling brands to make genuine apples-to-apples comparisons.

You can access the full report today here. And by way of disclosure, I need to mention that Pentaleap is a client of mine.

Let's jump in!

1: Show me where to Test and Scale

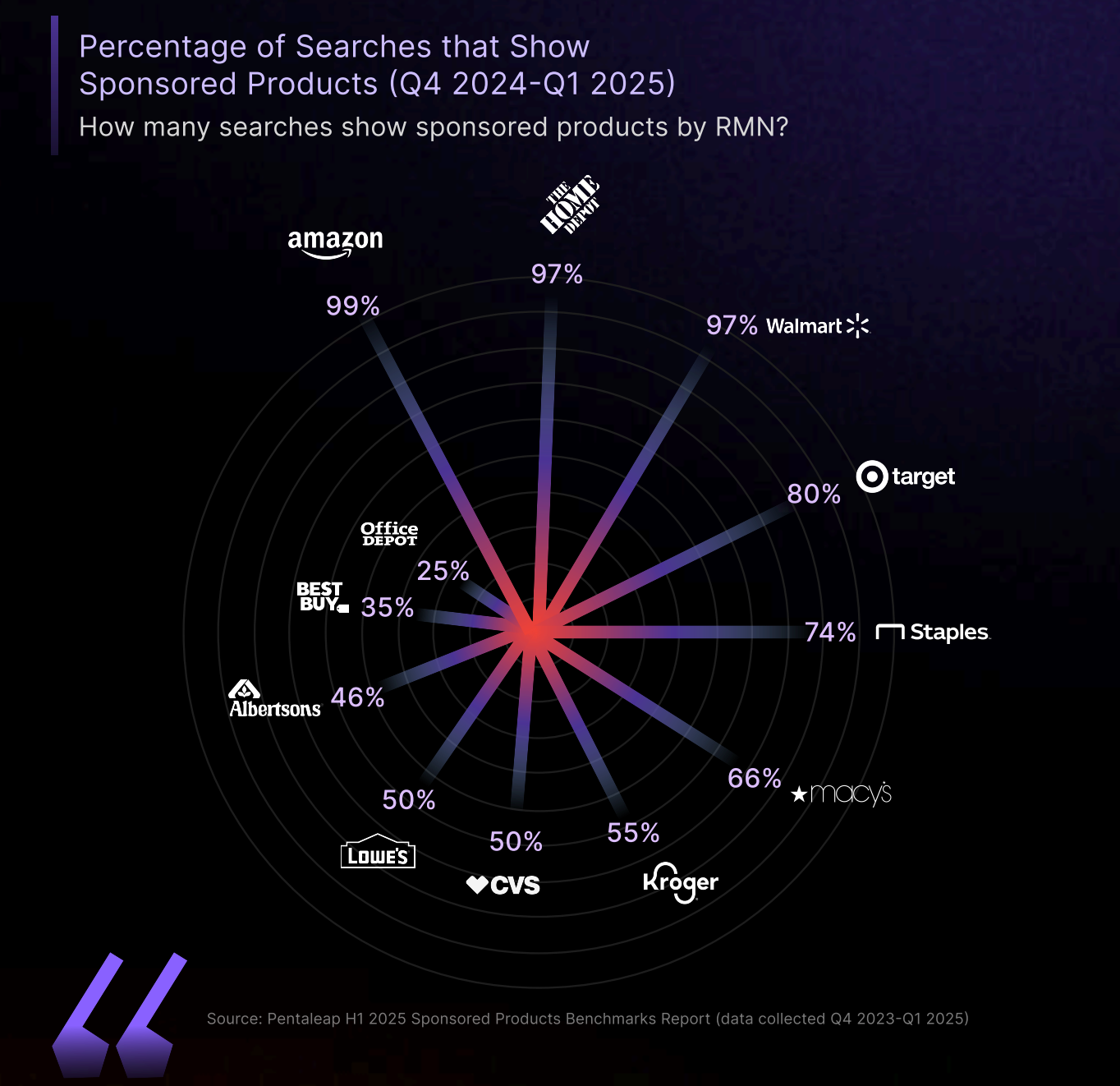

Amazon, Walmart and Home Depot have mastered the art of inserting sponsored products on virtually every query they handle - with Amazon at 99% of searches and Walmart & Home Depot at 97% of searches. This ubiquity doesn't just mean higher impression volumes - it signals these platforms have developed sophisticated relevance algorithms that keep shoppers engaged despite the high ad density.

For brands, it means that when testing new tactics—creative formats, day-parting, bidding strategies—run them first on these mature surfaces where data comes back fastest. The scale and sophistication of these platforms provide the ideal testing ground before rolling out campaigns to smaller networks.

2: Long-Tail Resilience: The New Quality Metric

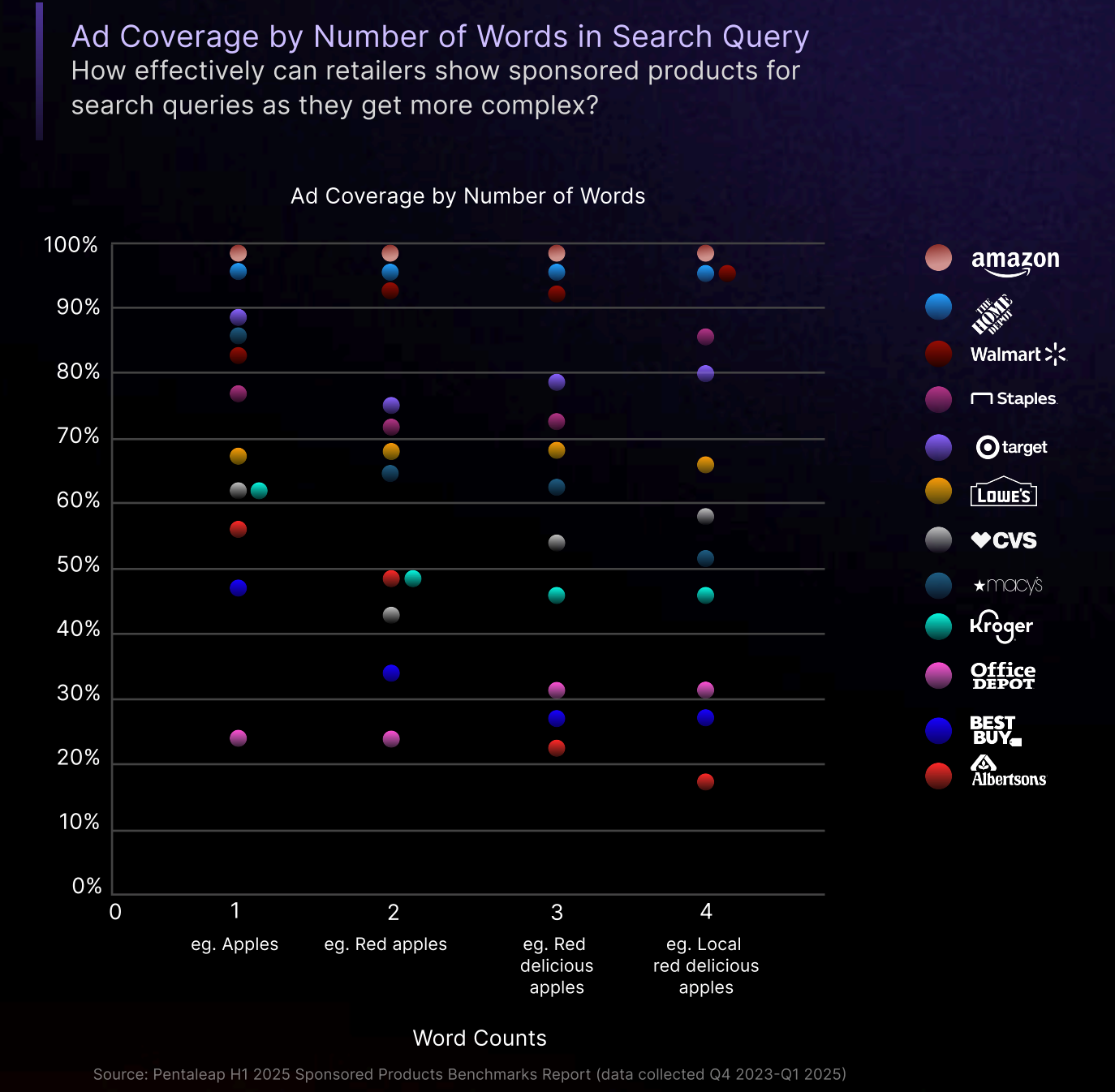

Another valuable insight from the report is how drastically retail media networks differ in their ability to serve ads on specific, multi-word searches. Pentaleap's word-count benchmark shows that Amazon, Walmart and Home Depot still return sponsored products on 5-, 6- and even 7-word search queries, whereas Office Depot's ad presence falls off dramatically once the query exceeds three or four words.

This matters tremendously because longer searches often signal higher purchase intent. In plain English: the first group can monetize the deep, highly specific searches that usually signal purchase intent; the second group can't.

As Andreas Reiffen, CEO of Pentaleap told me, "When long-tail searches don't trigger sponsored products, it's a clear sign of weak tech." For brands allocating retail media budgets, this suggests prioritizing platforms that maintain coverage across the full spectrum of search complexity.

3: Why Bidding Models (Product-First vs. Keyword-First) Matter

The report highlights a critical evolution in retail media bidding approaches:

- Keyword-first (legacy): Advertisers upload keyword lists with bids for each. The retailer shows the ad only when the typed string matches those keywords.

- Product-first (feed- or item-level; "auto" campaigns in Amazon parlance): Advertisers bid at the SKU level; the platform's AI decides which search terms map to that product in real time (similar to Google Shopping).

This distinction has major implications for campaign management. Jordan Witmer, head of retail media at agency Nectar First, notes that while product-based systems are simpler to operate, they "can result in large investments against ads [advertisers] wouldn't choose to buy." He adds that while CPCs and CPMs from product-based targeting are generally lower than keyword-based targeting, product-first "can cost more in total though as it generally comes with more page/placement types and keywords available to eat up investment."

Pentaleap's Reiffen offers a different perspective, noting that Amazon itself "started as pure keyword targeting, then moved to product-level bidding for exactly this reason: campaigns are only as good as the keywords you cover." He suggests retailers still reliant on keyword-first setups "will always leave incremental revenue on the table" because they physically can't keep up with the combinatorial explosion of search phrases.

4: Category-Specific Opportunities

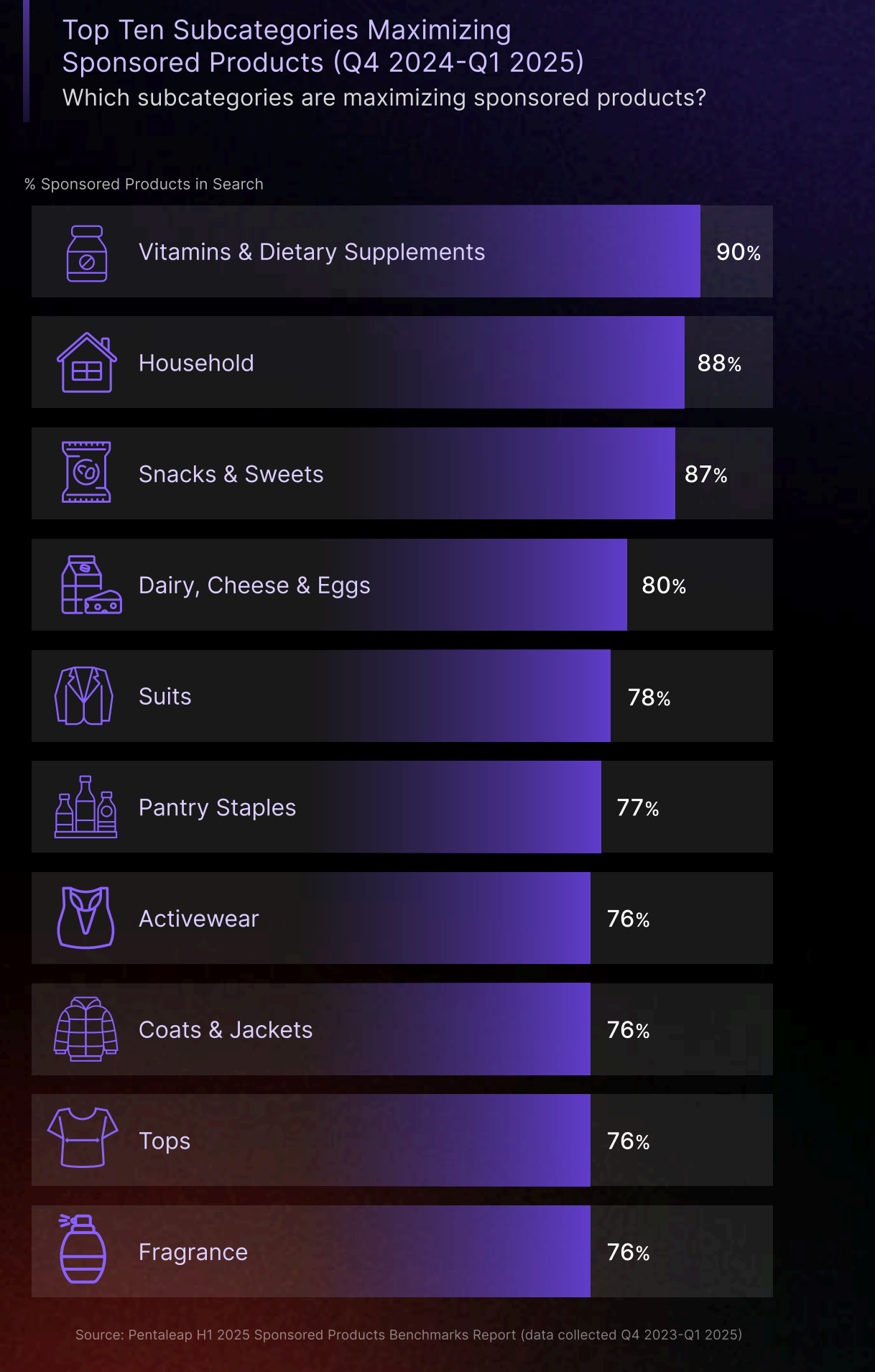

How do these trends filter down to your brand's product category? This section of the benchmark shows that ad saturation is higher everyday essentials: Vitamins & Supplements (90% of searches carry an ad), Household products (88%), Dairy (80%), and Snacks (87%). Brands in these categories face higher competition.

Conversely, opportunity exists in under-monetized categories. Even in Amazon's 99% coverage world, some sub-categories remain lightly contested: Large Appliances (61% of searches still show no ad), Fresh Produce (58%), and Nail Care (54%). For smaller or challenger brands, these segments offer cheap clicks and outsized share of voice, provided your creative and landing pages are conversion-ready.

The Bottom Line

For brands navigating retail media investments in 2025, Pentaleap's report suggests three key actions: prioritize platforms with robust long-tail coverage, understand the implications of different bidding models on your campaign structure, and look beyond category averages to identify pockets of opportunity where competition is still manageable.

As retail media continues to mature, advertisers need every edge they can get. Understanding how retailers "do" sponsored products can arm you with a better idea of where to place your next ad dollar.