AI Makes Shopping Easier. But Shoppers Still Check The Receipts.

The gap between stated and revealed preferences isn't going away. But neither is the opportunity for brands who show up where shoppers are actually going—not where they say they'll go.

A few weeks ago, my family and I returned to the U.S. after a year abroad. We'd stored everything—clothes, furniture, electronics. When we opened the unit, it was a disaster. Rats had chewed through boxes. What the rats missed, mold had claimed. The insurance coverage for all of it? $250. 😠

If you'd asked me what I wanted when I rented that unit, I would've said "I want my belongings safe and protected." That was my stated preference. But here's what I actually did: I found the cheapest storage unit in my area and signed whatever insurance paperwork they put in front of me.

That gap—between what people say they want and what they actually do—is exactly why new research from the IAB matters. At the IAB's Connected Commerce Summit in September, Jack Koch, the IAB's SVP of Research & Insights, previewed findings from a study that didn't just survey consumers about their AI shopping intentions—it tracked 450+ real shopping missions with screen recordings to see how people actually behave when AI enters their journey. (The full research launches October 28th, register here)

I moderated a panel immediately after with Adam Heimlich (CEO of Chalice AI), Amie Owen (Chief Commerce Officer at IPG Mediabrands), and Nicholas Ward (President of Koddi) to unpack what this research means and how we should prepare.

Will AI Replace The Traditional Shopping Journey?

I opened the panel by asking Adam and Nicholas to rate on a 1-5 scale how much AI agents will replace shopping. Five would mean end-to-end replacement.

Adam landed at a two. His reasoning: chatbots still aren't accurate enough—most of us are stuck doing multiple searches and asking for clarification. "I think a lot of people enjoy shopping and don't want it to be shorter," he said.

Nicholas scored it close to five—but for different reasons. "36 months ago, none of this existed," he said. The transactions we find tedious will get offloaded to agents, but we're not getting one AI shopping assistant. We're getting dozens of specialized buying interfaces fragmenting the journey in ways we've never seen.

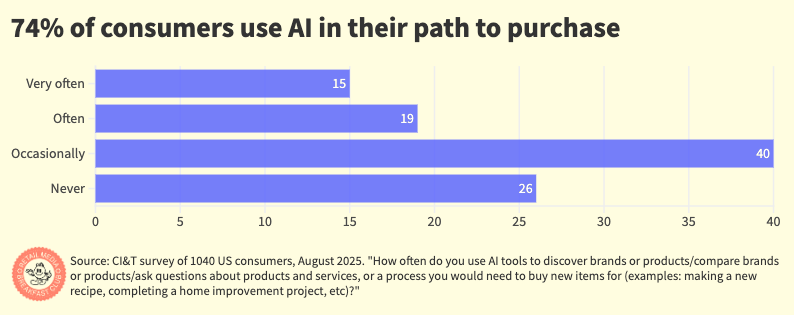

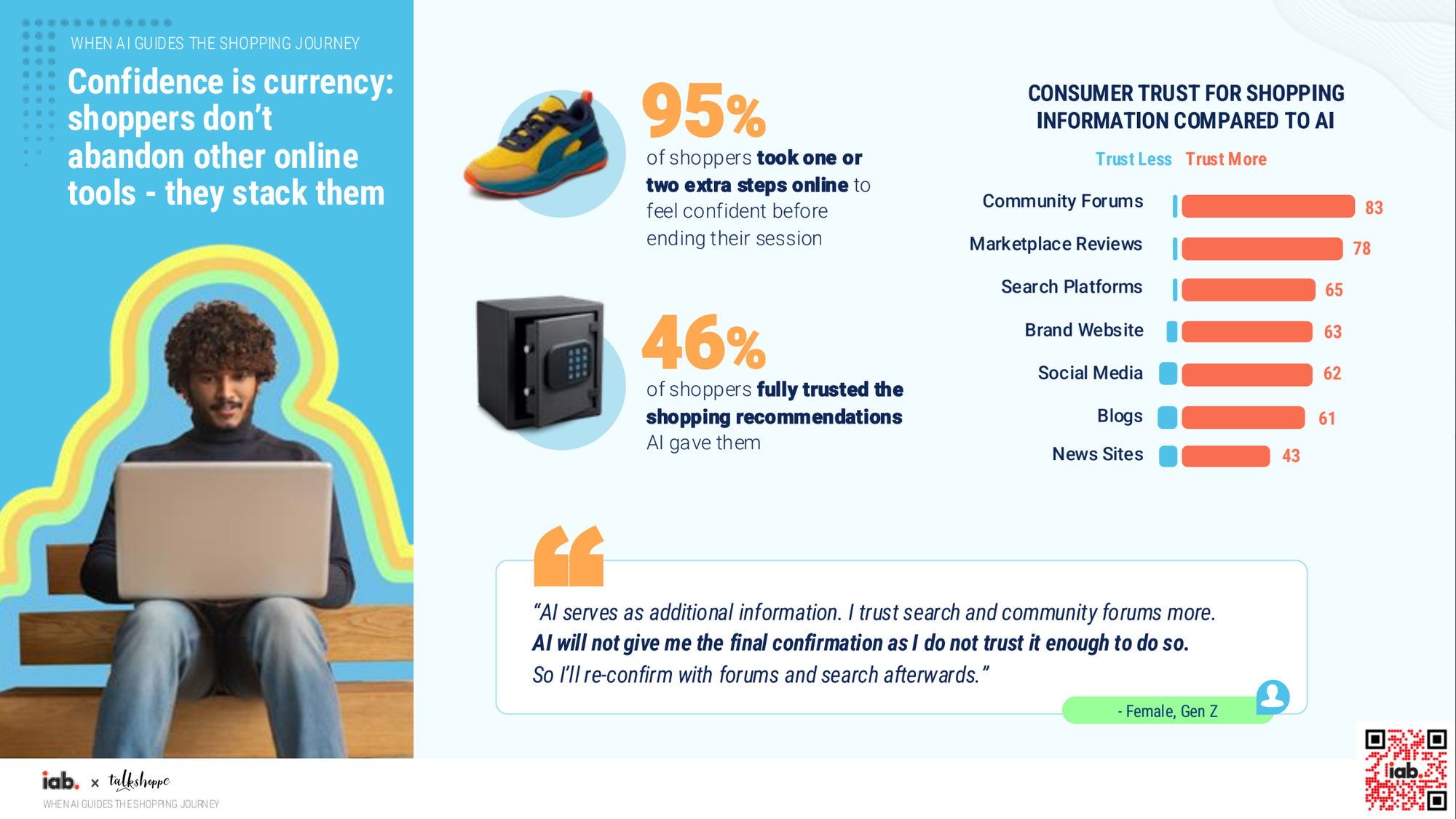

The IAB research backs up this complexity: 71% of shoppers clicked through to brand or retailer sites to validate price, availability, and policies—and marketplace visits nearly doubled after using AI. This tells is that AI shopping journeys are creating more touchpoints, not fewer.

Are We In The Worst Targeting Era... Or the Best?

Against a backdrop of walled gardens and vastly more data points of consumer signals, I asked the panel whether we're entering the best targeting era ever, or the worst.

Nicholas went all-in on "best time." Retailers and platforms with closed-loop data now face what he called "a deterministic problem"—you can actually identify every meaningful micro-audience rather than targeting 12 broad segments. "You enter a world where these are the millions of experiences that really drive that outcome you want," he said. For 20 years we've had path-to-conversion data showing 600,000 different shopping journeys but couldn't act on it. Now we can.

Acosta Group’s retailer intimacy is legendary—merchants answer their calls. You're not going to find that access at the same scale with any other partner out there. That expertise with both retailers and shoppers fuels its Connected Commerce team, which offers digital shelf, retail media, and data analytics all under one roof. Tap into 100 years of retailer relationships and award-winning digital commerce capabilities. Learn more at Acosta.Group

Adam agreed it's the best targeting era—"it's almost like free energy, any big company has access to enormously rich data"—but immediately added the warning: it's also the worst. "I'm not encouraged by what I've seen in the market. People are having a hard time making the shift fast enough."

Then came his prediction about what happens when companies move too slowly. He pointed to Amazon's insurmountable lead in e-commerce driven by their advantage in prediction and data—a gap so large that no online retailer can catch them. The same pattern could play out across other industries where early AI adopters pull so far ahead that innovation becomes concentrated in single dominant players per category.

That's when Amie entered with a reality check. "We have the right data in front of us," she said, but there's a catch: implementation. Even with perfect data, household-level targeting breaks down in practice—she shared how her son's Alexa orders for Beyblade spinners polluted her own recommendations.

What Mid-Tier Brands Need to Do

The IAB research reveals an opening for consumer brands: 64% of missions surfaced a new-to-me product via AI platforms. That's a discovery engine creating consideration that didn't exist before. But 71% of shoppers said AI is most effective at narrowing broad categories—when agents cut the field to four or five options, mid-pack brands get squeezed.

I asked Amie what premium and mid-tier brands can do besides discounting, and she didn't hesitate with her answer: "Being ready with your digital assets." That means organic websites explaining product characteristics and availability, optimized PDP pages, retail media keywords, and understanding exactly how your catalog shows up in search results. "We can actually manipulate what you're getting in your search," she said, but only if you know how your products surface across platforms.

The 90-Day Action Plan

My storage unit disaster taught me that stated preferences are worthless. The IAB research proves it at scale: consumers say AI makes decisions faster (73% agree), say they'll rely on it more (80% agree), but then 95% of them take extra verification steps anyway.

The brands and retailers who win won't be the ones with the most sophisticated AI. They'll be the ones who stopped optimizing for last year's playbook and started preparing for the journey that's actually happening—one where AI creates more touchpoints to convert, not fewer.

So I asked the panelists what to stop and start in the next 90 days:

Nicholas: "Stop continuing on the same path." His thought exercise: what would you do differently if your ability to drive impressions became boundless? That question forces different decisions around team structure, data strategy, and partner engagement.

Adam: "Stop thinking you have enough help." There's never been a moment where it's this hard to tell what next year will be like. His call to action: speed up NDA and RFP processes to test more partners, especially startups. "They're proliferating, popping up every day, doing amazing stuff."

Amie: "Stop talking about the past." Most of the time teams do big presentations, everyone says 'Wow that was great,' and then planning season comes and it's 'What did we do last year?' The old model should be dead if companies are actually embracing what's coming.

The gap between stated and revealed preferences isn't going away. But neither is the opportunity for brands who show up where shoppers are actually going—not where they say they'll go.

Sign up for the IAB's full research findings: When AI Guides the Shopping Journey.

More from me on related topics: