Remember the effortlessly cool kid at school who never seemed to try too hard? While everyone else scrambled for attention, they just existed—tousled hair, aloof confidence, universally admired precisely because they didn't need the validation.

That's Costco's retail media network.

While over 80 retail media networks compete for advertiser attention in the U.S. alone, Costco has been suspiciously absent from the hype. No splashy announcements, no media kits circulating at industry conferences, no vendor partnerships trumpeted in press releases. Mark Williamson, assistant vice president of retail media at Costco, freely admits the company is a "last mover" in this space.

Williamson doesn't do traditional press interviews—just the occasional podcast—making even basic information about Costco's retail media plans hard to come by. So I did what any self-respecting analyst would do: I listened to every podcast interview Mark has done recently and pulled out the best bits.

What emerged is a philosophy that runs counter to nearly everything the retail media industry has been building toward. Here's what Costco is doing differently.

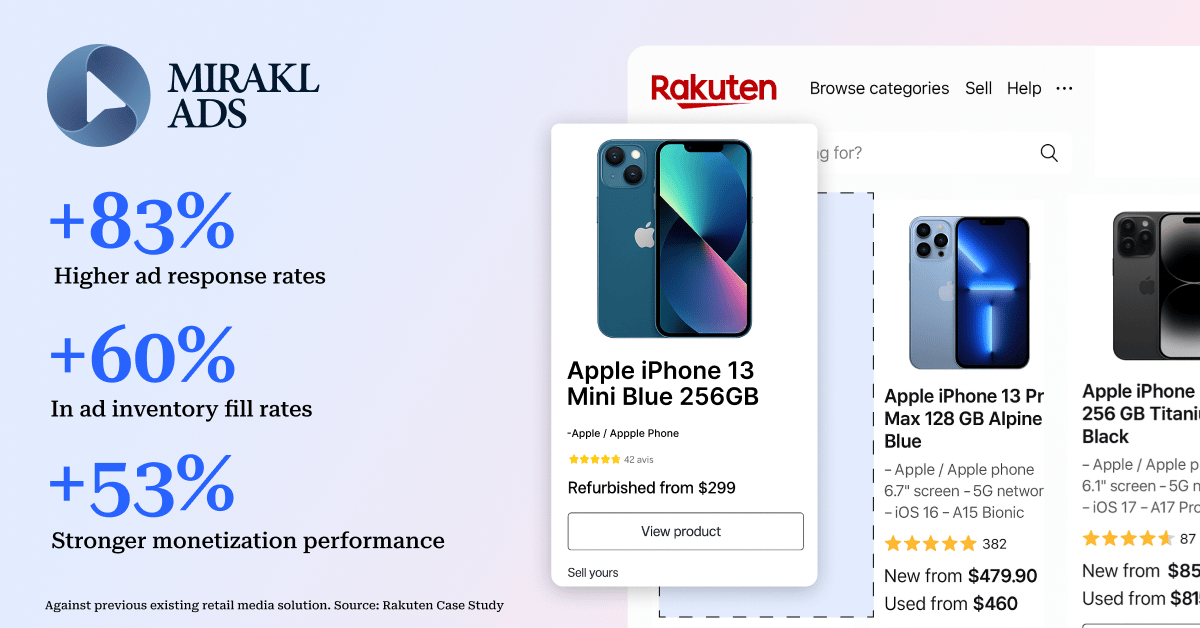

SPONSOR: MIRAKL ADS

Did you know leading retailer media networks drive 85% of their ads revenue through mid- and long-tail advertisers?

Mirakl Ads provides full funnel ad formats tailored to both 1P and 3P advertisers, leveraging unique AI-capabilities that provide unprecedented levels of relevance and engagement.

Retailers who want to capture ad spend from the long tail of 3P marketplace sellers use Mirakl Ads in their tech stack.

Costco Doesn't Use the Word "Monetization"

The Setup: Most retailers pitch retail media as high-margin revenue that offsets e-commerce losses or funds price investments. The business case writes itself. Costco flips that logic entirely.

Mark Williamson on the CPG Guys podcast:

"We actually don't use the word monetization. Not that like profit center—we work very hard to make sure that we maintain our purpose. And as a media publisher, yes, it's a profitable business for us. It's meaningful in the way that we fund our business, but it's not the reason why we do it.

If the only success metric we have is media margin, then we've failed. One way we've aligned the retail media initiative with our core business strategy is that the money our retail media business generates is immediately allocated to our merchandising departments where they can then go invest."

What This Actually Means: Other retail media networks use advertising revenue to pad out net margins. Costco uses it to make membership better value. Retail media revenue gets pushed straight back to merchants who use those funds for deeper promotions, longer promotional windows, or everyday price investments.

Williamson calls this "clearing our P&L frequently"—retail media doesn't hoard margin or operate as a profit center detached from core retail goals.

The Member-First Filter That Blocks "Free Money"

The Setup: Many retail media networks talk about "do no harm" to shoppers. Costco's bar is higher: prove you're adding value to membership, or don't do it.

Mark Williamson on Flywheel's Commerce Collective podcast:

"There are days where this reality frustrates me because there's just opportunities sitting in front of us. There's things that we could do, there's decisions we can make, there's capabilities we can build tomorrow if only we could get rid of this pesky member thing that kind of gets in the way.

I have to remind myself that when you charge people to shop at your store, you are obligated to give them some value in exchange for that. I could say to our leadership team: We could do $5 billion in retail media. We have so much data and so much engagement. We could totally do this.

But what business are we in? We're in the business of selling memberships. And if we can't do both things at once, there's definitely an order of operations. At the top of that hierarchy is new members and keeping the members we already have. Unless I can demonstrate that what we're doing within retail media is in service to that—it's not just about do no harm, it's how can we use retail media to actually reinforce the value of membership? Because that's what we're all here for."

Why This Matters: Costco will walk away from what Williamson calls "free money" to protect member trust. When they first tested offsite advertising with co-branded units, the team braced for member backlash. They waited to see if complaints flooded the CEO's inbox or the call center.

‘The Growth Team’: Merchant Translators

The Setup: At most retailers, retail media operates as a separate fiefdom—different P&L, different leadership, often reporting through a chief revenue officer rather than merchandising. Costco takes the opposite approach.

Mark Williamson on the CPG Guys podcast:

"We will always be retailers to our core. The merchants are still the center of our universe—regardless of the source of funding. We've created what we call our Growth Management Team. They're aligned by merchandising department. Their job is to translate all this nascent retail media stuff that our merchants don't really live and breathe every day.

There's nine people on the team now—we went from zero to nine, so I'm very excited about that. Nearly every single one of them worked merchandising, and almost all of them started their Costco journey in the warehouse. So they bring this mentality of retailer first.

We've positioned them to be the Costco Sherpa. Whether they're talking to a DSP or a managed service agency, a brand directly, or a supplier—they really are that point of entry to help remove as much friction as possible."

The Accountability Test: When reporting results to the chief merchant, Williamson can't simply cite media margin. He must demonstrate how media investments translated into actual sales growth for Costco.

As he puts it: "If it's not 3 billion, 4 billion, 5 billion of returns, we could have spent that money differently."

The Data Foundation: 100% Member-Identified Transactions

What Makes It Different:

Every Costco transaction is member-identified. Not 80%, not 95%, but 100%. That deterministic foundation spans an unusually broad mix of categories: food, consumer electronics, tires, gas, travel, health and beauty, apparel.

The cross-category breadth paints a richer picture of member behavior than grocers capturing primarily food purchases. And because members aren't buying single units on promotion—they're buying bulk quantities that represent real commitment—the purchase data carries more weight.

The Infrastructure Investment:

Over the past two years, Costco has invested heavily in what Williamson calls "boring, unsexy foundational work":

Built a unified data platform in a private Google Cloud instance

Stitched together more than 15 unique identifiers that previously didn't talk to each other

Implemented universal consent and preference management (Williamson describes Costco's internal privacy requirements as "over-compliant")

The Offsite Offering:

Launched roughly a year ago, demonstrating the payoff. Costco builds custom audiences from first-party data, onboards them through LiveRamp, and pushes to multiple DSPs including Trade Desk, Epsilon, Stack Adapt, and Yahoo.

On the back end, Costco ingests exposure files, brings them into a clean room, and marries ad exposure with transaction data spanning online and warehouse sales. The data science team provides custom campaign analytics including new-to-item, new-to-brand, and new-to-category metrics with support for holdout audiences for lift testing.

It's managed service today—"fairly manual," Williamson admitted—but the roadmap includes launching a Habu-based clean room where select partners get self-service access.

The Bottom Line

The cool-kid routine only works if you can deliver. Costco is demonstrating that the retailer who appears least interested in retail media might be building the version of it that actually works—for members, for merchants, and ultimately for brands.

Perhaps the best way to promote a retail media network is to refuse to promote it at all.

Mark Williamson's full interviews are available on the CPG Guys podcast (June 2024) and the Commerce Collective podcast (October 2024). Both are worth listening to for additional context on Costco's measurement approach and technology roadmap.

A version of this article was published to my column at The Drum. It has been reproduced here with permission.

Until tomorrow,

Kiri