3 New Developments In RTB (Real Time Bidding) For Retail Media

For many, RTB carries baggage from its early programmatic display days. But Andreas Reiffen, CEO and co-founder of Pentaleap, has a different take: RTB is the key to unlocking retail media's next phase of growth.

The retail media world loves to throw around technical terms, but few provoke as much debate as "real-time bidding." For many, RTB carries baggage from its early programmatic display days—low-quality inventory, brand safety nightmares, and money disappearing through murky supply chains.

But Andreas Reiffen, CEO and co-founder of Pentaleap, has a different take. He believes RTB is the key to unlocking retail media's next phase of growth. And after our recent conversation (unfortunately plagued by technical difficulties—thank goodness for transcripts), I'm starting to see why his perspective matters.

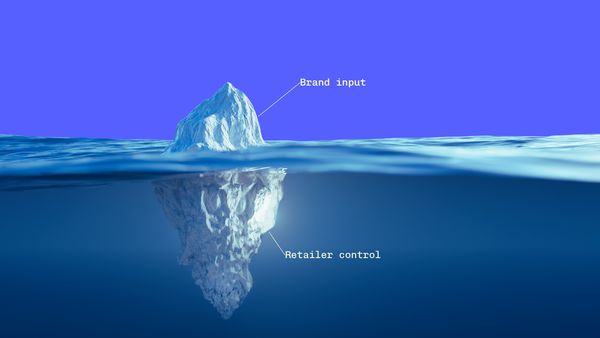

So what is RTB in retail media? At its core, it's a mechanism that lets major ad platforms connect directly to onsite inventory across different retail media networks. When a shopper visits a retailer's site, an ad request goes out in real-time. Platforms like Google, Microsoft, or The Trade Desk respond with relevant product ads in milliseconds. The retailer maintains control over what inventory is available and which brands can participate.

RTB is like Booking.com for retail media. Just as travelers can search availability across thousands of hotels through one interface, advertisers can access inventory across multiple retailers through one platform. The hotels (retailers) control their rates and availability, but they're all bookable through a common system.

Why does Andreas care so much about this? Because he sees RTB solving retail media's biggest structural problem: fragmentation. Retailers struggle to access large media budgets that agencies control. Brands struggle to buy retail media at scale without managing relationships with dozens of individual retailers. RTB creates the connective tissue between these two worlds.

[Full Q&A transcript from our conversation is available here: www.retailmediabreakfastclub.com/real-time-bidding-retail-medias-savior-or-saboteur]

RTB as Infrastructure, Not Just Advertiser Demand

Let's start with something that has been a little contentious so far in the world of retail media. When most people think about RTB, they think about it purely as a way to bring in new advertising demand. But here's what Andreas had to say about how retailers are actually using on two other dimensions:

We’ve used RTB internally for about two years, not just for new demand but to improve flexibility in ad-tech stacks. It enables modularity. You can think of two layers:

Front-end orchestration — managing the customer experience and page rendering.

and Ad-serving — selecting and delivering the right ads.

RTB lets you swap one layer without replacing the other. That means less vendor lock-in, easier experimentation, and faster innovation.

This reframes how we should think about RTB adoption. It's not just about opening the floodgates to external demand—though that's certainly part of it. Andreas pointed out that Pentaleap has been using RTB internally for about two years to create modularity in their technology stack.

Andreas notes that large retailers like Home Depot and Macy's already take this modular approach, but smaller retail media networks often don't realize how much flexibility RTB gives them. This is because RTB lets retailers swap one layer without replacing the other, reducing vendor lock-in and enabling faster innovation.

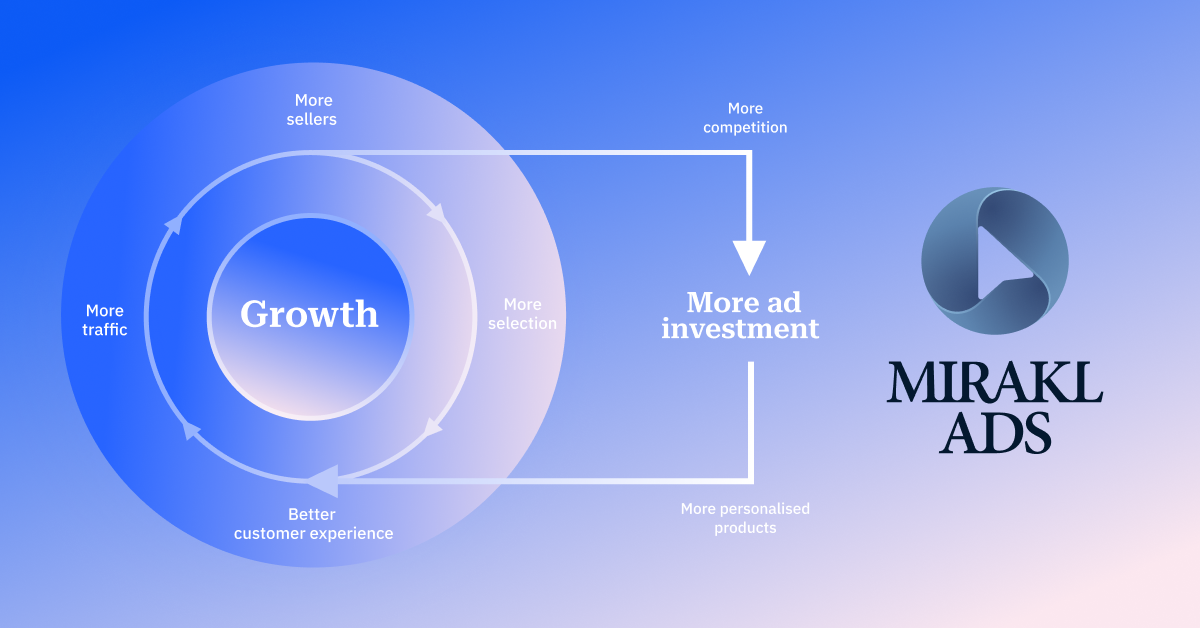

Retailers know that a marketplace model can dramatically boost product assortment, shopper engagement, and total revenue. But, to get the most out of your marketplace, you need an ad tech solution that can really engage sellers. Mirakl Ads is powering the future of retail media for leading retailers — to activate both 3P sellers and 1P brands.

What Percentage Of Retail Media Could Be RTB?

Once retailers have that technical infrastructure in place, the next question becomes: how much of their advertising business will actually run through RTB versus traditional direct sales? Andreas had a bold prediction on this, which is that in 5 years, there could be a 50/50 between direct and programmatic-style buying.

But that split won't be uniform—it depends heavily on retailer size and category depth.

Big retailers will likely handle most of their demand directly and backfill the rest programmatically. They have established relationships with major brands and the infrastructure to support direct campaigns. Smaller retailers, especially those joining multi-retailer networks, could see nearly all their demand coming through RTB.

This makes sense when you consider the 80/20 dynamics that most retailers face. Many retailers get the vast majority of their revenue from their top 20% of suppliers/ brands. These strategic relationships will remain direct. But the long tail of smaller brands—who are already spending media dollars elsewhere—represents a perfect opportunity for RTB backfill.

B2B Retail Media Gets Real

I fielded a question from a B2B company that's considering setting up a retail media network, so I posed this question to Andreas – can B2B companies build RTB-enabled media networks?

He says that the mechanics are remarkably similar to consumer retail media. The key differences lie in customer lifetime value and audience segmentation rather than technical implementation.

Consider Home Depot's professional customers, which represent about 30% of their business. These pros have entirely different purchase rationale than DIY consumers— they reorder frequently, making customer lifetime value significantly higher than typical consumer purchases. This means campaigns need to account for long-term relationship value, not just individual transaction metrics.

Significant segmentation opportunities open up with B2B buyers.

Andreas described using bid modifiers to target professionals, allowing brands to raise bids by 150% when products are shown to professional buyers. This precision targeting, combined with the higher CLV of B2B customers, makes the economics extremely attractive.

The catch is, you need a diverse set of endemic advertisers for this to work. But for B2B platforms with multiple competing suppliers and regular reordering patterns, retail media could become as significant as it has in consumer retail.

Wrapping Up

RTB in retail media isn't the wild west of early programmatic display. It's evolving into something more strategic—a layer of infrastructure that gives retailers flexibility, a mechanism to access new budgets without abandoning direct relationships, and even a path forward for B2B commerce platforms.

Andreas's prediction of a 50/50 split feels bold, but the logic checks out. Not every advertiser needs—or wants—a white-glove direct relationship with every retailer. Sometimes efficiency and scale trump depth of reporting. The retailers who figure out how to offer both options simultaneously will capture more budget overall.

Whether you're bullish or skeptical on RTB, one thing is clear: retail media can't scale to its projected potential if it remains entirely relationship-based. Maybe RTB offers a complementary path.

Find the full transcript of my with Andreas available here

More from me on related topics: