Amazon's Triple Squeeze: Private Label Growth, 3P Pressure, and Tougher Vendor Negotiations

Last week, I stumbled upon three separate research reports that, when viewed together, reveal something critical about Amazon's evolving marketplace strategy. While each report was interesting independently, the real insights emerged when I overlaid the data sets.

As we enter March 2025, it's clear that Amazon is executing a market position strengthening on three fronts simultaneously: expanding their private label offerings, allowing third-party sellers to absorb pricing pressure, and extracting more value from brand partners through tougher vendor negotiations. Here's my analysis of this "triple squeeze" and what it means for established consumer brands navigating the Amazon ecosystem.

The Three Converging Forces

1. Amazon Basics Is Thriving, Not Retreating

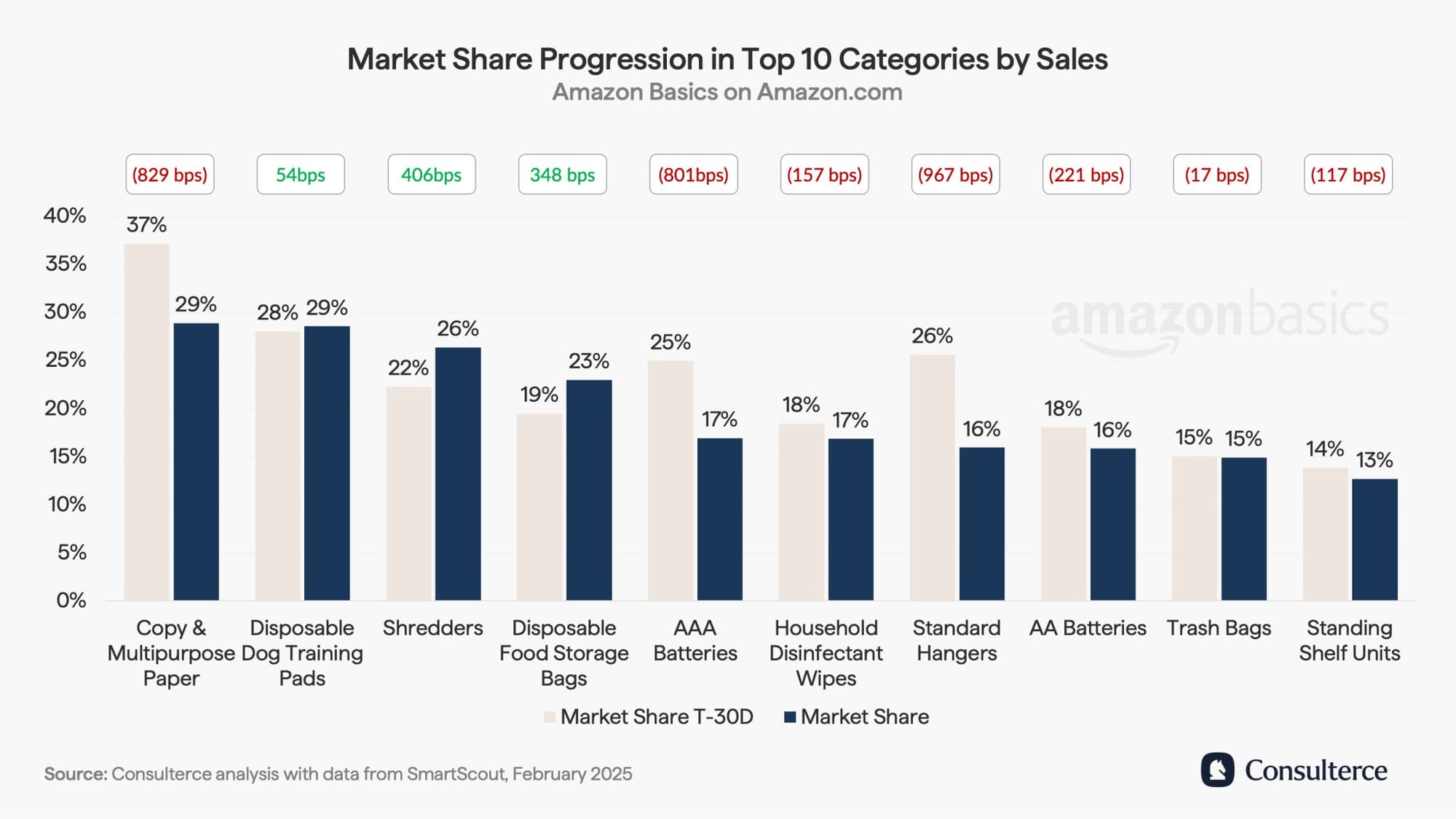

Despite periodic media speculation about Amazon scaling back its private label ambitions, recent data from Consulterce and Smart Scout reveals Amazon Basics remains a formidable force. With approximately 4,300 products spanning 21+ categories at an average selling price of $30.32, Amazon's house brand continues to capture significant market share.

The scale is impressive: Amazon Basics generates over $180 million in monthly GMV from U.S. customers alone, with an additional $35 million from EU5 markets. Categories like Health, Household, Office, Home, Kitchen, and Pet Supplies lead the charge, contributing to Amazon Basics' estimated global turnover exceeding $2.7 billion annually.

2. Third-Party Sellers Face a Pricing Paradox

SmartScout's "Voice of the Seller" research, officially released this week, paints a clear picture of the challenges facing smaller marketplace sellers.

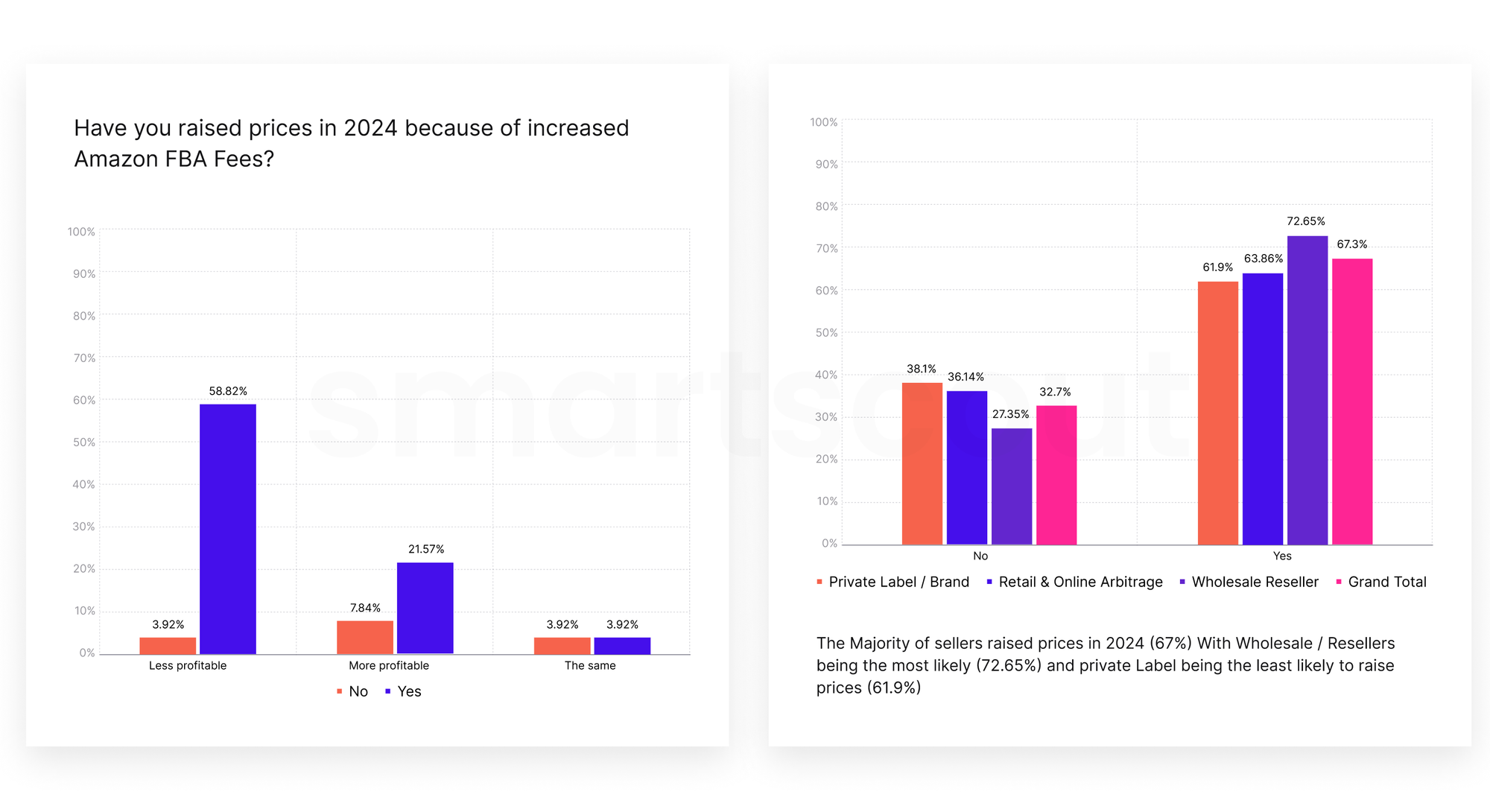

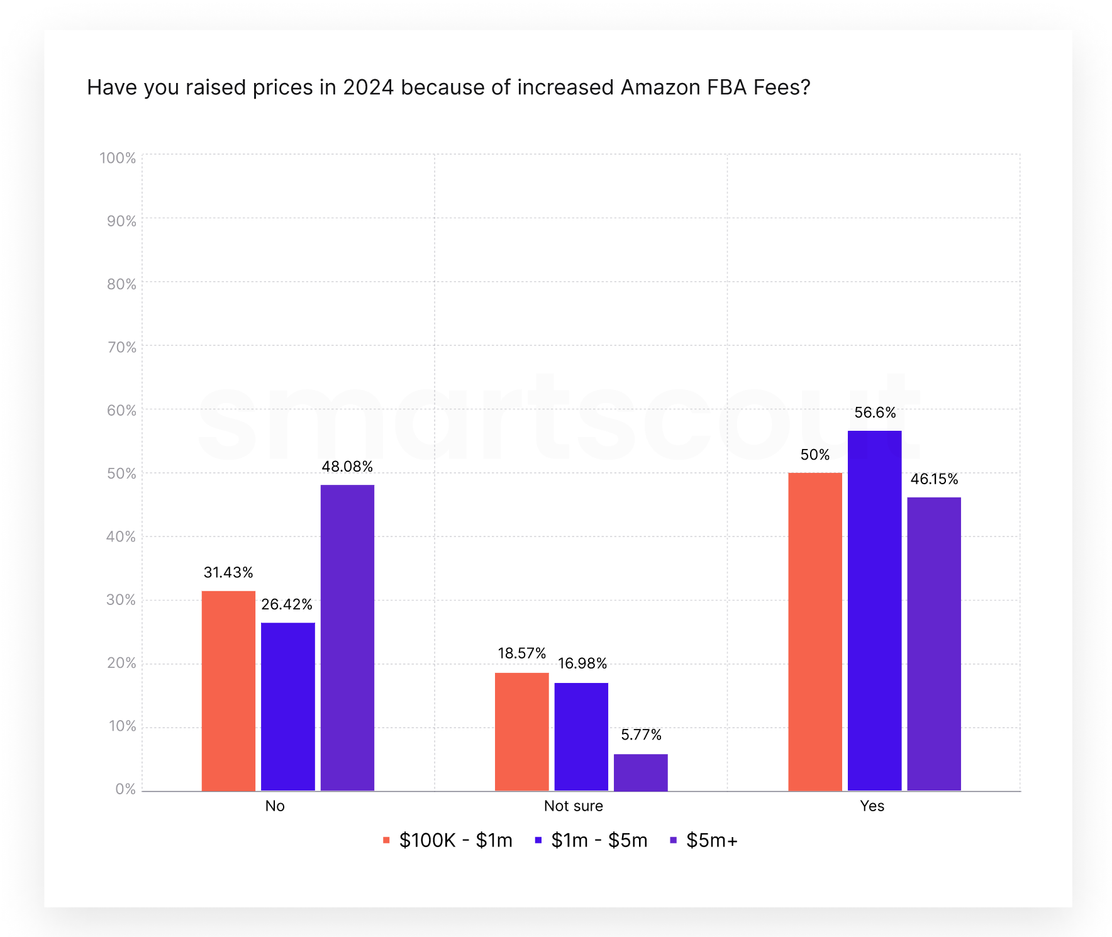

A striking 67% of surveyed Amazon sellers increased their prices in 2024, primarily due to rising FBA fees. Yet price increases aren't necessarily translating to improved profitability – 58.82% of respondents who raised prices reported feeling less profitable afterward.

This paradox is exacerbated by intense competition, with 46.7% of brands identifying competition as their single biggest obstacle to Amazon success.

International sellers present a particular threat, with half of all respondents citing overseas competition as a risk to their business. Even among larger sellers with over $5 million in revenue, 46.15% expressed concern about this competitive pressure.

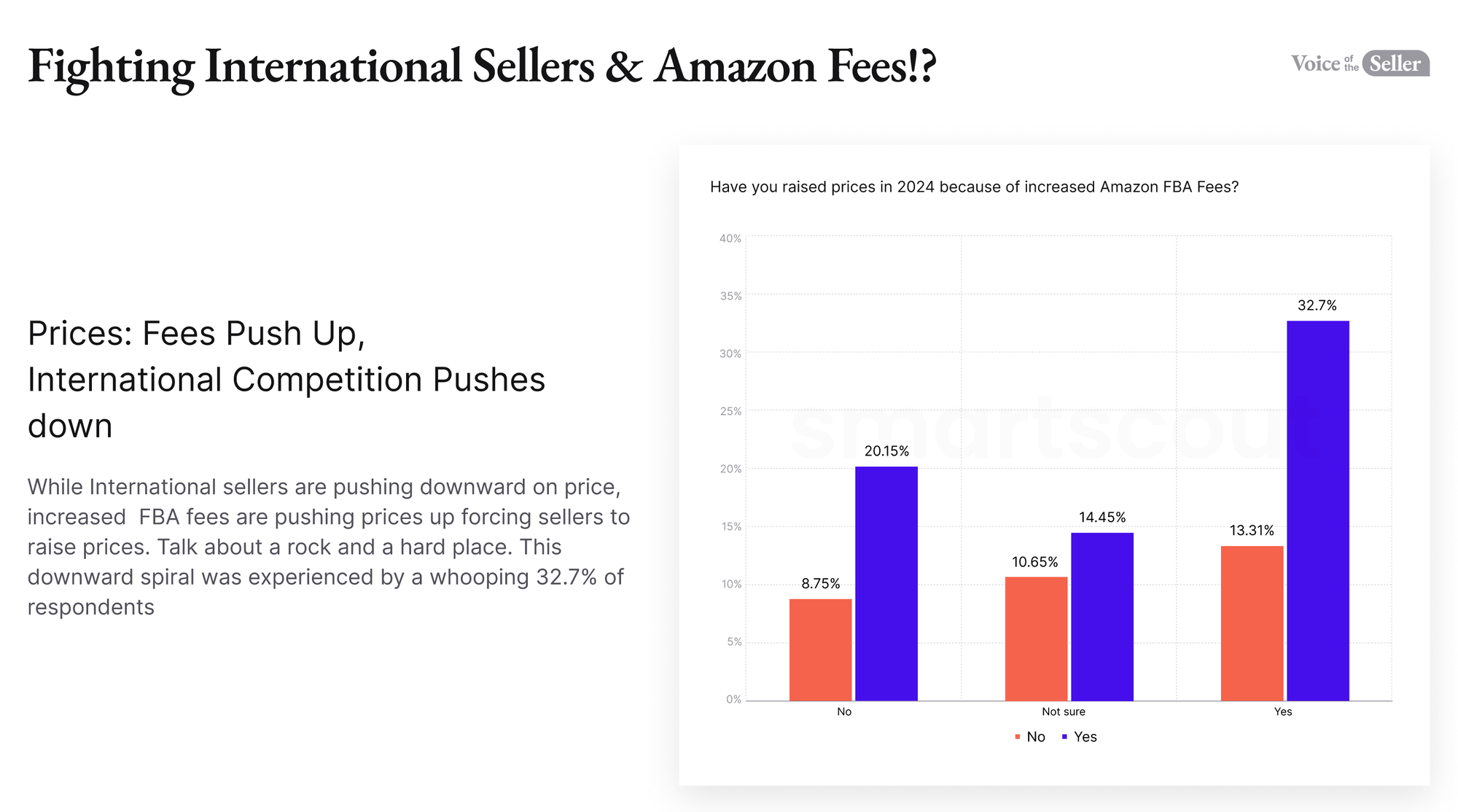

The result is what 32.7% of respondents described as a "downward spiral" – international competition drives prices down while rising FBA fees force prices up, creating unsustainable margin pressure.

3. Tougher Vendor Negotiations for Brands

As Amazon Vendor Negotiations (AVNs) unfold in 2025, Stratably and Consulterce research reveals increasing pressure on brands. A net 17% of brands report this year's negotiations are harder than last year's, while 51% expect an increase in trade terms. Perhaps most concerning, 40% face potential punitive measures in their negotiations.

Look, AVNs are always considered tough, and this year is no different. The net result as usual generally higher co-op and marketing fund requirements, lower cost prices, and stricter supply chain compliance. But the factor that should be on more brands’ radars is that Amazon is continuing to invest in its own competing private label offerings.

Where These Trends Converge

The convergence creates a market dynamic increasingly tilted in Amazon's favor: both third-party sellers and first-party vendor brands face margin-squeezing pressure while Amazon expands its private label portfolio. Amazon Basics serves as both a profitable business line and a strategic lever in negotiations, maintaining sharp pricing while marketplace sellers are forced to increase theirs.

Yet amid these challenges, there's an important counterpoint: 73% of Amazon Vendors report that their Amazon margins are meeting or exceeding internal thresholds and goals, compared to just 27% reporting unhealthy margins. This suggests that while the ecosystem is undoubtedly challenging, brands with the right strategies can still achieve profitability.

Strategic Implications for Larger Consumer Brands

For established consumer brands with revenues exceeding $500 million, this convergence creates a distinct set of challenges and opportunities:

1. Negotiate from a Position of Strength

Larger brands typically possess greater negotiating leverage than smaller sellers – Amazon customers expect to find major brands on the platform, and their absence would impact customer experience. While AVNs are still challenging, brands that clearly articulate their value proposition and brand equity can often maintain acceptable profitability.

When entering negotiations, come prepared with robust cost justifications and a clear plan for driving volume growth. Stratably / Consulterce data suggests that even amid tougher terms, nearly three-quarters of brands are achieving healthy margins, indicating room for mutually beneficial agreements.

2. Differentiate to Avoid the Amazon Basics Trap

Amazon Basics is most successful in “commodity‐like” categories (think standard cables, everyday office supplies). Larger brands should lean into R&D, unique packaging, or brand messaging to avoid falling into the commodity trap.

Categories where products are easily substitutable represent the greatest vulnerability. Brands should conduct honest assessments of their portfolio, identifying SKUs most susceptible to private label encroachment and developing strategies to enhance their differentiation.

3. Invest in Brand Building Beyond Amazon

While Amazon represents a critical sales channel, established brands should invest in building customer relationships that transcend the marketplace. Lean into what sets you apart from the race-to-the-bottom commodity products and sellers.

This brand strength becomes a powerful negotiation asset – Amazon recognizes that customers often search for specific brands, not generic product categories, and strong off-Amazon brand presence enhances on-Amazon performance.

Conclusion

The convergence of Amazon Basics' continued growth, third-party seller price pressure, and tougher vendor negotiations creates a challenging environment for all brands selling on Amazon. However, established consumer brands have unique advantages they can leverage to navigate this landscape successfully.

By focusing on meaningful product differentiation, operational excellence, and strategic negotiation approaches, larger brands can maintain healthy Amazon profitability while protecting their market position from private label encroachment. The key lies in understanding how these trends intersect and developing comprehensive strategies that address the full complexity of the evolving Amazon marketplace.