TL;DR

Big numbers from Adobe and Salesforce about AI-referred traffic

BUT are we just measuring a bigger user base?

Nobody really had time to learn these tools

Retailers are blocking the AI agents they claim to embrace

What actually changed

You’ve probably seen some headline numbers by now declaring that AI shopping has finally arrived. Adobe Analytics reported that AI-driven traffic to U.S. retail sites surged 805% year-over-year on Black Friday.

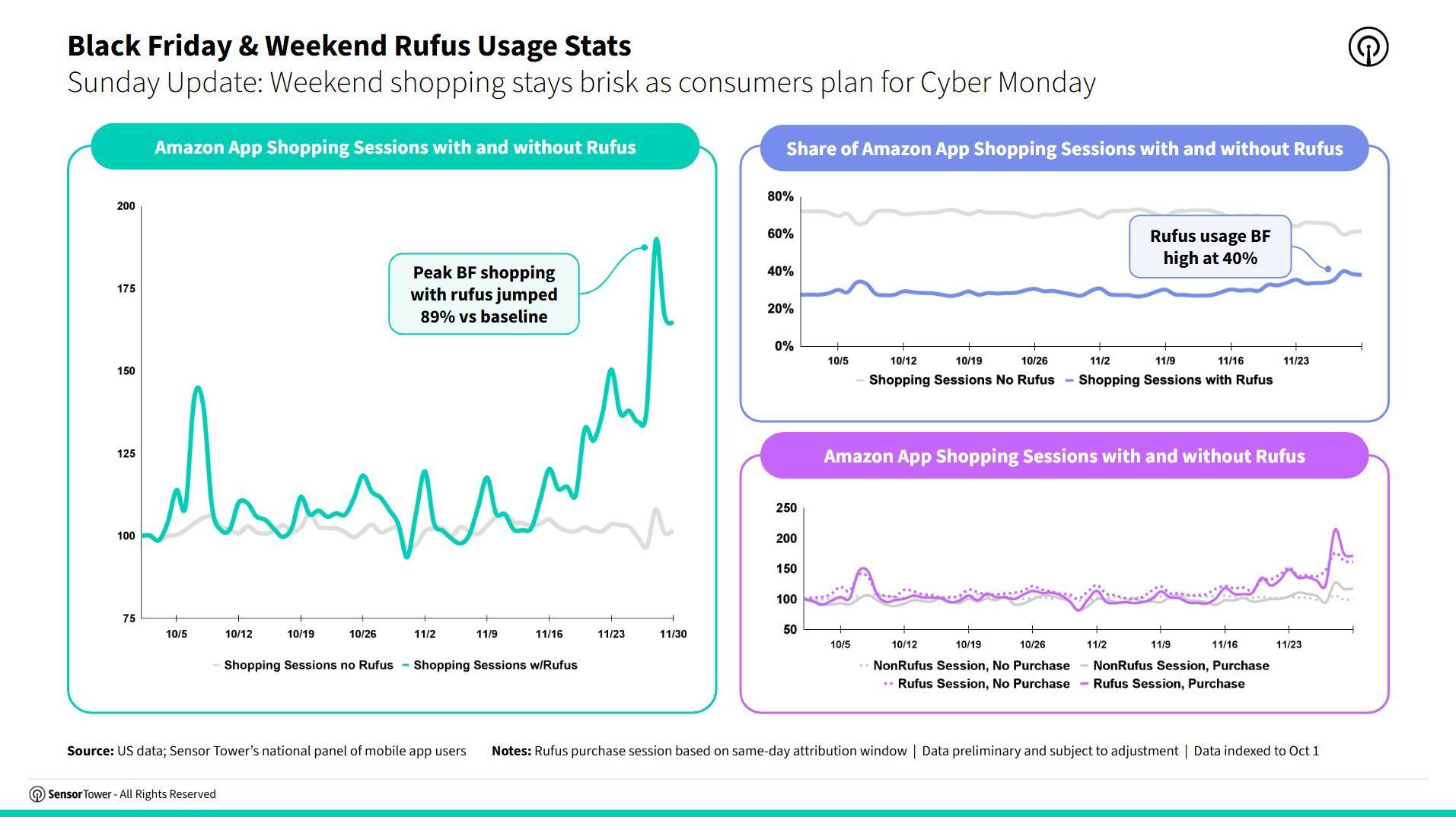

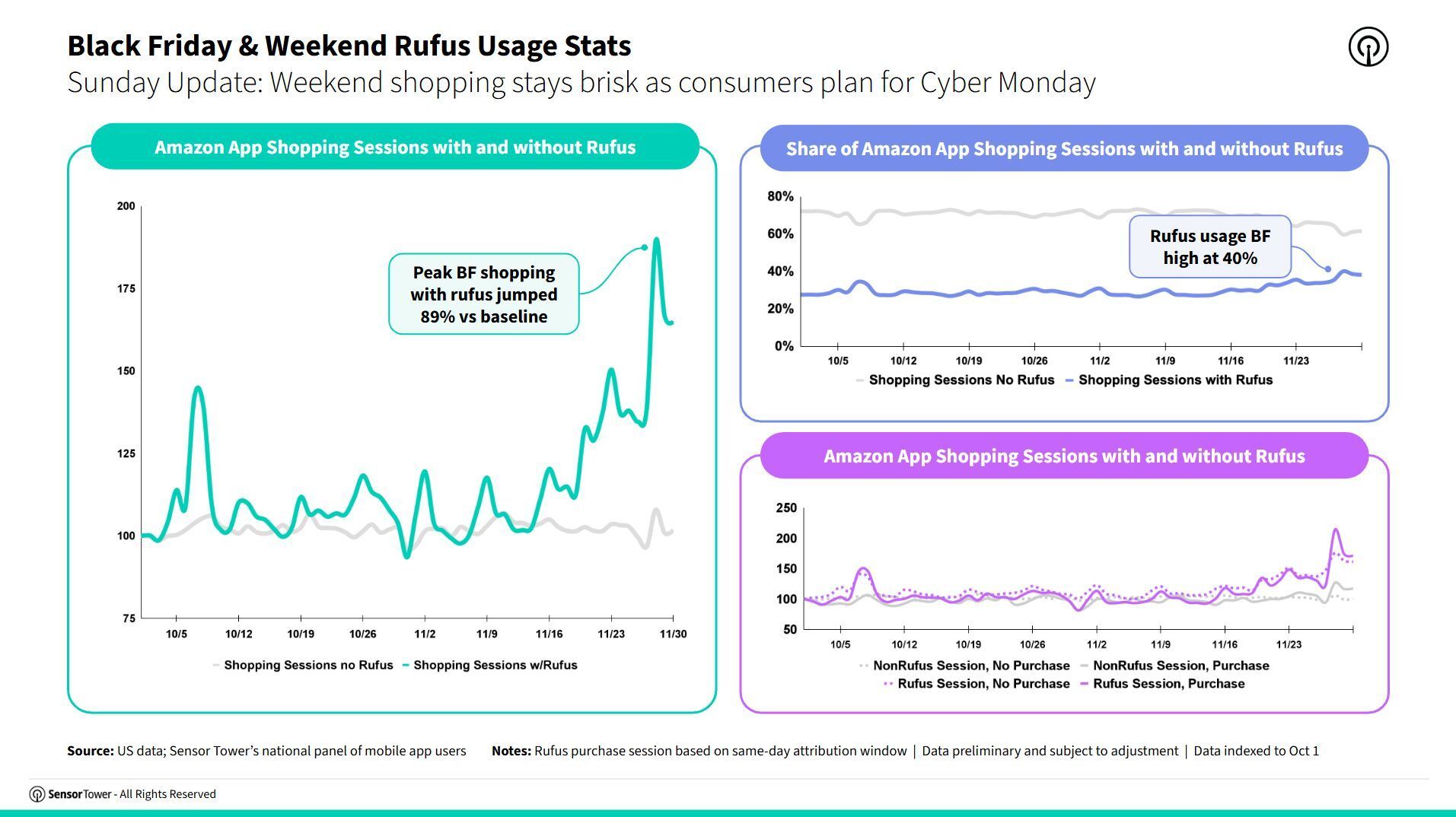

Salesforce, tracking 1.5 billion global shoppers, announced that generative AI and agents drove $14.2 billion in online sales on Black Friday alone. Sensor Tower found that Amazon shopping sessions involving the Rufus chatbot that resulted in purchases jumped 100% compared to the prior 30 days.

The narrative is that AI shopping has finally arrived. The robots are here, and they're buying stuff. But Ian Simpson, SVP of Innovation & Strategy at Sensor Tower, had a word of caution about reading too much into these figures, which I’ll share later.

I'm writing this Monday afternoon watching Cyber Monday numbers roll in, still far too early for conclusions. But let’s look at some of the data that’s flowed in so far and where it may be pointing.

SPONSOR: MIRAKL ADS

Did you know leading retailer media networks drive 85% of their ads revenue through mid- and long-tail advertisers?

Mirakl Ads provides full funnel ad formats tailored to both 1P and 3P advertisers, leveraging unique AI-capabilities that provide unprecedented levels of relevance and engagement.

Retailers who want to capture ad spend from the long tail of 3P marketplace sellers use Mirakl Ads in their tech stack.

The 805% Stat Might Not Mean What You Think It Does

Adobe's number—805% growth in AI referrals to retail sites—sounds explosive. Salesforce says AI influenced $14.2 billion in Black Friday sales globally. Sensor Tower reports that Rufus-involved Amazon sessions that resulted in purchases jumped 100% versus the prior 30 days.

These numbers look huge until Sensor Tower’s Ian Simpson asks the obvious question: Didn't ChatGPT usage roughly quadruple this year?

If you're measuring AI referral traffic and the total addressable market of AI users grew 4x, of course referrals surged. That's not a shift in the daily shopping behavior of everyday customers—it's basic math about a larger base of users.

Simpson unpacked three other problems with the narrative in a post on LinkedIn:

Amazon has been blocking OpenAI for months. Those referral numbers are artificially suppressed for the largest retailer in the game. Meanwhile, Walmart and Target referrals are up dramatically, but they still represent a tiny fraction of total traffic to those sites.

Revenue up 7%, but traffic is flat or down. Simpson doesn't have revenue data, but Sensor Tower shows overall unique visitors to retail sites are looking flat or down from last year. So either consumers bought more items, or we're just measuring inflation. He's betting on the latter.

Rufus conversions are higher, but probably not for the reason Amazon wants. Simpson's take: "My bet is consumers are using Rufus more as advanced search and less as an agentic shopper. Conversions do seem to be higher with Rufus but that could be because it's driving better search results vs radically changing the shopping experience."

So people are using AI tools, but are they shopping differently, or just using better search?

Nobody Had Time to Actually Learn These Tools

Consumers got maybe 48-72 hours to test these new features before the biggest shopping weekend of the year.

Scot Wingo has been tracking agentic commerce announcements on his Retailgentic blog. Look at the timing:

ChatGPT Shopping Research: Launched Monday, November 25 (four days before Black Friday)

Target in ChatGPT: Launched Tuesday, November 26 (three days before)

Perplexity/PayPal Instant Buy: Launched Wednesday, November 27 (two days before)

Walmart on ChatGPT: Launched Sunday, November 30 (Cyber Monday eve)

This is AI shopping's "first real test at scale"—the moment when supply and demand finally clicked like tap-to-pay did for mobile wallets. But we're not actually there yet. The supply arrived, but consumers barely got to try it before the shopping event was underway.

What we don’t know yet is if conversion numbers we're seeing this weekend from genuinely new behavior, or are early adopters testing shiny new features during a high-intent shopping window? We'll need to see January usage numbers when there's no sale urgency to know if behavior actually shifted.

Are Retailers Are Blocking The Future They Claim to Want?

James Taylor, founder of ad-tech firm Particular Audience dropped a post that captures the contradiction at the heart of retail's AI strategy. According to his analysis, 71% of Cloudflare-protected sites block GPTBot, and 80% block Claude. (Cloudflare protects about one in five websites on the internet.)

[Note: I'm skeptical of these exact percentages and the methodology here, but the directional point stands.]

The reason is straightforward economics: browser-based AI agents load full pages—every script, image, dynamic element. That's expensive to serve at scale, especially when many of those sessions don't convert to purchases. So retailers block AI traffic to save on server costs.

But here's the problem: if AI assistants can't access your product catalog, they can't recommend it. They just default to competitors who haven't blocked them.

Taylor argues that retailers need to stop treating AI agents like scrapers and start providing structured access through protocols like Retail-MCP. That would let them control and meter AI access while keeping frontend performance fast for humans.

What Actually Changed This Weekend

Strip away the inflated percentages and what actually happened was more modest, Per Salesforce Data

Mobile became default 72% of global orders and 79% of U.S. traffic came from mobile devices. Mobile wallets hit 30% of U.S. digital orders, up from 28% last year. This is real behavior change, but it's been building for years.

Margins held. Average Selling Price grew 5% year-over-year even with discounting staying flat. Retailers protected their margins while consumers traded up.

Customer service automation doubled. Salesforce reports agentic customer service conversations surged 86% week-over-week, with agent-completed tasks like returns doubling. This is where AI is already delivering concrete value—handling the volume spike without hiring seasonal workers.

OTHER NEWS

My latest piece for The Drum shares how Amazon keeps its ad coverage super high, and other retailers are moving in the same direction, continually bumping their ads-per-page up. How do they manage to do this, while keeping CPC's in check AND not completely turning customers off? Read here: You're not imagining it: Amazon really is a sea of ads (and it still works)

If you want a primer on the new research which I shared in that article, join me and Pentaleap CEO Andreas Reiffen for a deep-dive this week, Thursday Dec 4 at 11AM ET [register for the LinkedIn Live event here]