Amazon Q2 Earnings: What Industry Experts Say About Power Buying, Ad Overload, and AI Threats

Amazon's advertising juggernaut shows no signs of slowing, the retail fundamentals remain surprisingly strong despite economic headwinds, and AI initiatives are creating both opportunities and concerns for the platform's future.

Amazon's Q2 2025 earnings landed with a thud on Wall Street, despite beating revenue expectations and posting strong retail growth. The stock dropped 8% as AWS failed to match the AI-fueled acceleration seen at Microsoft and Google. But beyond the headline numbers, industry experts are spotting deeper trends that could reshape how brands and retailers think about Amazon's ecosystem.

Over the past couple of days, I've been listening to the smartest voices in retail break down these results, and three themes keep emerging: Amazon's advertising juggernaut shows no signs of slowing, the retail fundamentals remain surprisingly strong despite economic headwinds, and AI initiatives are creating both opportunities and concerns for the platform's future.

The Advertising Machine That Keeps Accelerating

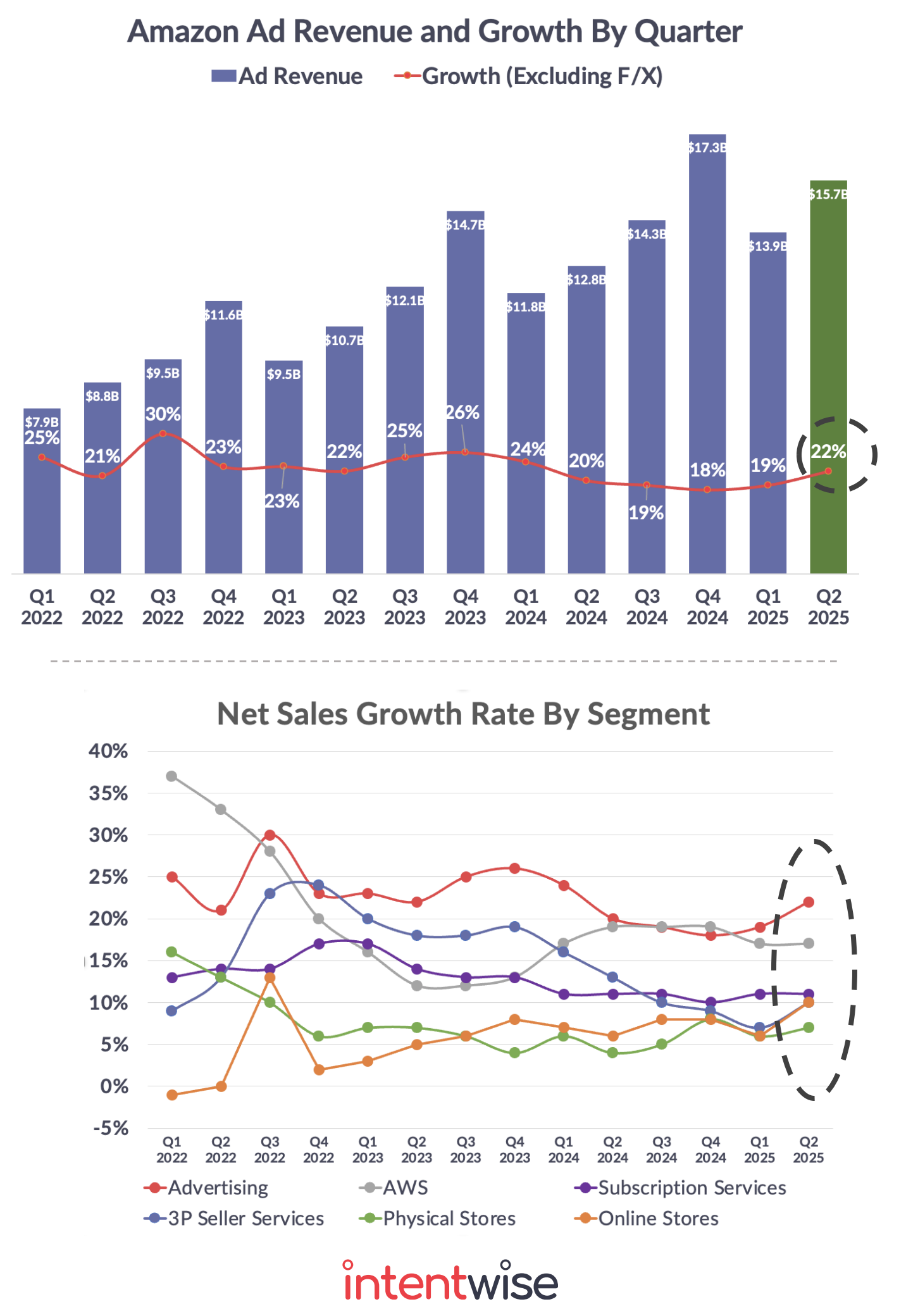

Let's start with the numbers that made everyone sit up: Amazon's advertising business hit $15.7 billion in Q2, growing 22% year-over-year—actually accelerating from 20% growth in the same quarter last year. This makes advertising the dominant growth driver across all Amazon segments, outpacing even AWS's respectable 17% growth.

Jason Goldberg, co-host of the Jason & Scot Show podcast put this in perspective, calculating that Amazon's ad business now runs at an annual rate exceeding $60 billion. Wall Street had projected just 17% growth for the quarter, making the 22% result a significant beat.

But while Prime Day 2025 fell in Q3 (not captured in these Q2 results), Scot Wingo, a co-host of the same podcast, reveals what sellers experienced during the lead-up: brands reported that Amazon was "pushing ads so incredibly hard" that advertising commitments became almost mandatory to access key promotional programs. This aggressive stance reflects a fundamental marketplace reality that Jason articulates: with over a billion items now on Amazon, there's a consensus among brands that ads are the only path to discovery—organic visibility has become virtually impossible.

Scott Ohsman, on his Always Off Brand podcast, adds another dimension to the advertising story. Noting that operating income grew 32% year-over-year, he connects the dots: "This is just getting ugly", suggesting that Amazon's profit surge is directly tied to extracting more advertising dollars from sellers and vendors who have little choice but to pay up.

Scot Wingo sees the degrading user experience from ad overload as a vulnerability for Amazon, and perhaps the "biggest strategic opening I've ever seen anyone have against Amazon since I've been following them for 20 years." He specifically points to AI-powered shopping agents from companies like OpenAI as potential disruptors, arguing these agentic browsers could offer consumers a cleaner, ad-free shopping experience that Amazon would struggle to block.

Retail Resilience: Inventory, Tariffs, and Consumer Behavior

While AWS disappointed and ads dominated the conversation, Amazon's core retail business showed remarkable strength. North America sales increased 11% year-over-year to $100.1 billion, while International revenue rose 16% to $36.8 billion (11% excluding currency impacts). With global GMV growth of 11% significantly outpacing the broader e-commerce market's 7% growth, Amazon continues to gain share.

Katherine Black, a Partner at Kearney offered crucial context about Amazon's competitive position in an interview on Bloomberg TV. "There's really only one retailer that's outgrowing the natural market growth in e-comm, and that's Walmart. They're on a much smaller base." But she notes Amazon's traditionally higher-income customer base provides an edge: "Amazon's customer traditionally has been that higher income household," offering some insulation from economic pressures.

The supply chain improvements Amazon has been making are paying dividends. Jason notes that an major initiave from the company around regional hub transformation is improving their service levels nationwide for delivery, and as a result Amazon has improved their cost-to-serve. This operational excellence showed up in an interesting shift: for the first time in over five years, first-party sales growth outpaced third-party sales growth. Jason explains this reflects changing consumer behavior toward "low-cost everyday essentials" that now represent "one-third of their total sales."

On tariffs, Amazon's messaging was notably calm. CEO Andy Jassy said on the earnings call that "tariffs haven't dented demand or driven up prices so far this year," adding "If costs end up being higher, we will absorb them" according to Amazon. Scott Ohsman is critical of Amazon's stance here, posing that Amazon is downplaying potential tariff impacts while quietly having "forward bought" vast quantities of inventory from vendors to get ahead of potential price increases.

AI Ambitions Meet Market Reality

The AI discussion revealed both Amazon's ambitions and its challenges. While everyone focused on AWS's underperformance in AI workloads, the retail-facing AI initiatives deserve attention from brands and retailers.

Most concerning for user experience advocates was Andy Jassy's hint about Alexa Plus advertising. On the earnings call, the Amazon CEO said that he could well imagine a version of ads being included in that interface at some point, a move that Jason Goldberg dunked on, it would create even more friction in an already challenging interface and calling the user experience "potentially awful".

This advertising creep is already extending to Amazon's shopping assistant Rufus. Scot shares a telling example of searching for dog treats using Rufus. "It did everything it could to sell me something else and not give me the thing I wanted," he said on the podcast. It makes complete sense to me that Amazon will monetize these AI tools. But just like its core web and app browsing experience, the company will need to be careful that shopper activity isn't so overly-monetized that it turns shoppers off.

As I have written about before, much like its other core businesses, Amazon is pursuing a 'walled garden' approach with its emerging AI capabilities. As Walmart builds toward a future where its shopping agent will interface directly with consumers' preferred personal AI agents, Amazon is choosing to block external AI agents from its site.

Scot argues that the new shopping agents from companies like Perplexity and OpenAI are going to "drive a huge wedge" into Amazon's business model. His reasoning: AI-powered shopping agents from companies like OpenAI's "Operator" can offer cleaner, ad-free experiences. While Amazon tries to block these agents, Scot believes that agentic browsers are "unblockable." If consumers can use AI agents to find the best products without wading through sponsored listings, Amazon's entire advertising model—now its fastest-growing segment—becomes vulnerable.

Jason takes this further, questioning the sustainability of ad-based models in an AI future: "If the world goes from one click to zero click... ads don't matter anymore." When AI agents handle routine shopping decisions, the traditional advertising funnel breaks down entirely.

Looking Ahead

The expert consensus suggests Amazon faces a delicate balancing act. Their advertising business prints money but risks alienating the very customers that make the platform valuable. Their retail operations remain strong, but competitive pressures from Walmart and potential AI disruptors loom large.

Amazon's platform is becoming more pay-to-play than ever, but it remains indispensable for reaching customers. The key is understanding these dynamics and planning accordingly—whether that means budgeting for increased ad spend, diversifying channel strategies, or preparing for an AI-transformed shopping future where traditional advertising may matter less.

As these industry experts suggest, Amazon's Q2 results show a company at the top of its game. But it's also one that's still not immune to nascent competition and changing consumer habits.