How an RMN's tech stack impacts your advertising results

Advertisers have both a duty and a right to understand how RMNs are built—and how that structure impacts their performance.

Recently I've been considering switching newsletter hosting platforms. There's a whole host of considerations here, like discovery (Substack and Kit emphasize 'recommendations' from each creator, which could potentially help grow my audience), the native SEO strengths of the provider, ease of use, and the ability to run native ads in the future. These are all things that could help me, as the author of this newsletter.

But what are the factors that matter for my audience? A big one is deliverability. Does this new platform make it more or less likely for my emails to hit "spam" filters?

Any one newsletter platform seems to have strengths and weaknesses against these criteria. What's good for me, might not be the best for the audience, and vice versa.

These same complex trade-offs occur in commercial settings with much higher stakes. Consider the choices that retailers make around the technology "stack" that powers their media networks.

Once upon a time, there was just one credible option: Criteo. Criteo was the butcher, baker and candlestick maker of the RMN tech stack, it did everything a retailer needed in a plug-and-play model.

But there's been an explosion in retail media tech in recent years. Startup tech solutions zeroing in on one capability in the value chain and optimizing the hell out of it. DSPs, SSPs, Ad Servers, OMSs, and tech layers that bridge these components. Inevitably these upstarts start looking for more opportunity up and down the value chain too. They are competing with incumbents on features, but also pricing and terms.

More choice than ever before when retailers build or update their tech stacks. That's great for competition—each retailer can now craft a truly unique selling proposition for prospective advertisers. There's no reason for Retailer A's RMN to look, perform, and cost exactly the same as Retailer B's anymore.

But this also means brands and advertisers need to be educated about what they're buying. Retailer A's frankenstack may significantly underperform Retailer B's modular approach using best-in-class tools. Advertisers have both a duty and a right to understand how RMNs are built—and how that structure impacts their performance.

Why Brands Should Care About RMN Tech Stacks

Amazon and Walmart command roughly three-quarters of retail media spend with their vertically integrated platforms. When buying media on these networks, everything is seamless: Amazon is the front-end, the ad server, and the reporting system. Simple.

Brands looking to expand beyond these giants need to understand the basics of an RMN tech stack, because technology fundamentally determines campaign outcomes in several critical ways. Here are a few, non-exhaustive examples:

Ad server load time significantly impacts user experience and ad effectiveness. Shoppers get frustrated and don't click on your ads. Slower-loading ad servers increase bounce rates and reduce click-through rates and conversions.

Amazon studied this back in 2006 and found that just a 100 millisecond delay, that's just one 10th of a second. Just this delay in load time can reduce conversion rates down 1%.

How organic and paid products are loaded and sorted determines visibility and engagement.

When a retailer's organic product results and ad system are disconnected, you'll see irrelevant placements. Think of paper towels showing up when you're searching for toilet paper. You may also see traffic, but no conversions or impressions without sales and duplication. Your sponsored products appear right next to your organic product listing.

Some platforms prioritize paid placement loading before organic results, while others use optimization layers like Pentaleap (note, Pentaleap is a client of mine) to blend results for enhanced conversions. These technical decisions directly affect your CTR and CPCs.

Workflow costs. Not included in ad performance metrics is the cost to manage and report on your retail media spend. User interfaces matter – real-time reporting, dashboards, reconciled line items. In a past article for Forbes, Alex Arnott from Dentsu's Newstream Media shared with me how some RMNs still send performance reports via email to advertisers!

Home Depot's Melanie Babcock told me that their media arm had 2 separate systems for offsite and onsite advertising, and it was not a great advertiser experience. Last year they brought in tech that unified the ad-buying experience, making it possible for advertisers to manage offsite and onsite media together.

Productivity from better reporting interfaces also belongs in the media ROI conversation—even if it never shows up in the campaign dashboard.

Who's who in the zoo?

As someone who spent most of her agency-side career within the Amazon ecosystem, learning the different modules of an RMN tech stack has taken time, and I'm candidly aware of all the things I don't yet know.

The landscape is complicated by an explosion of startups solving discrete portions of the value chain, from order management systems (OMS) to Sell Side Platforms (SSPs) and ad servers, while larger players continue absorbing smaller specialists.

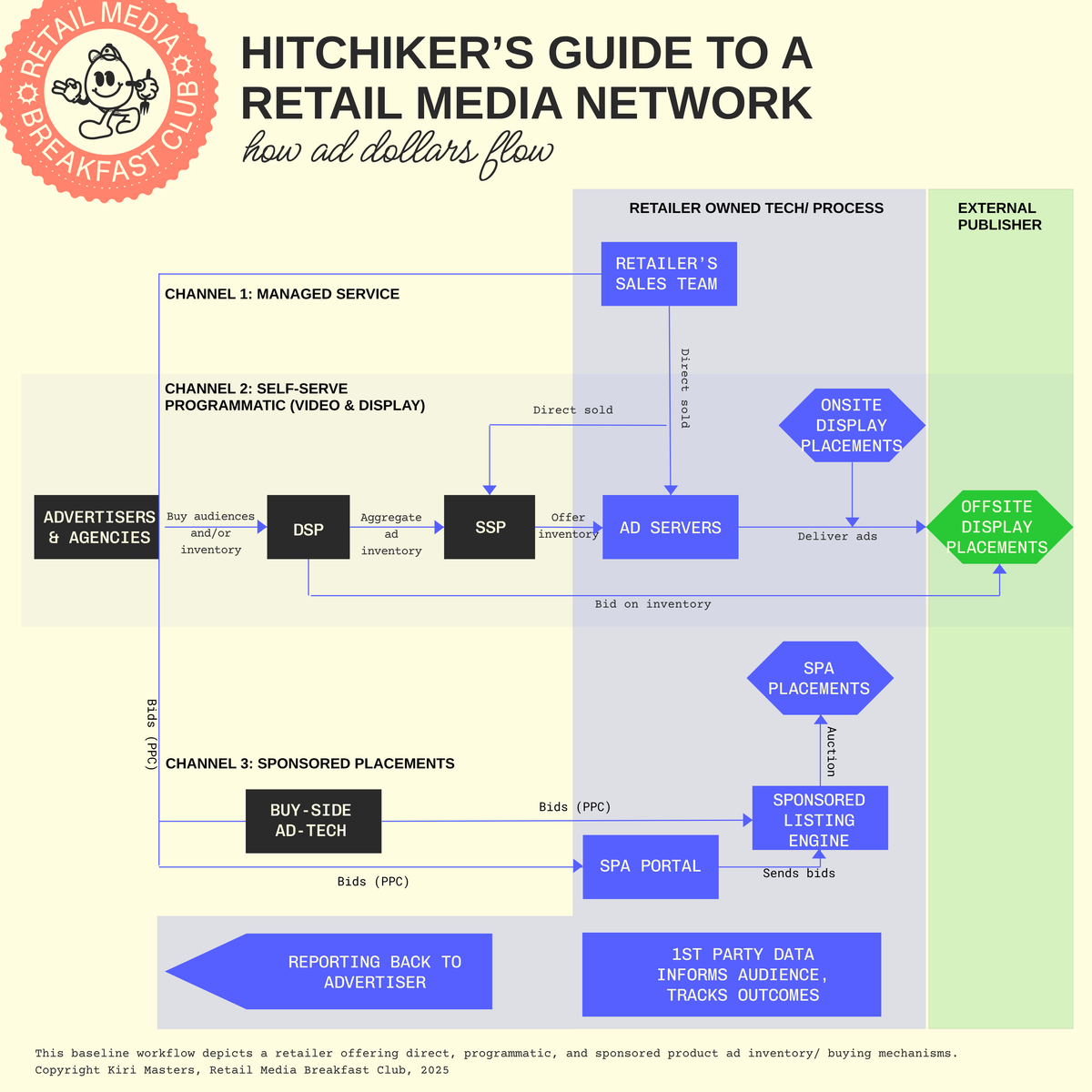

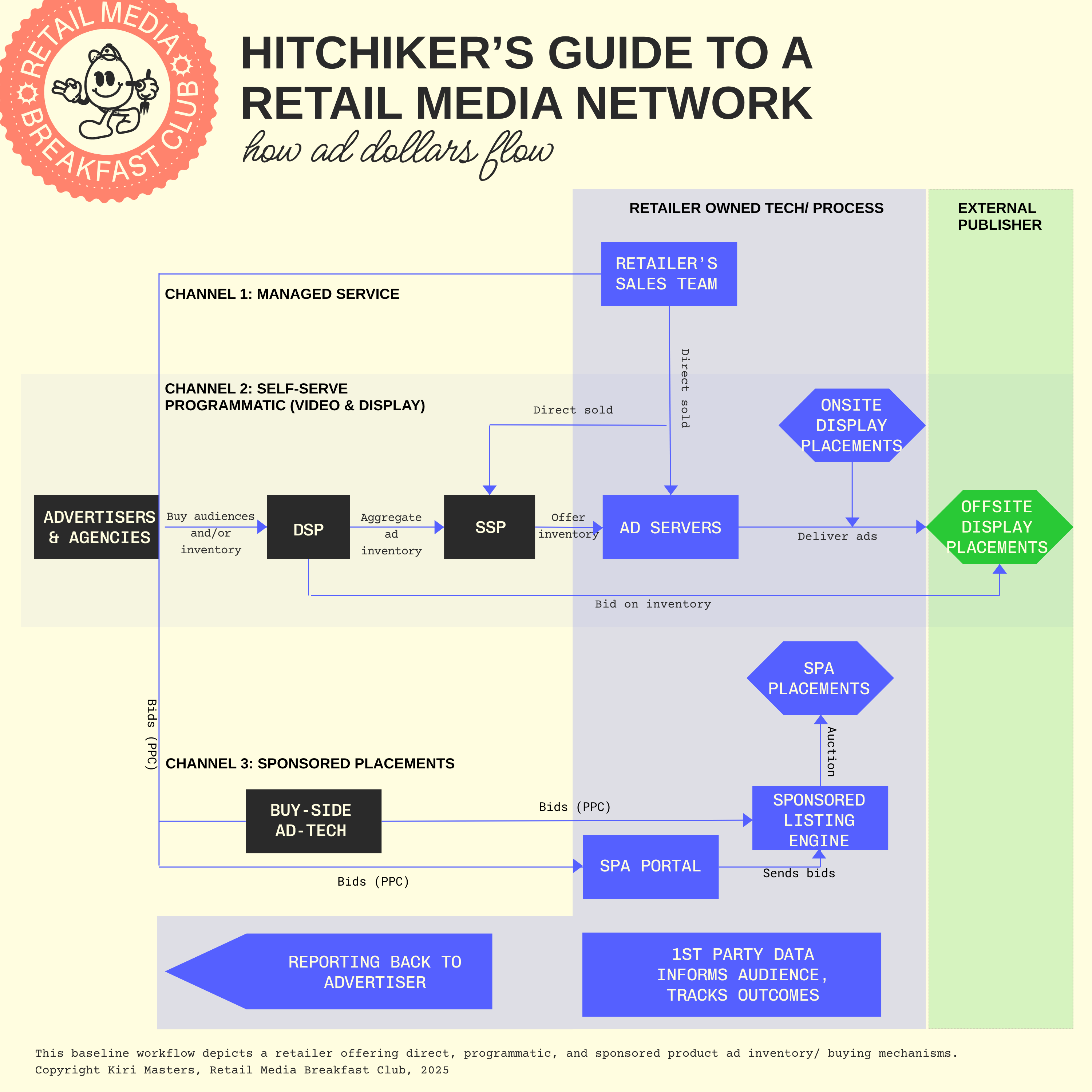

Here's my attempt at mapping out the various ways retail media can be bought, and the workflow at a high level. Additional solutions and layers exist but aren't represented here to keep it beginner-friendly.

10 Questions Media Buyers Should Ask Retailers

Each component in a retail media tech stack takes a fee or percentage of ad spend. The technical infrastructure choice directly affects your experience as an advertiser. So before committing additional budget, ask these tech-focused questions:

- What systems do you use to sell and buy ad space, and can I bring my own buying tools?

This tells you:- Whether you’ll be able to connect your preferred buying platform (e.g. DSP, agency trading desk) in the future instead of being stuck with whatever the retailer picked today.

- How much say you get in which partners are bidding for your ads (so you’re not locked into a single vendor).

- Where your ads can show up (e.g., on the retailer’s site only, or also across other sites/apps).

- Do you support true Real Time Bidding on ad calls?

This tells you:- No slow-loading pages: Shoppers don’t bounce because of lag.

- Win the best impressions: Your bids compete live for every impression, so you’re not stuck in slower, less efficient auction steps.

- How do you balance bid price vs. relevance in your ranking algorithm (and which personalization/search engine underlies it)?

This tells you:- Better ROI: If relevance counts, your ads reach people more likely to buy, not just the biggest spender.

- Smarter placements: You avoid paying top dollar for clicks that don’t convert.

- What’s your site’s load time for organic versus paid placements, and how do you mitigate any page-speed impact?

This tells you:- Happy shoppers: Faster pages keep people browsing and buying.

- Ad reliability: You know ads won’t break the user experience or hurt conversion rates.

- How do you ingest and activate our first-party segments (CDP integration) both on-site and off-site?

This tells you:- Consistent messaging: The same shoppers get personalized ads on-site, in social channels, email, etc.

- Unified performance: You can track how these audiences behave everywhere, not just in one place.

- What reporting APIs, dashboards or CSV exports do you offer—can we get real-time, placement-level performance data?

This tells you:- Quick tweaks: Spot underperformers immediately and move budget to winners.

- Full transparency: You see exact stats by product, placement, creative or audience.

- How do you measure incrementality (iROAS) and do you provide raw exposure logs or clean-room attribution?

This tells you:- Real-world lift: You know if your ads are driving extra sales, not just last-click credits.

- Data security: Your customer data stays safe and compliant with privacy rules.

- What automation and creative tools do you offer—can we upload our own dynamic ads or automate keyword-to-product mapping?

This tells you:- Less manual work: Rules or templates handle updates, freeing up your team.

- Faster creative swaps: You push new offers live without back-and-forth with the retailer’s ops team.

- What share of your inventory is reserved for managed service deals versus self-serve programmatic buys, and how do you differentiate that allocation?

This tells you:- Clear expectations: You know if prime spots are taken by big-brand contracts before you bid.

- Better budget planning: You understand floor prices and whether auctions are truly competitive.

- How open is your ecosystem to new integrations—can we plug in our BI, attribution or martech tools?

This tells you:- Keep using your stack: You can run your favorite measurement and reporting tools without manual exports.

- Future growth: As you adopt new tech, you won’t need to rebuild your campaigns from scratch.

Looking Forward

As retail media evolves beyond the big two players, technology infrastructure will increasingly determine winners and losers. Retailers who invest in superior technology stacks, offering better performance, more transparency, and advanced optimization capabilities, will attract more advertiser dollars despite the proliferation of options in the market. Brands that understand these technical nuances can make smarter investment decisions and build more effective retail media strategies.

Further reading on this topic from me:

- Retail Media Unpacked: Retailer tech stacks (WARC - gated for WARC subscribers)

- Retail media unpacked: The DSP arms race (WARC - free to read for non-WARC subscribers for 1 more day, don't miss out!)

- Why Real-Time Bidding Is Retail Media's Next Frontier (Forbes)