AI For The Holidays

A barrage of new AI shopping features launched in November, right before Black Friday, means we're about to see AI's first real test at scale.

Last week I flew to St Louis for a night to present to Purina's ecomm team. On route to the airport I did an inventory check: Passport, phone, laptop, insulin, wallet? Oopsies on the last one—not a credit card in sight.

Just a couple of years ago, this would have been a disaster. But with tap-to-pay ubiquitous now and apps like Uber already having my cards on file, the biggest issue was a slight side-eye from the hotel when checking in. (I would not be allowed to order room service without a credit card on file. Noted.)

A year ago, traveling without a wallet would have been impossible. This year, I barely noticed. That's how quickly new behaviors become normal once supply and demand click—once consumers want something and the infrastructure exists to deliver it.

AI-enabled commerce is hitting that same inflection point right now, just in time for the holidays.

In 2024, AI shopping tools were mostly experimental—interesting toys that ChatGPT Plus subscribers tested while the rest of us watched from the sidelines. This year, a barrage of new AI shopping features launched in November, right before Black Friday. And according to Salesforce's data across 1.5 billion global shoppers, we're about to see AI's first real test at scale.

Consumers Are Actually Using AI This Holiday

Salesforce projects that AI and agents will influence $73 billion in global sales during Cyber Week—that's 22% of all sales, up from $60 billion last year. To put that in perspective, AI's influence on commerce is growing faster than commerce itself.

"Digital traffic has skyrocketed, indicating shoppers are engaging early to see what's new and build out their wishlists," says Caila Schwartz, Director of Consumer Insights and Strategy at Salesforce. "This year more shoppers are leaning on AI and agents to research products, help them budget, and prepare for the holiday season."

The tools that just launched are legitimately useful, not just novelties. For example,

- Google’s updated "AI Mode" now lets shoppers track a product’s price, set a desired budget and be alerted when it hits that target; it can even call local stores on your behalf to check inventory and deals.

- ChatGPT now supports Instant Checkout with select sellers (starting with Etsy in the U.S., some Shopify merchants, and Target announcing it will be live this week), meaning you can move from chat-to-purchase in seconds.

- Amazon’s “Rufus” assistant is also stepping up, offering 30- and 90-day price-history views so you can see whether a sale is real.

- Klarna is letting you snap or type what you’re after and watch for price drops

- Walmart’s app brings AI into the store with in-aisle deal alerts and curated party-lists

These features solve real friction points in holiday shopping: tracking deals across retailers, confirming inventory before driving to a store, consolidating research.

Salesforce says that traffic from AI and agent-powered sources (ChatGPT, Perplexity etc.) has already increased 2.5x YoY over the last seven weeks.

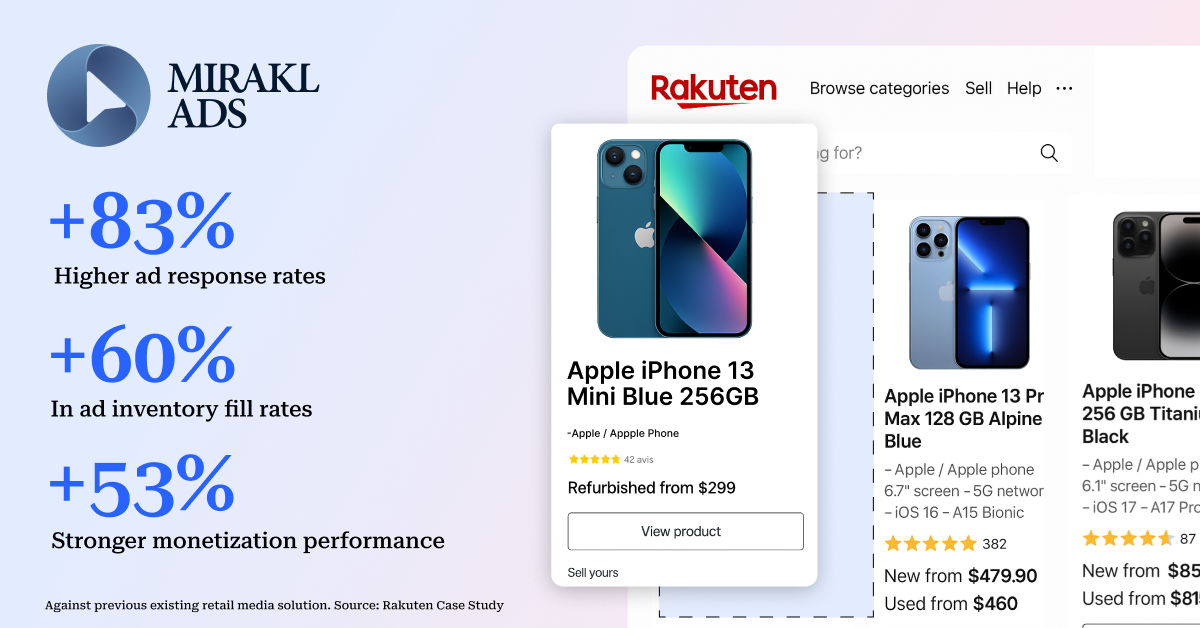

Did you know leading retailer media networks drive 85% of their ads revenue through mid- and long-tail advertisers?

Mirakl Ads provides full funnel ad formats tailored to both 1P and 3P advertisers, leveraging unique AI-capabilities that provide unprecedented levels of relevance and engagement.

Retailers who want to capture ad spend from the long tail of 3P marketplace sellers use Mirakl Ads in their tech stack.

Will Consumers Use Retailer Chatbots, or Prefer to BYO-LLM?

I've argued before that shoppers will prefer using their own AI sidekick—ChatGPT, Perplexity, Claude—rather than learning a different retailer-specific chatbot at every site. Why would I talk to Walmart's bot when ChatGPT already knows my preferences, my budget, and my shopping history across multiple retailers?

Caila challenged me on this, and her argument is compelling:

"Even if consumers are starting their journey in ChatGPT or Perplexity, they eventually end up at the brand-owned property. And once they get there, that experience has to feel consistent. When we think about the modern e-commerce experience evolving into more of a conversational format, it feels natural—it's a logical progression."

She's right about the form factor. 80% of e-commerce traffic comes from mobile now, according to Salesforce data. Scrolling, typing, conversational interfaces—this is how people interact with their devices. If that's the expected interface, retailers need to deliver it or risk feeling dated.

The data backs her up: Retailers with AI agents saw 13% U.S. sales growth this fall, compared to 2% growth for retailers without them. That's seven times higher growth.

I'm still skeptical – at least with the current state of on-site chatbots. I asked the Williams-Sonoma chatbot for gift recommendations for my mother-in-law. The chatbot suggested two air fryers as gift ideas, glomming on to my mention that she already has an air fryer but not comprehending that I was hunting for complementary accessories. When I used the same prompt with ChatGPT, it recommended more useful accessories that pair with the kitchen devices she already owns.

If retailers invest in their own on-site chat experiences, they'll need to build experiences that actually know their customers and deliver genuinely helpful recommendations. Most retailers aren't there yet.

Gen Z Is Shopping in Stores, With A Twist

Here's the counterintuitive finding from Salesforce's research: Physical stores are the #1 preferred channel for holiday shopping. And Gen Z is leading the charge.

3 in 4 Gen Z shoppers plan to shop in-store this holiday. They're the #1 generation for Black Friday in-store shopping—the chart literally goes up and to the right as you move from Boomers to Gen Z.

It's nostalgia for something this generation never had – and a craving for immediate gratification, the ability to touch and feel merchandise, and the social experience of being in a store.

But this isn't your grandma's shopping spree. More than half of Gen Z shoppers using AI say they're using it while in the store—taking photos of product shelves, asking follow-up questions, getting recommendations from AI assistants as they browse physical aisles.

(Case in point: Target is giving the first 100 customers at every store on Black Friday a gift bag worth at least $100. Caila pointed out this brilliant play for a generation that's been posting TikToks about missing the old Black Friday door-buster chaos.)

This is where agentic commerce optimization matters beyond just SEO for LLMs. If ChatGPT knows your product feed, it can recommend where to buy in-person and surface the best local price. The research phase happens in the AI, but the transaction happens at the store.

And it reinforces a point I've made before: physical retail media—endcaps, displays, shelf placement—might be the most AI-proof part of the retail media business. When Gen Z is in the store using AI on their phones, they're still walking past those displays.

What This Means (And What to Watch)

"With AI and agents set to drive $73 billion in global sales next week, it's clear that AI has moved from a nice-to-have to an absolute necessity," Caila told me. "Agents are the power brokers of Cyber Week, giving retailers the ability to convert this strong buying intent into record-breaking revenue."

Here's what I'm watching over the next week: How much of that $73 billion in AI-influenced sales translates to actual behavior change versus correlation. Are people genuinely shopping differently, or are we just measuring existing shoppers who happen to use AI?

Either way, this is AI's first real commercial stress test. By December, we'll know whether this is another mobile wallet moment—where the behavior clicked and became ubiquitous overnight—or whether we're still waiting for the supply and demand to fully align.