Amazon Q1 Earnings Scorecard: Winners, Losers, and the Calm Before the Tariff Storm

Amazon announced its Q1 2025 earnings last Thursday. Here's my hot take on a few winners and losers, from within the earnings call and in recent discussions with brands and solution providers.

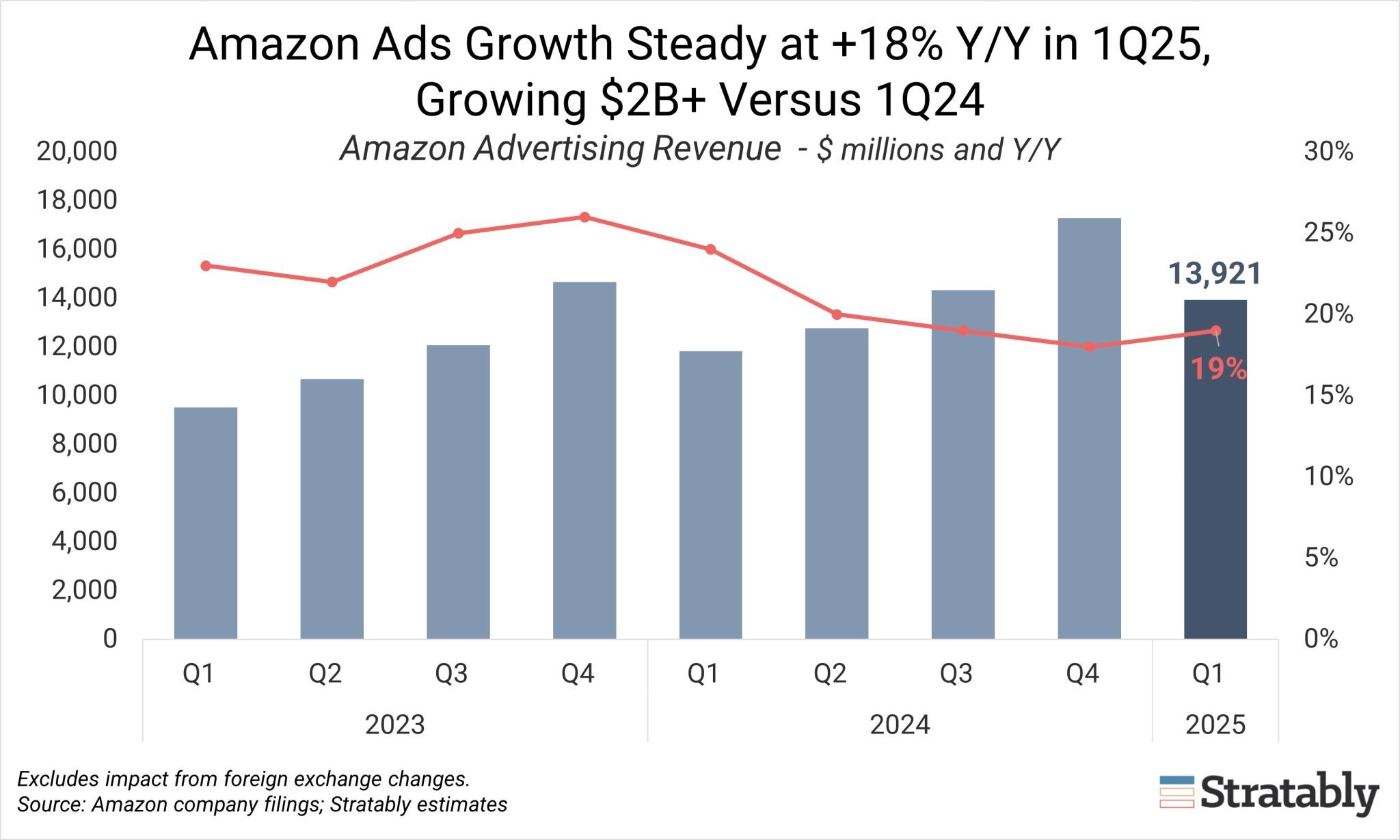

When the dust settled on Amazon's Q1 earnings, the headline numbers looked solid – Amazon beat on sales (+9 % YoY), gross profit was up 14 %, and 19% ad revenue growth. But scratch beneath the surface and you'll find an ecosystem in upheaval. While Amazon positions itself for the coming tariff storm, vendors, sellers, and even consumers are already feeling the shock waves.

Here's who's winning, who's losing, and what it means as we enter the eye of the hurricane.

Winner (for now): 1P vendors

For a few golden weeks, first-party vendors experienced something rare—Amazon placing massive orders to stock up before tariffs hit, referred to as forward buying in the earnings call. One 1P vendor on Reddit reported purchase orders worth an unusual 10-14 weeks of cover for China-sourced items.

But this is as hollow as victories get. But I have also heard from at least one 1P vendor with US-sourced items that Amazon already pulled right back on POs, even with consumer demand being very healthy in their category.

Amazon took a $1 billion hit from this forward-buying strategy, covering extra freight, FBA fees, and warehouse surge costs. What goes up must come down—expect PO cancellations and cuts as these inventory surpluses work through the system.

Takeaway: This $1B expenditure signals just how seriously Amazon is preparing for tariff disruption. For 1P vendors, these inflated orders are borrowed time.

Loser: China-reliant small sellers.

Chinese sellers face the perfect storm: Trump's 145% China duties piled on top of Amazon's rising fees. But here's where it gets interesting—the advantage still tilts toward Chinese manufacturers who are directly factory-sourced. While US brands adding minimal value (the "get rich quick with FBA" crowd) struggle with middleman markups, Chinese sellers are increasingly leveraging AI for branding and marketing capabilities that level the playing field.

The reality: Chinese sellers who adapt with technology will outlast US resellers adding limited value to the supply chain.

Winner: Amazon’s Ad business

Ad revenue climbed 19% year-over-year to $13.92 billion—now Amazon's fastest-growing P&L line, outpacing even AWS. (By the way, it continues to baffle me how the analysts ask a ton of questions about AWS, but practically nothing about advertising)

Here are some levers driving this growth:

- Rolled Prime Video ads into every U.S. (and nine other) Prime account unless subscribers pay $2.99 extra – this helped grow Amazon’s ad-supported reach to 275 M monthly U.S. viewers. This is an attractive source of new upper-funnel inventory for both endemic and non-endemic brands.

- More AI driven ad creation and relevance. I'm hearing from brands that are using Amazon's AI tools to build video ads for long tail products that they wouldn't otherwise bother to advertise.

- But the most substantial driver is overall macro retail media tailwinds - retail media is hot and getting hotter compared to other digital media channels like Meta and Google, who by comparison grew their ad businesses by 16% and 8.5% respectively. Retail media is future-proof against cookie deprecation, and closer to the purchase for consumer goods – essential in today's economic environment where ROI is paramount.

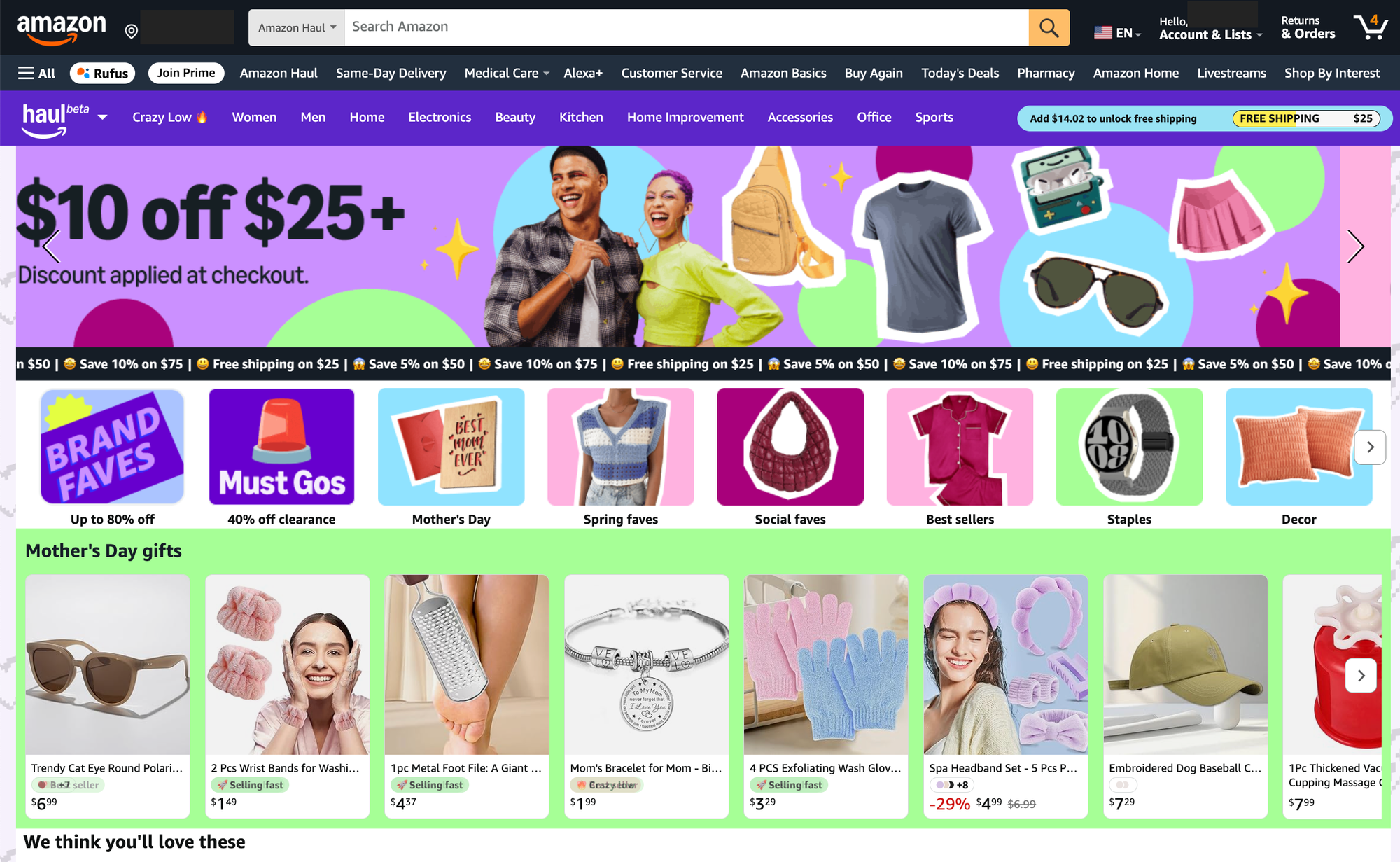

Winner: Amazon Haul

The sub-$20 Haul storefront (launched Nov-24) is expanding just as Temu & Shein scramble under Trump’s 120-145 % duties. Haul items are still $1-$20, ship in 1-2 weeks, and require only a $25 basket for free freight.

This was not mentioned in the earnings call but something I recently covered for Forbes - Amazon has expanded a couple of capabilities (adding the microsite to desktop, adding in discounted products from known brnads) ahead of expected turbulence for Temu and Shein.

Winner: Consumers hunting for bargains

Overall site prices “have not appreciably gone up yet,” per Jassy. This is due to all that forward-buying on 1P inventory, and the huge mix of 3P sellers, some of which have adjusted their pricing, some have not.

According to new data sent to me from Momentum Commerce, there have been four consecutive weeks of the 1,000 most popular products being less expensive year-over-year, with the week of April 13-19 showing the greatest YoY decline in average selling price year-to-date at -2.3%.

But here's the fascinating paradox: consumers are stockpiling due to fear while simultaneously trading down to cheaper alternatives. Earlier data from Momentum Commerce showed established diaper brands losing ground to more affordable alternatives:

- The current Top 100 diaper products dropped 3.9% year-over-year in average selling price

- Meanwhile, historic bestseller diapers raised prices 8.5% year-over-year

Price inflation is already emerging in categories with pricing power: Baby Feeding (+14.2%), Diapering (+8.5%), Skin Care (+5.3%). Yet consumers are responding by switching to cheaper alternatives—panic buying on a budget.

Momentum Commerce notes that prices across Amazon are holding steady more broadly since it will take time for the full price impact to emerge, largely due to Amazon's 1P business.

The Zero-Sum Game

Every winner creates a loser. Amazon's Q1 results pleased investors while merchants and brands brace for impact—if not now, then in Q2. Amazon's leadership signals they'll keep costs down for consumers (witness Haul) while refusing to interfere with market pricing dynamics.

We're in a holding pattern. The real tariff impact hits in Q2. Amazon seems to be playing chess in an industry full of checkers players, positioning itself to capture advertising dollars as the inevitable pricing pressures squeeze traditional e-commerce models.