How Alliances Could Solve Retail Media's Fragmentation Problem (Part 1)

Just as ad networks and exchanges brought order to the fragmented display advertising market, retail media federations are emerging as the logical next step in an industry that's grappling with signficant complexity.

I've been reading Ari Paparo's excellent new book "Yield: How Google Bought, Built, and Bullied Its Way to Advertising Dominance," and it's hitting me like a ton of bricks. As someone who came to advertising from the ecommerce world, the parallels between today's retail media chaos and the mid-2000s digital advertising landscape are eerie.

Back then, hundreds of individual websites sold ads directly. Media buyers had to negotiate with each publisher separately, manage countless insertion orders, and somehow stitch together campaign performance across incompatible reporting systems. Sound familiar? Today's retail media landscape is living through its own version of this nightmare, except now we're dealing with hundreds of retail media networks instead of publisher websites.

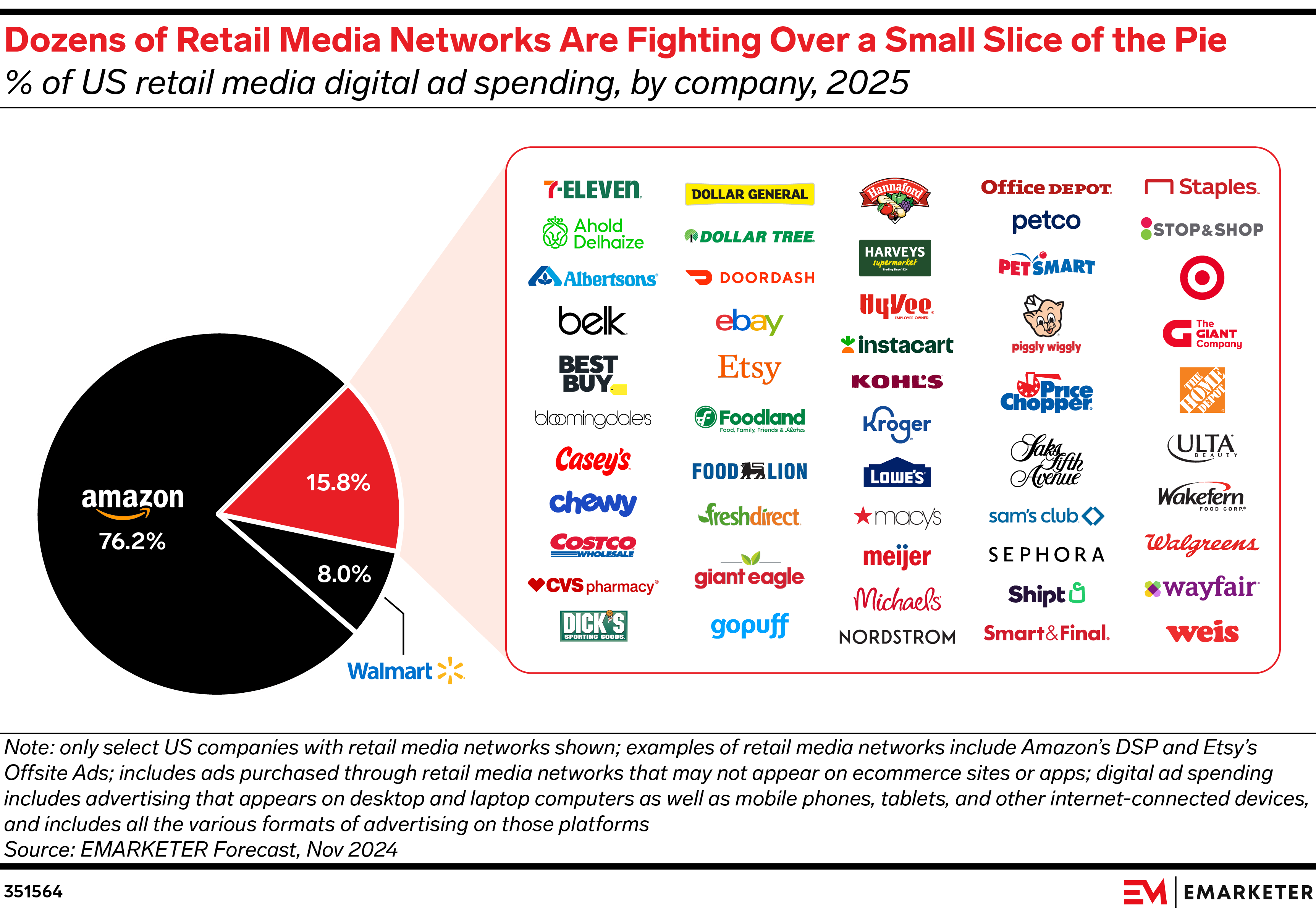

Yet distribution among RMNs is top-heavy, to say the least. According to EMARKETER, Amazon commands 75% of US retail media spend. Walmart takes another 7%. That leaves just 16% for the "long tail" of everyone else—split among what industry estimates suggest could be 600 retail media networks globally.

Should we be shocked when our industry is then described as 'mid'?

Promising The World

Let's be honest about how we got here. Management consultants swept through retail boardrooms promising a profit oasis in a desert of razor-thin margins. "Launch a retail media network," they said. "It's pure profit," they said. "Brands will line up to spend," they said.

The rationale made sense. Amazon first started breaking out eye-popping financials for its advertising business in 2021. The pie is surely large enough for more. What the consultants didn't mention was the catch-22 awaiting these retailers. You can't attract significant ad revenue without major investments in technology, sales teams, and measurement capabilities. But you can't justify those investments without the revenue. Welcome to 'the doom loop' of retail media.

Meanwhile, brands – the end users of these networks – are drowning in complexity. The ANA's July 2024 report spelled out their biggest retail media headaches: 57% cite lack of standardization across platforms as their top challenge. Another 44% point to the walled-garden problem—each network operates as its own isolated kingdom with its own login, metrics, and reporting standards.

Various studies show that brands are only meaningfully investing in 5-7 retail media networks before the operational burden becomes crushing. Supporting the #27 retailer's media network requires the same planning, buying, and reporting work as the #7, but for a fraction of the reach. The ROI math stops working fast.

Acosta Group’s retailer intimacy is legendary—merchants answer their calls. You're not going to find that access at the same scale with any other partner out there. That expertise with both retailers and shoppers fuels its Connected Commerce team, which offers digital shelf, retail media, and data analytics all under one roof. Tap into 100 years of retailer relationships and award-winning digital commerce capabilities.

Are Retail Media Federations A Possible Solution?

This is where history starts to rhyme. Just as ad networks and exchanges brought order to the fragmented display advertising market, retail media federations are emerging as the logical next step.

Take Rippl, launched by Cardlytics/Bridg. They've assembled what they call "the leading national consortium of regional grocers and convenience stores"—Wegmans, Giant Eagle, Schnucks, Lowes Foods, Food City, Associated Food Stores and more. Together, they're aggregating 140+ million shopper profiles across 58,000 locations. Suddenly, these regional players can offer national scale to advertisers through a single platform.

By pooling their audiences and standardizing their offerings, smaller retailers can compete for budgets that would otherwise flow exclusively to Amazon and Walmart. For brands, it means accessing diverse retail audiences without the operational nightmare of managing dozens of separate campaigns.

I've been told of other alliances in formation that haven't yet been publicized. The momentum is building, and it should be. The current model—where every retailer operates their own isolated platform—is unsustainable. Brands don't have infinite bandwidth. Retailers can't all build Amazon-level ad tech. Something has to give.

The Path Forward

The retail media industry is more dynamic than ever, but there are some cold truths to face. We can continue down the current path, where Amazon and Walmart hoover up ever-larger shares of spending while hundreds of smaller networks fight over scraps. Or we can recognize what history has already taught us: fragmented markets naturally consolidate through cooperation.

But here's the thing—building these alliances isn't as simple as shaking hands and sharing data. In future posts, I'll peel back the layers of what it really takes to make federation work.

In Part 2, we'll get into the mechanics: How does a retailer in Chicago share audience data with one in Miami without giving away competitive secrets? What happens when six grocers need to split advertising revenue from a campaign that ran across all their stores? We'll examine real federations like Rippl to understand the tech infrastructure, governance models, and awkward compromises that make or break these partnerships.

Part 3 takes us to the history books. From the catalog cooperatives of the 1990s to failed mobile carrier alliances, from HookLogic's early success to publisher consortiums battling Google—I'll dive into advertising history for lessons. Spoiler: the successes and failures follow predictable patterns that today's retailers would be wise to study.

Finally, Part 4 looks ahead to the wild cards. What happens when Microsoft's Copilot or Google's AI agents start doing the shopping for consumers? How will Amazon respond if federations actually start working? We'll explore why AI might actually accelerate the need for alliances.

There's an old saying: 'If you want to go fast, go alone. If you want to go far, go together.' Amazon went fast and got there first. For everyone else, going far might mean going together.