DSPs Wanted: The Retail Media Revolution 96% of Advertisers Crave

Until 1914, any vessel moving between the Atlantic and Pacific had to brave the 13,000-kilometre journey around Cape Horn. The Panama Canal completely rewired world trade by letting ships cut straight through a tightly governed corridor—with Panama collecting the tolls.

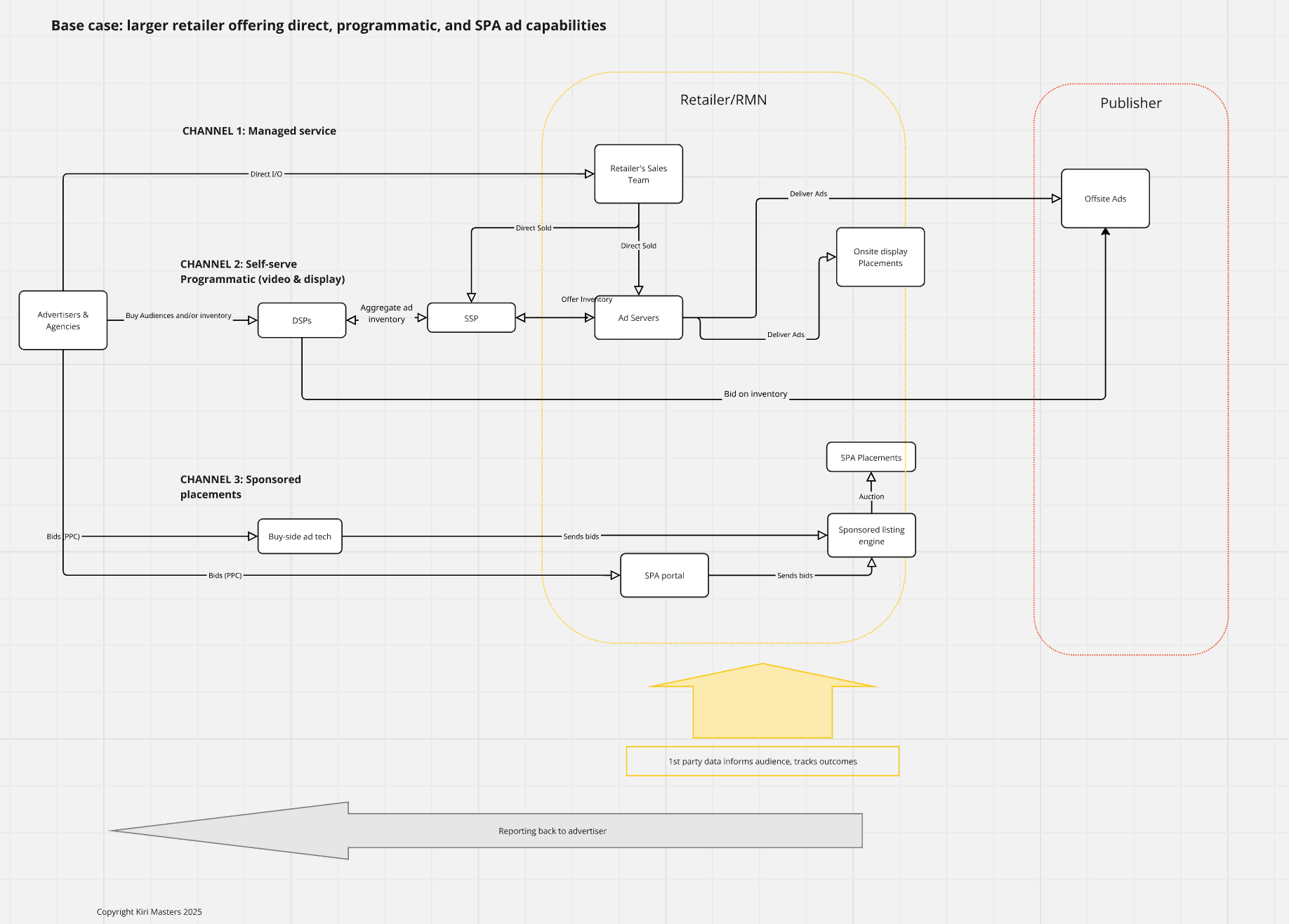

Today, retailers sit on a trove of first-party data and on-site ad inventory, yet much of advertisers' budget still takes the long way around. Koddi's new "State of Programmatic Retail Media" report makes the case that opening programmatic "locks" to advertiser demand by way of DSPs can replicate the Panama Canal's breakthrough: unleashing faster, larger flows of retail media ad dollars while retailers remain the gatekeepers.

Here are my takeaways from the report.

Fragmentation and manual work-arounds are the #1 brake on retail media growth

Much of today's retail media dollars (77%) are spent on Amazon, with Walmart scooping up 7% and the remaining 16% spent on dozens of other retailers' ad networks. (EMARKETER)

Koddi's point is that many adverisers and brands would like to allocate more budget to this 'long tail' of retailers if only it were easier to do so. Dare I say it, if only buying media on other retailers was more like... Amazon?

So what's standing in the way? There are many roadblocks. But one that Koddi calls out specifically, and one that the industry does indeed seem to be working toward, is DSP access.

More DSP integrations would 'unblock the canal'

For many advertisers, the current landscape feels prohibitively complex. Despite retail media's effectiveness (81% agree it's an effective medium), 61% of respondents admitted that "buying retail media can be painful, but as it performs well, brands' spend on it will continue to grow."

96 % of buyers say they “will certainly or will consider buying on-site media via a DSP,” and 93 % would shift non-retail budgets into retail media if they could do so programmatically.

The most compelling advantages of buying through a DSP, according to the study, center around operational efficiency and cost savings:

- 67% cited "more cost-efficient buying" as the top advantage

- 51% valued "eliminating manual tasks/saving on resources"

- 47% highlighted "more effective/precision targeting"

But Retailers Are Concerned About Commoditization

Why are retailers reluctant to integrate into DSPs, if there's so much to gain?

The report subtly points out a concern that retailers have: that opening up their network to more demand will commoditize their key value-prop of proprietary first party data. Why would advertisers commit to spending with a specific retailer when they could access a whole basket of retailer-driven ad inventory through a DSP?

Retailers may also fear the prices they painstakingly negotiated for managed-service campaigns will collapse once on-site inventory sits in the same DSP as other performance advertising offerings.

The reality is that retailer can syndicate inventory through a DSP without it becoming an open-auction free-for-all. "retailers can retain their competitive edge by placing guardrails around data, preserving exclusive ad formats, and offering curated deals tailored to their audiences," Koddi says.

Koddi says that with the right supply-side tech retailers have the capabilities to protect and enhance their network and customer experiences, both direct and through a DSP. In other words, the right sell-side stack (ostensibly, theirs) can mediate DSP demand safely.

What else is holding us back

I wrote last month in a post for Forbes “Why Real-Time Bidding Is Retail Media’s Next Frontier” that 70-plus RMNs in the US alone cannot keep growing thier retail media revenue through one-off, manual dashboards. Real Time Bidding, the technology that powers programmatic advertising and CTV, is required for a true advertising matchmaking scenario where buyers and retailers can exchange bids and ad inventory both on-site and off-site in real time, creating a better customer experience and still allowing the control that retailers want over who and what can be advertised on their sites.

I also think about what happens when retailers chase budget without smoothing access. Last month, Walmart asked advertisers to bump their existing ad spend by 25%, apropos of no performance improvement. Here's the simple truth of what actually unlocks ad budgets: better outcomes, legibility, and ease of use.

Where to next

Asking retailers to integrate with DSPs is not a silver bullet, to be sure. While opening up on-site inventory to demand-side platforms will ease buying friction, it still won't solve the even stickier issue of apples-to-apples measurement. Brands still face a patchwork of methodologies and limited cross-retailer comparability, which industry groups are trying to codify.

The need for progress in other areas aside, I do agree that DSP integations by retailers will be a net benefit to all. Like the Panama Canal, which revolutionized global trade while still keeping control firmly in place, programmatic access to retail media can potentially transform digital advertising flows. For retailers who embrace this approach, the reward could be substantial: unlocking new revenue streams while maintaining their position as indispensable gateways to highly valuable consumer audiences.

The alternative—forcing advertisers to navigate each retail media network separately—increasingly looks like asking them to sail around Cape Horn, when a more direct route is clearly possible.