Growth Beyond Amazon: Retail Media's Broader Opportunities

It takes effort to expand to additional retail media networks, but the payoff can be disproportionately high.

This is part two of a three-part series on effectively engaging retail media networks beyond the "big two." This series is sponsored by Connected Commerce at Acosta Group.

The average U.S. household shops across 39 unique retailers per year.

Yet most brands concentrate their retail media investments in just two or three networks, essentially going dark wherever a majority of shopping missions are actually occurring.

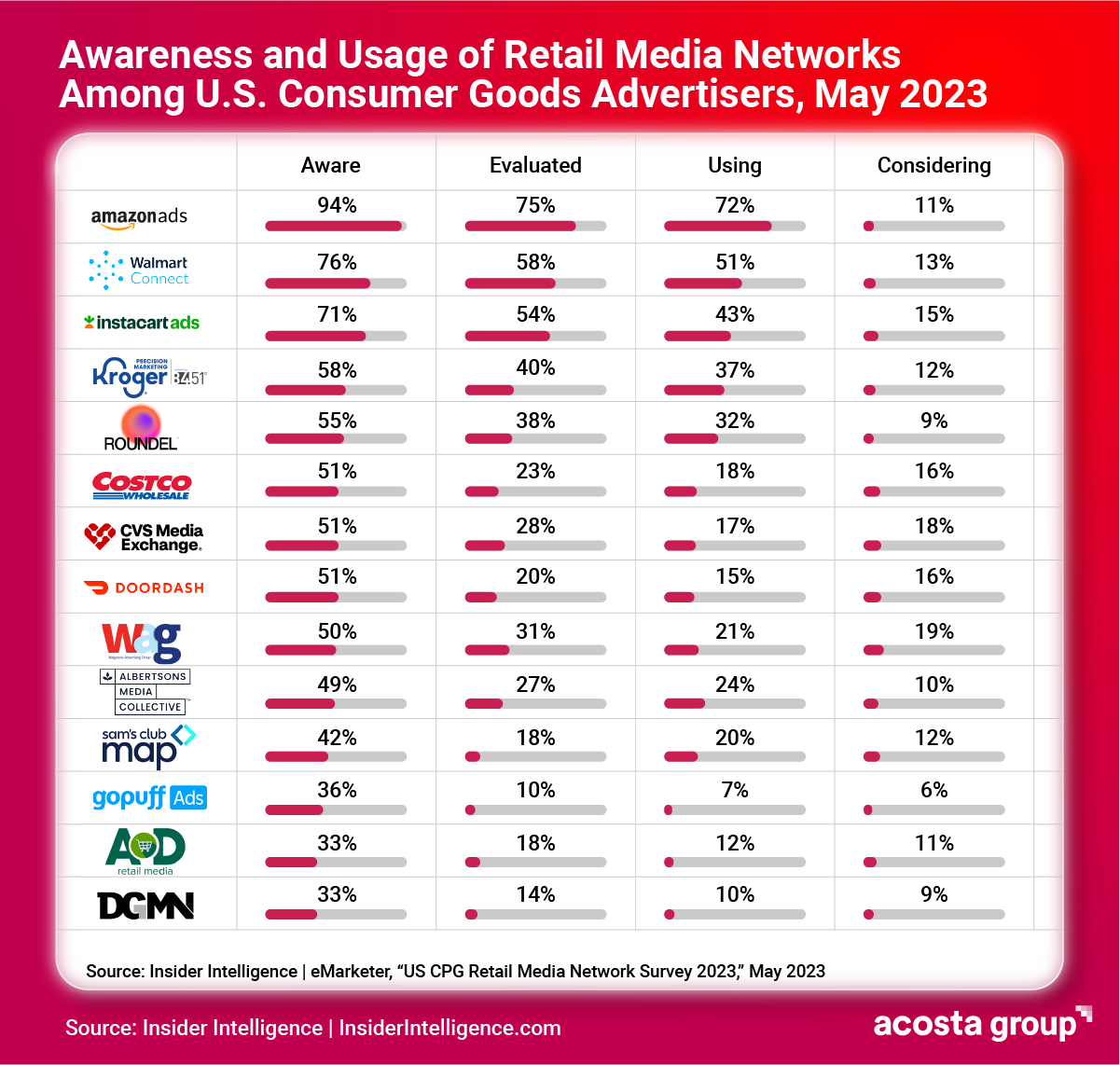

Let's address the elephant in the room. Amazon dwarfs every other retail media network, controlling more than 70% of all retail media spend. In my opinion, Amazon deserves this dominance in many ways. They invested early and heavily, continue to lead with innovation, and made all their media buying programmatic from the very beginning. The planning, buying, and reporting is transparent and immediate.

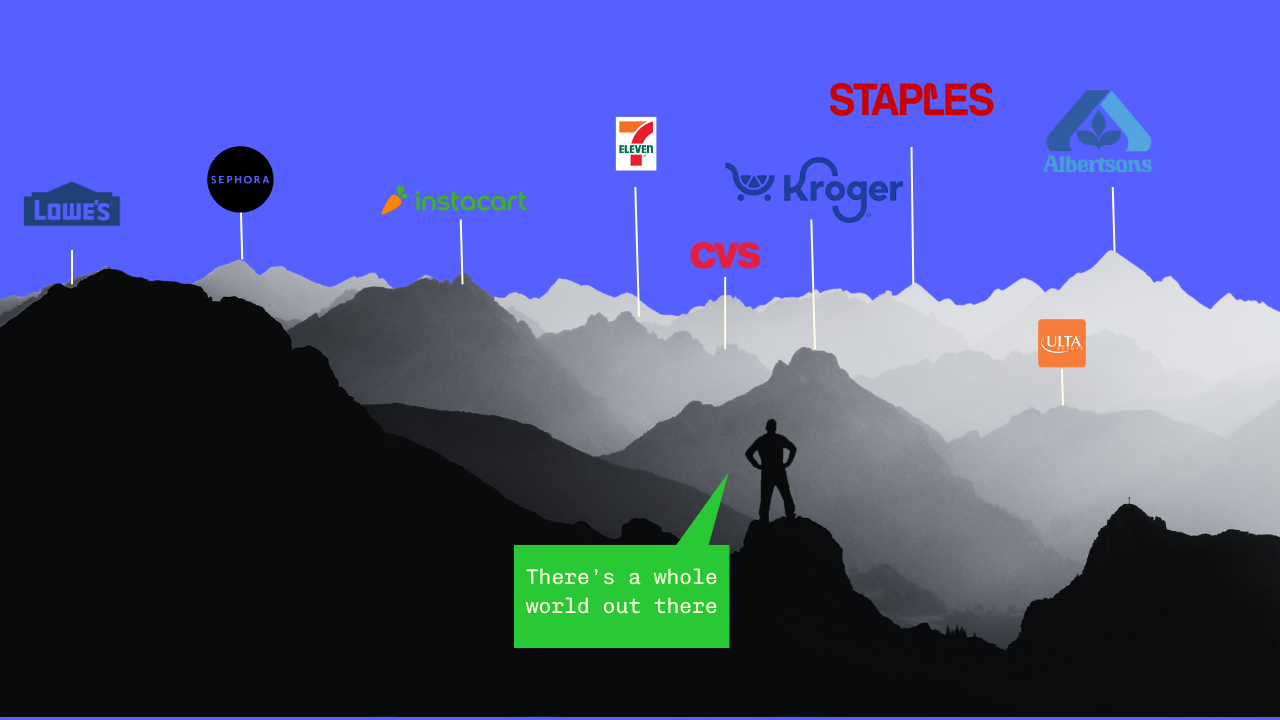

But there's a whole world of retailers out there that brands can and should be tapping into. Last week, in Brands Are From Mars, Retailers Are From Venus, I explored how brands need to understand internal retailer dynamics—the complex interplay between merchants, retail media teams, and trade marketing organizations. This week, I'm back with Cody Tusberg, EVP of Connected Commerce at Acosta Group, to dig into allocation strategies across retail media's expanding universe.

Double Down On Profitable Channels

"Shoppers don't live in a single ecosystem," Cody tells me, pointing to data showing households spreading their purchases across six to eight retailers monthly. "If you're only investing in the top two or three, you're actually missing where your shoppers are spending."

But here's the thing: some of these other retailers may offer better wholesale margins to a brand. "These growing channels can be more profitable overall, and retail media is actually a lever that brands can use to accelerate that growth," Cody explains.

This creates a strategic opportunity. Rather than just chasing volume through Amazon's massive funnel, brands can use retail media to deliberately grow their most profitable retail relationships.

Beyond Volume Metrics

We know that brands typically work with only five or six retail media networks. Once Amazon and Walmart are locked in on the media side, how should brands evaluate which additional retailers deserve investment?

"You have to first look at the overall relationship and how that retailer fits into your overall growth plan," Cody says. That means looking several years out in your brand’s strategic growth plan and using that to decide where to spend the money now.

These reasons can extend far beyond simple reach metrics. Customers shop at various retailers for distinct reasons. “You can find retailers that you can invest in that might be the best place to launch a new product,” Cody says. “You might find that you're going to have a lower cost of acquisition. You might find that your retail media investment is actually more incremental at another retailer outside of maybe the big three or four."

This is where retail media can become truly strategic rather than just tactical. Instead of treating all impressions as equivalent, smart brands are using these investments to accomplish specific business objectives that align with their broader retail strategy.

The Operational Reality Check

But there's a reason most brands stop at five or six networks: operational complexity scales brutally. "When you start to stack these things together, it requires more horsepower, more people, or more tools and technology," Cody says.

This is where many brands hit a wall. Extending to retailer number eleven feels like almost as much effort as working with one of their larger partners, but without the scale benefits.

Cody explains that these unique demands shaped how Acosta Group’s Connected Commerce capability was built out.

"One of the reasons we built our organization the way we did is because we can scale very effectively across those different ecosystems, whether that's simply through knowledge and understanding exactly how those retailers operate, or whether it's the investment we can make at scale in technology solutions that drive a more efficient outcome while maintaining better results," he says.

The Measurement Challenge Gets Real

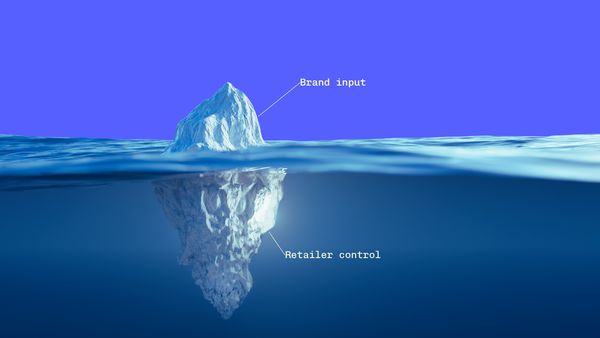

Amazon's closed-loop attribution spoils marketers. Other retailers aren’t currently matching that level of self-serve measurement sophistication.

"The data is not only not as clean, it's fragmented. It's differentiated," Cody says. "Things like attribution windows are generally going to be different. The industry is doing its best to work toward some level of standardization, but you also have to realize that what success looks like at one retailer may be different than what success looks like at a different retailer."

This forces a more fundamental approach to measurement. While the media metrics in front of you should be considered, brands should also be measuring actual sales outcomes. Did we sell more stuff? Did we sell more stuff than we did last month or last year?. Or the retail media buzzword of 2025: was the investment actually incremental?

When working with less sophisticated retail media networks, Cody says you need to work either internally or with a partner that understands ‘good, old-fashioned’ marketing and measurement, and the fact that the ultimate objective is to move more shipments, to move more PO’s, and to put more product on the floor.

Making JBPs Work with Media Reality

The annual Joint Business Planning cycle creates another layer of complexity. Merchants work on yearly planning cycles, but retail media's biggest advantage is real-time optimization based on performance data.

The tension shows up when brands want to reallocate dollars midyear based on what's actually working, but merchant agreements assume spending patterns were set during JBP season.

The solution that Cody's team employs to handle this scenario is pragmatic: hybrid models where 70% of spend is locked in with 30% reserved for agile optimization. “The break isn't perfect for every brand, but the key is communication, making sure you have flexibility built into your agreements, and making sure you build trust with everybody involved."

But there's an opportunity here too. Cody says his team has seen brands unlock secondary displays or better feature placement by bringing retail media into the trade conversation. "It's about understanding what success looks like internally for that retailer team you're working with and creating a win-win situation."

Why Retailer Intimacy Trumps Technology

This brings us to Acosta Group's century-long heritage in trade marketing and how that translates to retail media advantage. While many retail media agencies focus on campaign optimization and creative development, understanding retailer organizational dynamics requires different expertise entirely.

"We often say that we understand these retailers from boardroom to backroom, and that's absolutely true," Cody tells me. That intimacy—knowing which merchants have real influence, how internal teams coordinate, where decision-making bottlenecks exist—often matters more than having the latest programmatic buying technology.

For brands stretched thin across multiple retail relationships, this institutional knowledge becomes invaluable. As Cody puts it: Retailer intimacy is key.

The Allocation Strategy That Actually Works

Understanding retailer politics is just the foundation. Once you've cracked the organizational code, the bigger question becomes strategic allocation across an expanding universe of networks.

The brands that master these internal dynamics find retail media becomes a strategic advantage rather than just another place to spend money. But as we'll explore in the final part of this series, executing across multiple retailer stacks brings its own operational challenges—from measurement complexity to team structures that actually scale.

Next week, we'll tackle the practical reality of managing multi-retailer retail media operations: how to optimize, measure, and prove ROI when you're working across platforms with different capabilities, different attribution models, and different definitions of success.

This series is sponsored by Connected Commerce at Acosta Group, learn more here.