Commerce GPTs Explained—And Why Retail Media Professionals Need to Pay Attention

Shoppers are starting to get comfortable with AI shopping assistants. Amazon Rufus was reported to have 250 million customers using it in 2025 according to Amazon’s Q3 earnings call. And shoppers using Rufus are 60% more likely to complete a purchase.

That shows that these chat-based AI tools are helpful—but they represent just one slice of a much bigger transformation happening in commerce.

Today, I want to introduce you to a concept that's been buzzing in commerce tech circles: Commerce GPTs. And if you're in retail media—whether you're selling it or buying it—why this matters.

For more on this topic, check out Brian Walker and Bill Friend's "Surf's Up" essay on the Cocktails & Commerce Substack, which was the first to coin the term Commerce GPT.

What Is a Commerce GPT?

Commerce GPTs work across multiple retailers—acting as autonomous agents that can research products, surface recommendations, and enable purchases across the open commerce ecosystem, not just within a single retailer.

Compared to traditional on-site search which relies on keywords to retrieve relevant products, Commerce GPTs are built on large language models trained not only on retailer data, but also on vast synthetic simulations of real-world shopping scenarios. This lets them grasp complex intent and deliver conversational shopping experiences that resemble the natural dialogue we're becoming used to through answer engines like ChatGPT.

John Andrews, cofounder and CEO of Cimulate, a Commerce GPT platform provider, described it on the Cocktails & Commerce podcast as needing to do two things: "Understanding customer behavior—that sequence model, that customer journey—to know the right next best thing to put in front of someone. And second, a model that understands effectively everything the internet knows about a product or market area."

A practical example: West Marine, the boating and fishing retailer with 90,000+ SKUs, implemented a Commerce GPT with Cimulate. Instead of relying on keyword search, their Commerce GPT uses synthetic data to simulate millions of customer shopping journeys. It learns what real buyers care about when searching for specific marine equipment.

When a shopper asks "What pump is best for deep hulls?" or "Which rod is good for saltwater night fishing?", the Commerce GPT grasps the context and intent—not just the keywords—and can answer with expert recommendations, product comparisons, or relevant guides. It also connects this product and user knowledge to their catalog, inventory and reviews.

Did you know leading retailer media networks drive 85% of their ads revenue through mid- and long-tail advertisers?

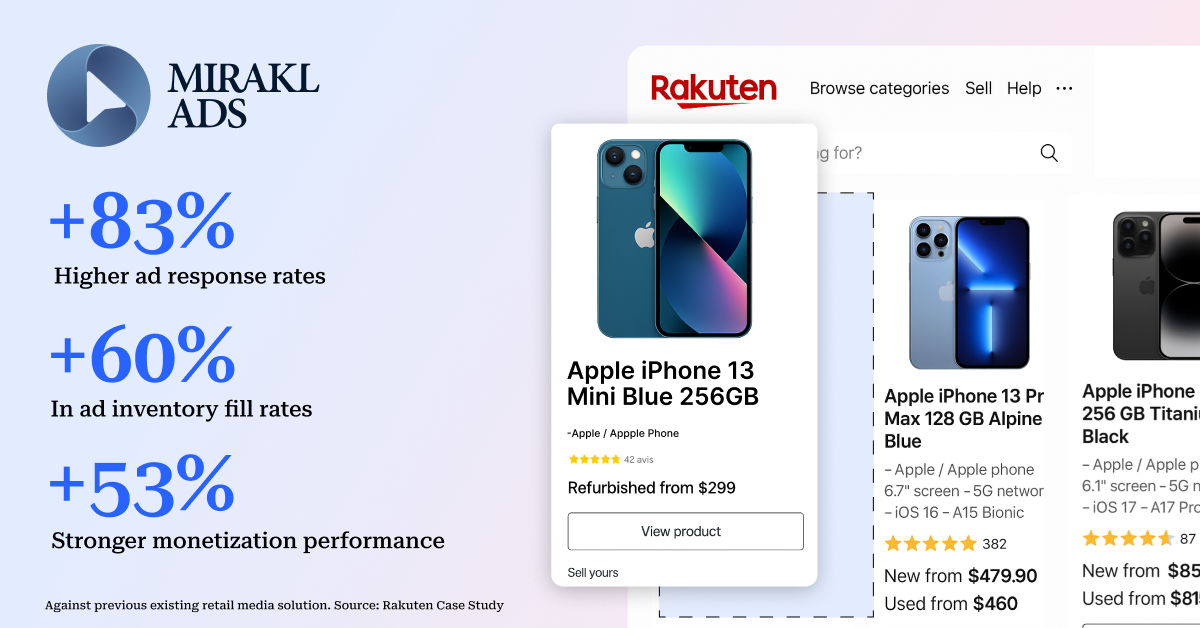

Mirakl Ads provides full funnel ad formats tailored to both 1P and 3P advertisers, leveraging unique AI-capabilities that provide unprecedented levels of relevance and engagement.

Retailers who want to capture ad spend from the long tail of 3P marketplace sellers use Mirakl Ads in their tech stack.

So where does this "live"? Commerce GPTs are cloud-based AI platforms—not tied to any one retailer's website. They're can be accessed via APIs, embedded widgets, or chat interfaces.

A shopper could conceivably access the West Marine Commerce GPT:

- Directly on the West Marine website, where the Commerce GPT is embedded and connected to West Marine's product catalog, inventory, and data.

- On other retailer websites where West Marine is a supplier, if those retailers have implemented Commerce GPT or similar AI-powered shopping assistants that access West Marine's product data.

- Via external answer engines like ChatGPT, Perplexity, or other conversational AI tools, IF those engines are connected to West Marine's catalog or have access to cross-retailer commerce GPT networks via APIs or integrations.

Comparing Commerce GPT to other AI-enabled shopping modalities

To fully grok Commerce GPTs myself, I had to compare them to our current swag of AI-enabled shopping tools:

- Retailer Chatbots (Rufus, Sparky) are powerful but work exclusively within one retailer's ecosystem, drawing on that retailer's catalog, reviews, and transaction history to guide shoppers.

- Commerce GPTs span multiple storefronts—acting as autonomous agents that can research products and surface recommendations across the open commerce ecosystem. They're tuned for the consumer's intent, not just one retailer's catalog.

- Agentic Commerce (like OpenAI's Instant Checkout) represents a leap beyond both by enabling the AI itself to conduct purchases directly from conversation, without ever leaving the chat environment.

| Aspect | Commerce GPTs | Retailer Chatbots (Rufus, Sparky) | Agentic Commerce (e.g. OpenAI Checkout) |

|---|---|---|---|

| Purpose | Cross-retailer agents for discovery, recommendation, and purchase | Site-specific AI assistants for product info and navigation | Purchases initiated and completed directly in AI conversations |

| Data Foundation | Synthetic simulations + brand/catalog/context data | Retailer's product catalog + selective web data | Open protocol connecting merchants to AI platforms |

| Scope | Cross-platform, agent-to-agent, context-aware | Confined to retailer's own ecosystem | Unified discovery-to-transaction in chat interface |

| Integration | Cloud-based SaaS connecting to multiple surfaces | Embedded within retailer platforms | Built on Agentic Commerce Protocol (Stripe, PayPal) |

| User Experience | Conversational, context-aware across platforms | Chat UI mixed with catalog browsing | Frictionless chat-to-buy, never leaving AI app |

| Journey Coverage | End-to-end commerce journey across platforms | Discovery and support within one retailer | Complete transaction within conversation |

| Who Builds/Pays | Specialist AI companies (e.g., Cimulate); retailers/brands subscribe | Retailers build for their own ecosystem | Merchants integrate via open protocol |

Why This Matters to Retailers (Especially Retail Media Sellers)

- Own the Discovery Layer or Lose It. As answer engines become default entry points for product discovery, retailers have to choose: build your own Commerce GPT to control how products are discovered and recommended, or risk having third-party AI agents mediate your customer relationships.

- Level the Data Playing Field. Most retailers lack the historic data volume that Amazon and Walmart have to build advanced AI. Commerce GPT platforms use synthetic data and simulations to close this gap—meaning mid-sized retailers can now compete on AI-powered personalization without needing a decade of purchase history.

- Stop Retail Media From Becoming Irrelevant. If your retail media business depends on on-site sponsored placements and search ads, but shoppers are increasingly discovering products through AI conversations, you need to own that conversational layer or face disintermediation.

- Pave the way to future partnership options. New monetization strategies may emerge from cross-retailer agent-driven commerce—referral fees, affiliate networks, data monetization, or premium placement within agent responses. Retailers could create partnerships to share product data for agentic commerce discovery.

What This Means for Brands and Advertisers

If you're a brand, your role is different: you need to integrate with and prepare for retailer and platform Commerce GPTs.

- Make your product data AI-ready. Commerce GPTs parse your product titles, descriptions, specifications, reviews, and contextual information to make recommendations. Poor product content means invisibility when a grocery retailer's Commerce GPT decides what to suggest for "easy weeknight dinners" or when ChatGPT searches across retailer catalogs.

- Work with your retail partners. Its likely only worthwhile for brands with a significant DTC channel to build their own Commerce GPT. For others ensure your products are discoverable and well-represented within your retail partners' Commerce GPTs. This means collaborating on product content, enrichment, and potentially sponsored visibility within AI-driven recommendations.

- Prepare to integrate. Brands may need to invest in enhanced product content for AI parsing, integration costs, attribution systems that capture AI-initiated demand, and conversational sponsored placements.

The Bottom Line

AI-enabled shopping in multiple forms is already changing where products get discovered and how shoppers make decisions. Retail media built around sponsored search and display ads will be impacted if the surfaces where shoppers actually browse starts to change. When AI handles the research, the old playbook doesn't help.

John Andrews from Cimulate was blunt about the urgency: "Brands need to do whatever they can to get visibility into these answer engines. If that means handing over their product catalog, so be it."

Read more from me on related topics: